The cryptocurrency market is showing signs of recovery as investors pour money back into digital assets. Recent data reveals a significant turnaround in crypto inflows, marking a renewed interest in the sector after a period of outflows.

Bitcoin, the largest cryptocurrency by market cap, is leading the charge. The world’s first cryptocurrency saw a substantial increase in investment, with BlackRock’s spot Bitcoin ETF (IBIT) recording its first positive daily inflow in three weeks. This shift comes after a challenging period where the fund experienced either zero flows or outflows for 11 consecutive trading days.

The broader crypto ETF market also saw positive movement. Combined spot Bitcoin ETFs attracted $12.8 million in net inflows on a single day. This includes notable contributions from other major players like Fidelity’s FBTC, Franklin Templeton’s EZBC, and VanEck’s HODL.

However, not all funds shared in this upswing. Grayscale’s GBTC, known for its higher fees, returned to net outflows after a brief period of inflows. Despite this, the overall trend remains positive for the crypto market.

Experts believe this surge in inflows may be linked to changing expectations about interest rates. Comments from former NY Federal Reserve President Bill Dudley hinting at a potential 50 basis point interest rate cut in September seem to have sparked renewed investor confidence.

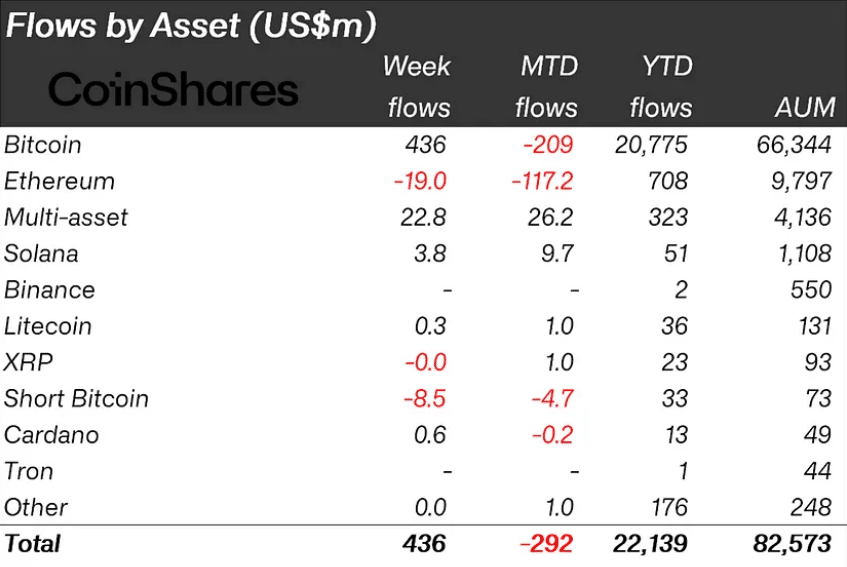

While Bitcoin ETFs are gaining traction, Ethereum-based products are facing challenges. Spot Ethereum ETFs saw net outflows of $9.4 million, highlighting the varying investor sentiment across different cryptocurrencies.

Crypto Inflows by Country

The regional breakdown of these inflows provides interesting insights. The United States led the charge with inflows totaling $416 million, while Switzerland and Germany also saw notable increases. This global interest underscores the growing mainstream acceptance of cryptocurrencies as a legitimate investment option.

Trading volumes for crypto ETFs, while positive, remain below the yearly average. This suggests that while investor sentiment is improving, caution still prevails in the market.

Blockchain equities are also benefiting from this positive trend. The launch of several new ETFs in the US has led to inflows of $105 million in this sector, indicating growing interest in companies associated with blockchain technology.

As the crypto market continues to evolve, these inflows represent a critical indicator of market health and investor confidence. While challenges remain, particularly for some altcoins and Ethereum-based products, the overall trend suggests a gradual return of optimism to the cryptocurrency space.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.