In a significant market development, crypto inflows have surged dramatically, with Bitcoin leading the charge amid the approaching U.S. elections and new investment vehicles entering the market.

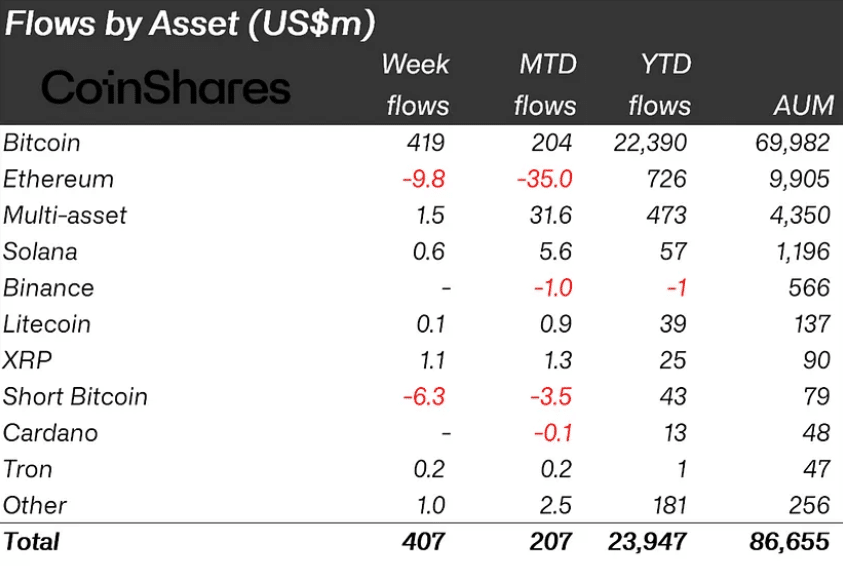

Recent CoinShares data reveals that digital asset investment products experienced inflows of $407 million, marking a substantial increase in capital movement towards cryptocurrencies. Bitcoin emerged as the primary beneficiary, attracting $419 million in new investments.

Crypto Inflows Reach Record Levels

Market analysts attribute this uptick to two key factors: the upcoming U.S. elections and the introduction of new investment options. The political landscape, particularly the perception of Republican candidates as more crypto-friendly, appears to be influencing investor decisions.

Simultaneously, the now-established Bitcoin ETFs in the U.S. continue to draw significant interest from both retail and institutional investors. The impact of Bitcoin ETFs on the market remains substantial, nearly a year after their introduction.

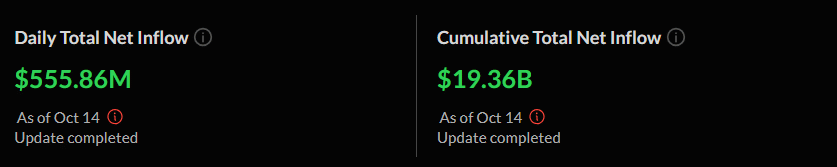

On October 14, these funds recorded net inflows of $555.8 million, the highest since early June. Fidelity’s FBTC led with $239.25 million in new investments, followed by Bitwise’s BITB at $100 million and BlackRock’s IBIT with $79.5 million.

Notably, Grayscale’s GBTC, which had struggled with outflows in the past, saw a reversal with $37 million in new investments.

Market Impact and Future Outlook

These significant inflows are having a tangible effect on cryptocurrency prices. Bitcoin’s value recently rose towards $66,500, representing a 2.8% increase in 24 hours. Ethereum has also seen positive movement, up 4% to peak at $2,654.

The cumulative inflow into U.S. Bitcoin ETFs since their January launch now stands at an impressive $19.36 billion, far exceeding initial expert projections. This figure underscores the growing mainstream acceptance of cryptocurrencies as a viable investment asset.

While Bitcoin dominates the headlines, Ethereum ETFs are also gaining traction, albeit at a slower pace. These funds recently attracted $17.07 million in new investments, indicating broadening interest across the cryptocurrency spectrum.

The ripple effects of this crypto boom are being felt in related sectors. ETFs focusing on blockchain-related companies saw inflows of $34 million, suggesting investor interest extends beyond digital currencies to the underlying technology and its potential applications.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.