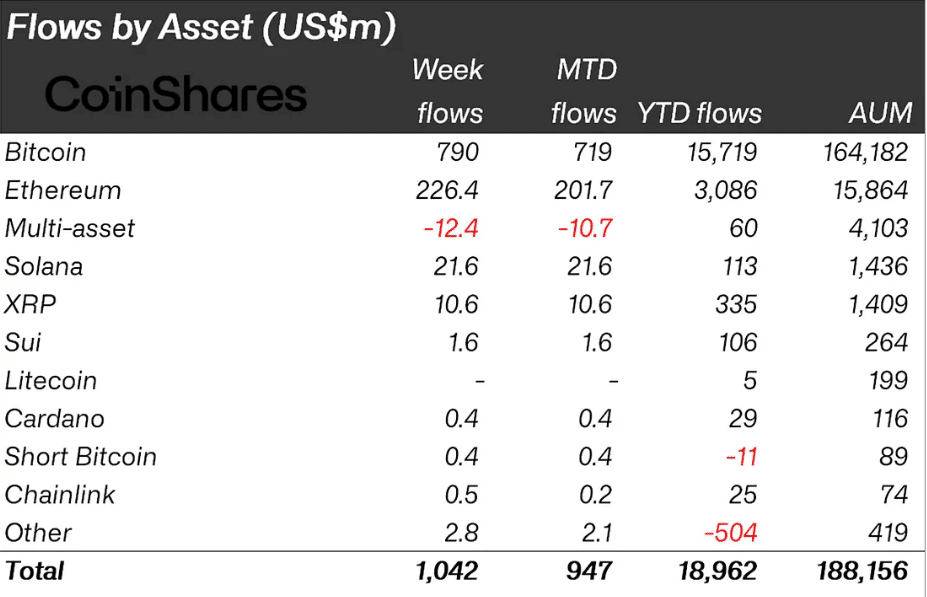

Digital asset investment funds continue their impressive streak, recording crypto inflows of $1.03 billion last week, according to CoinShares’ latest research.

This marks the 12th consecutive week of positive flows, pushing total assets under management to an unprecedented $188 billion.

The sustained momentum demonstrates growing institutional confidence in digital assets, with year-to-date inflows now reaching $18 billion. Trading volumes remained robust at $16.3 billion, aligning with 2025’s weekly averages and indicating healthy market liquidity.

Regional Distribution Shows Clear Market Leaders

Geographic analysis reveals stark regional differences in investor sentiment. The United States dominated with $1 billion in weekly inflows, while Germany and Switzerland contributed $38.5 million and $33.7 million, respectively.

However, Canada and Brazil bucked the trend with outflows of $29.3 million and $9.7 million, highlighting varying regulatory environments and market conditions across jurisdictions.

This regional divergence suggests that local factors, including regulatory clarity and institutional adoption rates, significantly influence investment patterns in digital assets.

Ethereum Outperforms Bitcoin in Crypto Inflows

While Bitcoin attracted $790 million in fresh capital, representing a slowdown from previous weeks’ $1.5 billion average, the moderation indicates potential investor caution as prices approach all-time highs.

Market participants appear to be taking profits or waiting for clearer price direction before committing additional capital.

Ethereum demonstrated superior proportional performance, securing its 11th straight week of crypto inflows with $226 million added. The $2.85 billion accumulated over this period represents 1.6% of Ethereum’s total assets under management weekly, significantly outpacing Bitcoin’s 0.8% rate.

This performance differential suggests investors view Ethereum’s ecosystem expansion and utility beyond store-of-value applications as increasingly attractive. The consistent inflows indicate growing confidence in Ethereum’s technological roadmap and its position in decentralized finance applications.

BlackRock’s IBIT Bitcoin ETF separately crossed the 700,000 BTC milestone, now holding approximately 56% of all spot Bitcoin ETF assets. Combined US spot Bitcoin ETFs control nearly 6% of Bitcoin’s total 21 million supply, representing significant institutional accumulation that could impact long-term price dynamics and market structure.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.