$COIN (NASDAQ: COIN) Forecast: July 9

Today, the Coinbase Global (NASDAQ: COIN) is poised for an upside reversal as it remains and holds its upward momentum. The slight selling pressure may subside, and the stock price could experience a turnaround to begin its bullish ride. In the meantime, the rising trend can continue to break through the $364.00 prior barrier and reach the $382.00 upper resistance line if there is a fresh spike in buyer interest, obtaining a higher footing to rise higher.

Key Levels:

Resistance Levels: $340.00, $345.00, $350.00

Support Levels: $165.00, $164.00, $163.00

COIN Long-term Trend: Bullish (Daily Chart)

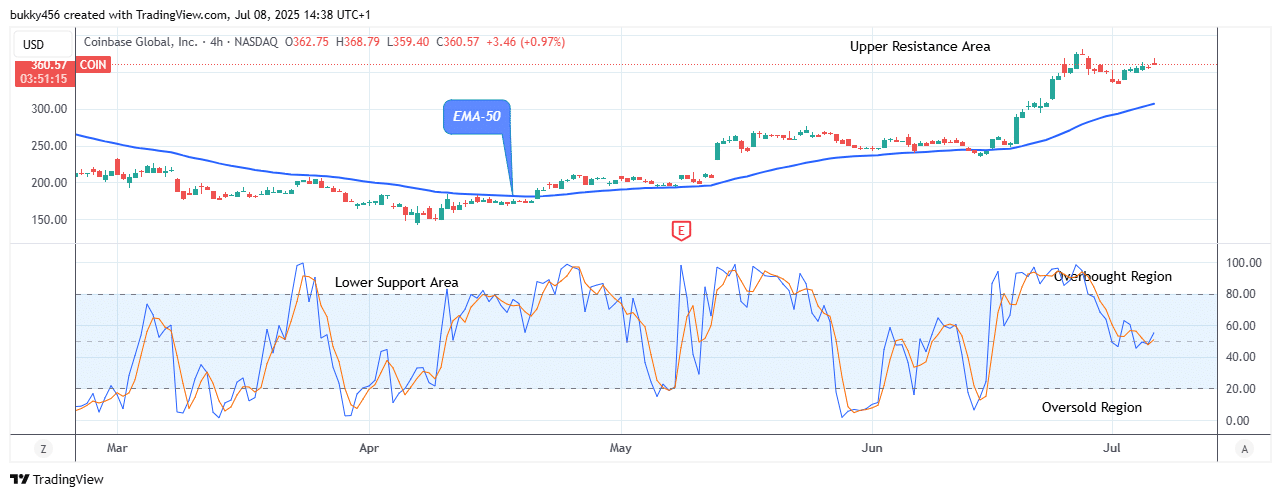

The NASDAQ: COIN market is in a bullish posture. However, the price may experience an upside reversal after a slight dip in its higher time frame. The price is above the EMA-50, indicating an upward momentum and the high impact of buyers.

The $COIN price at the $359.01 support level remains above the resistance trend line at the time of writing, indicating a bullish trend, which has not stalled the market structure as it remains intact.

Hence, investors could take advantage of the current low price and purchase the stock in anticipation of future gains.

Therefore, to predict a bullish rise in the market above the $364.00 supply level, buyers must step up their efforts.

Additionally, the NASDAQ stock price will have the potential to undergo an upside reversal at the present support level of $359.01 if it maintains its position above the supply levels.

As a result, the share price may soon rise to the upper high of $382.00, indicating a favorable entry point for shareholders from a long-term view.

COIN Medium-term Trend: Bullish (4H Chart)

The NASDAQ: COIN market trades in a bullish trend market in the medium-term outlook, due to the high impact of long-term traders on the price flow.

At the press time, the $COIN price at the $359.40 support level above the supply levels, indicates a bullish momentum.

It’s worth noting that the upward trajectory could face another barrier near the next resistance level at $377.30 if buyers could exchange hands with the bulls at that point. A breakout above this level could propel the stock price higher by 20%.

Additionally, the NASDAQ stock price is above the supply, indicating an opportunity for stock buyers to affect the price trend.

Therefore, a positive breakout above the current support is required to confirm the potential bull run and could lead the share price to the $382.00 upper high level, providing a strong resistance to the stock price and drawing in more investors, if buyers eventually overcame sellers’ trend control and recovered from the $359.40 support.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.