The cryptocurrency market witnessed unprecedented activity this week as digital asset investment products recorded massive crypto inflows totaling $2.2 billion. This surge coincided with MicroStrategy’s announcement of acquiring an additional 11,000 Bitcoin for $1.1 billion, marking a significant milestone in institutional crypto adoption.

MicroStrategy has acquired 11,000 BTC for ~$1.1 billion at ~$101,191 per bitcoin and has achieved BTC Yield of 1.69% YTD 2025. As of 1/20/2025, we hodl 461,000 $BTC acquired for ~$29.3 billion at ~$63,610 per bitcoin. $MSTR https://t.co/SOgvMscghy

— Michael Saylor⚡️ (@saylor) January 21, 2025

Market Momentum and Regional Distribution

The substantial inflows, largely driven by US investors contributing $2 billion, represent the highest weekly inflow in 2025. Switzerland and Canada also showed strong participation, adding $89 million and $13 million, respectively.

Trading volumes on Exchange-Traded Products (ETPs) reached $21 billion, accounting for 34% of total Bitcoin trading on trusted exchanges.

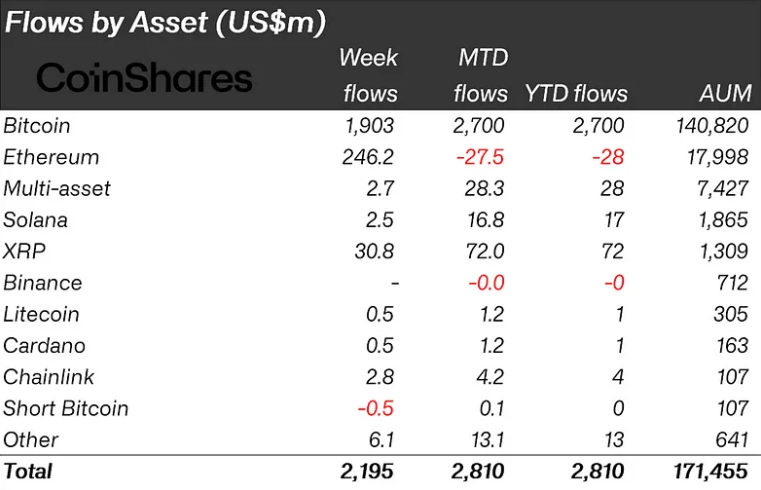

As always, Bitcoin dominated the inflow statistics with $1.9 billion, pushing its year-to-date inflows to $2.7 billion. Interestingly, despite Bitcoin’s price appreciation, short positions experienced minor outflows of $0.5 million, breaking from the typical pattern of increased short interest during price rallies.

Crypto Inflows Across Major Assets

Other cryptocurrencies also experienced notable movements:

- Ethereum attracted $246 million in inflows, recovering from earlier outflows this year

- XRP continued its strong performance with $31 million in new investments, bringing its total inflows since November 2024 to $484 million

- Solana received modest inflows of $2.5 million

- Stellar saw minor participation with $2.1 million in inflows

MicroStrategy’s Bitcoin Accumulation Strategy

MicroStrategy’s latest Bitcoin purchase, executed between January 13 and January 20, was completed at an average price of $101,191 per Bitcoin. This acquisition brings the company’s total holdings to 461,000 BTC, representing over 2% of Bitcoin’s maximum supply of 21 million coins.

The purchase was funded through the sale of 3,012,072 MicroStrategy shares, aligning with the company’s aggressive cryptocurrency acquisition strategy. MicroStrategy maintains substantial funding capacity with $5.42 billion worth of shares still available for sale as part of its planned $42 billion capital raise, split equally between equity offerings and fixed-income securities.

This development occurs amid MicroStrategy’s expansion of its investment strategy, including a potential $2 billion preferred stock offering aimed at attracting institutional investors such as insurance companies, pension funds, and banks.

The company’s total Bitcoin investment now stands at $29.3 billion, including fees and expenses, with an average purchase price of $63,610 per Bitcoin.

The market’s response has been notably positive, with MicroStrategy’s shares closing up 8% at $396.50 last Friday, reflecting a remarkable 693% gain over the past year.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.