Bitcoin and the broader crypto market are experiencing significant shifts in investment patterns, with recent data from CoinShares revealing complex market dynamics. While the overall digital asset sector recorded modest inflows of $48 million last week, the market faces near-term challenges from macroeconomic factors.

Market Performance Breakdown

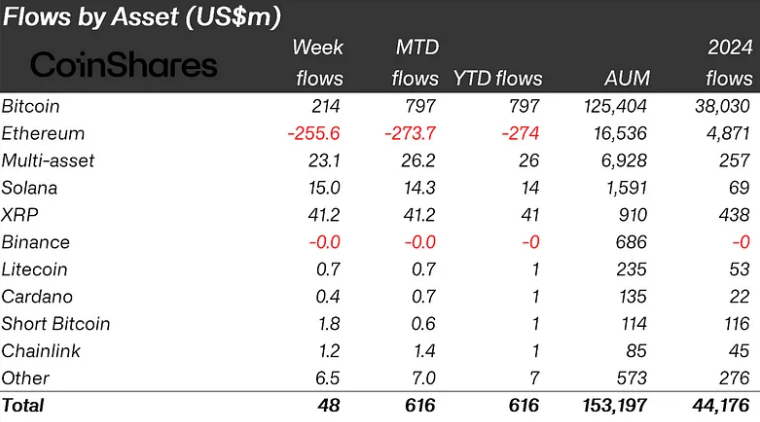

The latest figures paint an interesting picture: Bitcoin attracted $214 million in inflows, maintaining its position as the top-performing asset with year-to-date inflows of $799 million. However, these positive numbers mask substantial market volatility, as nearly $940 million exited the market in the latter half of the week following new U.S. economic data releases.

Ethereum, traditionally a strong performer, faced considerable pressure, with outflows reaching $256 million. Market analysts attribute this decline to broader technology sector weakness rather than Ethereum-specific issues.

In contrast, XRP showed remarkable resilience, attracting $41 million in inflows as investors appear optimistic about the upcoming SEC appeal deadline on January 15.

Looking Ahead: Outlook for Bitcoin in 2025

Despite current market pressures, analysts maintain a bullish long-term outlook. Steno Research projects Bitcoin could reach $150,000 in 2025, citing several key factors:

- An increasingly favorable regulatory environment

- Expected interest rate reductions

- Improved market liquidity conditions

- The anticipated impact of Bitcoin’s halving event

However, short-term caution remains warranted. Market experts predict potential downward pressure on Bitcoin’s price, with some analysts suggesting it could test support levels as low as $85,000. This projection stems from concerns about:

- Higher-than-expected inflation readings

- Persistent strength in the U.S. dollar

- Ongoing Federal Reserve hawkishness

- Current derivatives market conditions showing excess leverage

Alternative cryptocurrencies have shown mixed performance, with several smaller tokens attracting modest inflows despite challenging market conditions. Notable mentions include Aave, Stellar, and Polkadot, which secured inflows of $2.9 million, $2.7 million, and $1.6 million, respectively.

The current market environment reflects a complex interplay between traditional financial factors and crypto-specific dynamics. While short-term volatility persists, institutional investment patterns suggest continued confidence in the sector’s long-term potential, particularly as the market approaches significant events like Bitcoin’s halving in 2024.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.