The crypto market witnessed unprecedented institutional interest this week, with crypto inflows reaching $1.98 billion amid strong post-election momentum. This surge coincides with MicroStrategy’s massive $2.03 billion Bitcoin acquisition, highlighting growing institutional confidence in digital assets.

Analyzing Recent Crypto Inflows and Market Dynamics

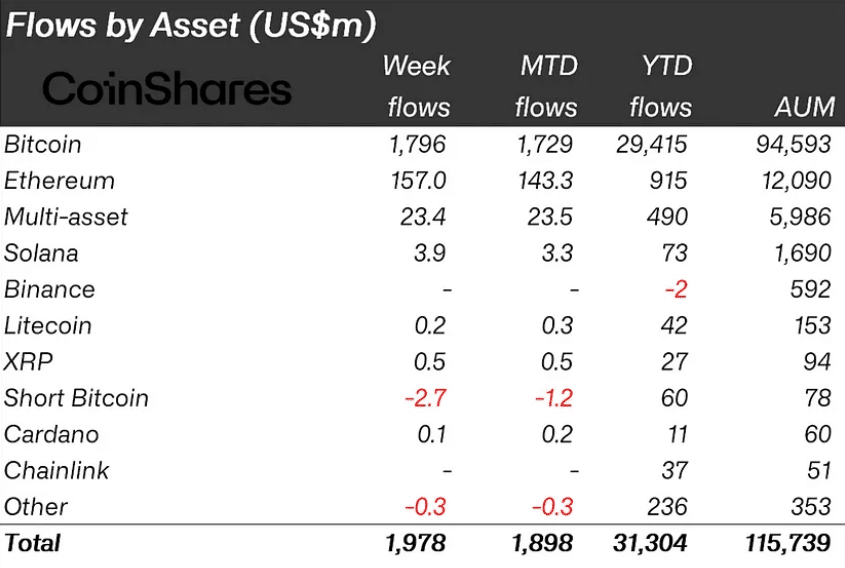

The latest CoinShares report reveals that investment products focused on digital assets have now attracted $31.3 billion year-to-date, pushing total assets under management to an all-time high of $116 billion.

The United States emerged as the primary driver, contributing $1.95 billion to the total inflows, while Switzerland and Germany added $23 million and $20 million, respectively.

Bitcoin dominated the investment landscape, capturing $1.8 billion in inflows. The leading cryptocurrency has seen $9 billion in institutional investments since September, when the Federal Reserve implemented its first interest rate cut of the current cycle.

Meanwhile, Ethereum showed renewed strength with inflows of $157 million, its strongest performance since July’s ETF launches.

Alternative cryptocurrencies also benefited from this wave of institutional interest, with Solana attracting $3.9 million in inflows, while Uniswap and Tron secured $1 million and $500,000, respectively.

MicroStrategy’s Bold Bitcoin Strategy

In a parallel development, MicroStrategy has significantly expanded its Bitcoin position, purchasing 27,200 BTC between October 31 and November 10 at an average price of $74,463 per coin. This $2.03 billion investment, funded through share sales, brings the company’s total holdings to 279,420 BTC, valued at approximately $23 billion.

MicroStrategy has acquired 27,200 BTC for ~$2.03 billion at ~$74,463 per #bitcoin and has achieved BTC Yield of 7.3% QTD and 26.4% YTD. As of 11/10/2024, we hodl 279,420 $BTC acquired for ~$11.9 billion at ~$42,692 per bitcoin. $MSTR https://t.co/uCt8nNUVqd

— Michael Saylor⚡️ (@saylor) November 11, 2024

The company’s aggressive accumulation strategy has proven successful, with its Bitcoin return on investment exceeding 100%.

Their average purchase price across 42 separate buying events stands at $39,292 per Bitcoin, positioning them well ahead of other corporate Bitcoin holders like Marathon Digital and Riot Platforms, which hold $2.1 billion and $840 million in Bitcoin, respectively.

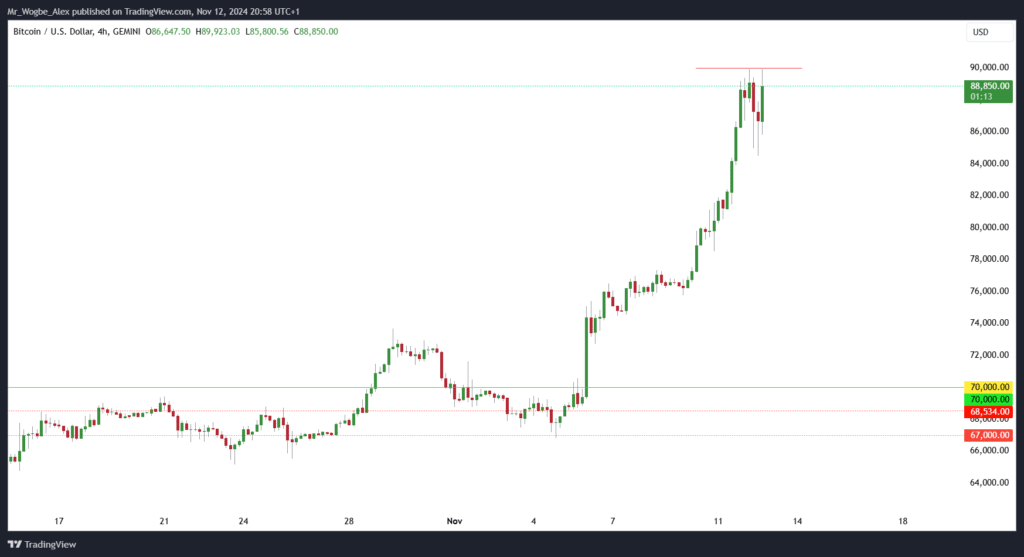

Market analysts attribute this surge in institutional interest to several factors, including shifts in U.S. political dynamics and supportive macroeconomic conditions. The combined effect of these institutional moves have contributed to Bitcoin’s strong price performance, with the cryptocurrency reaching new highs near $90,000.

These developments suggest a maturing crypto market with growing institutional acceptance, as both traditional investment vehicles and corporate treasuries increase their exposure to digital assets.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.