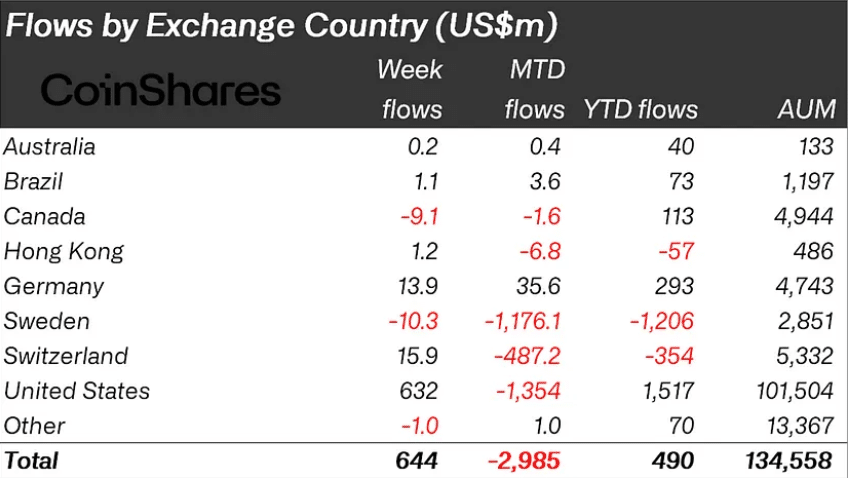

Recent data from CoinShares reveals a significant turnaround in digital asset investment products, with crypto inflows totaling $644 million last week. This development marks the end of a five-week streak of outflows that had previously drained $5.4 billion from the market.

Bitcoin led this recovery with $724 million in inflows, while the altcoin market showed mixed results. Total assets under management have increased by 6.3% from their March 10th low point, signaling a potential shift in investor sentiment.

Improving Macro Conditions Drive Crypto Inflows

Market analysts attribute this positive trend to several factors. BTC Markets Crypto Analyst Rachael Lucas told The Block that “macro conditions are improving, especially with the Fed shifting from quantitative tightening to easing.” She also points to former President Trump’s comments calling for rate cuts as adding “fuel to that optimism.”

The majority of these flows originated from the US ($632 million), with Switzerland, Germany, and Hong Kong also recording inflows of $15.9 million, $13.9 million, and $1.2 million, respectively.

What’s particularly notable is that every day last week recorded inflows, following a 17-day consecutive run of outflows. This consistent pattern suggests a decisive shift in sentiment toward digital assets.

Bitcoin ETFs Extend Positive Flow Streak to Seven Days

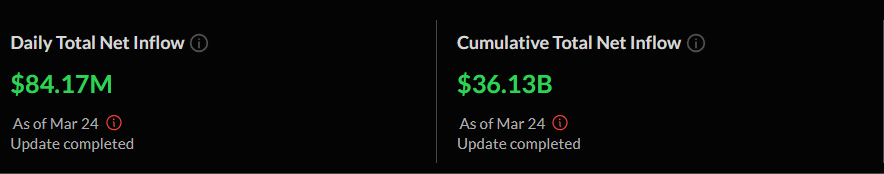

The positive momentum extends beyond general crypto investment products. According to The Block, US spot Bitcoin ETFs recorded their seventh straight day of net inflows on Monday, bringing in $84.17 million.

Fidelity’s FBTC led the charge with $82.85 million in inflows, followed by Bitwise’s BITB with $19.23 million. BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, reported $18 million in inflows. This seven-day streak has drawn in a total of $860.6 million, raising the cumulative inflow of spot Bitcoin funds to $36.13 billion.

Enmanuel Cardozo, market analyst at Brickken, told The Block that “global liquidity climbing roughly to 8% this year” is creating a favorable environment for Bitcoin. He describes the current situation as “a mix of market momentum from a macro perspective, and Bitcoin’s maturing role as a key asset in investor’s portfolios.”

Despite this optimism, analysts caution that seven days isn’t enough to establish a long-term trend. As Lucas puts it, “It’s more like a spark, not a full-on fire just yet.” Any potential disruptions, including tariff concerns or inflation spikes, could easily trigger shifts in market sentiment.

Meanwhile, Ethereum faced continued challenges, with $86 million exiting the asset, highlighting uneven confidence across the digital asset space.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.