Centralized crypto exchanges saw their strongest monthly performance of 2025 in October, with combined spot and derivatives trading surging 25.9% to reach $10.3 trillion.

This spike came during one of the market’s most volatile months, highlighted by nearly $20 billion in liquidations on October 10th—the largest single-day cascade this year.

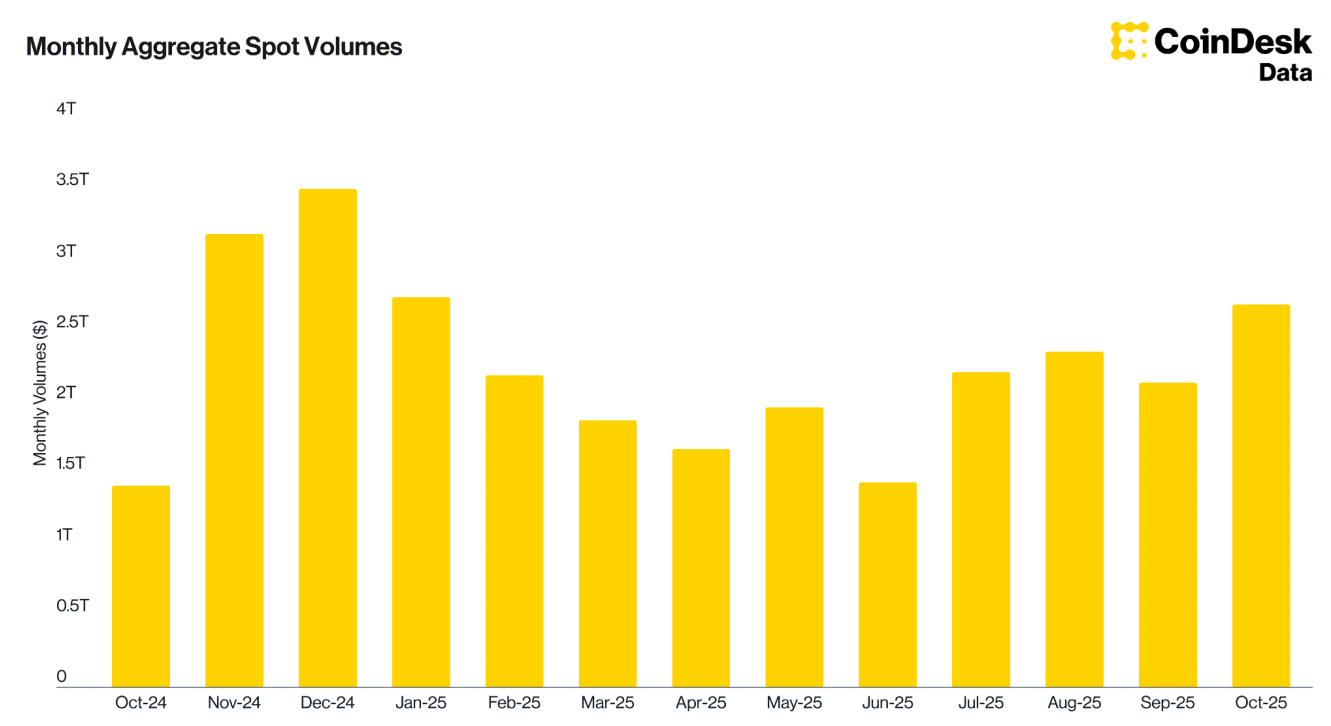

According to the latest CoinDesk Data report, spot trading volumes climbed 26% to $2.70 trillion, while derivatives activity jumped 25.8% to $7.56 trillion, marking the highest derivatives volume since December 2024.

The dramatic price swings throughout October drove traders to increase their activity across both markets.

Major Shifts in Market Leadership for Crypto Exchanges

The derivatives space experienced a notable shakeup in October. CME overtook Binance to become the leading exchange by open interest, capturing 23.2% market share.

This shift is significant for institutional traders who increasingly favor regulated platforms. Total open interest fell sharply by 21.4% to $160 billion, largely due to the October 10th liquidation event that wiped out nearly $60 billion in positions.

Binance’s open interest dropped 23.6% during the month, while Bybit saw an even steeper 30.6% decline. Both crypto exchanges now hold 18.8% and 11.0% market share, respectively.

Gate Emerges as Second-Largest Spot Exchange

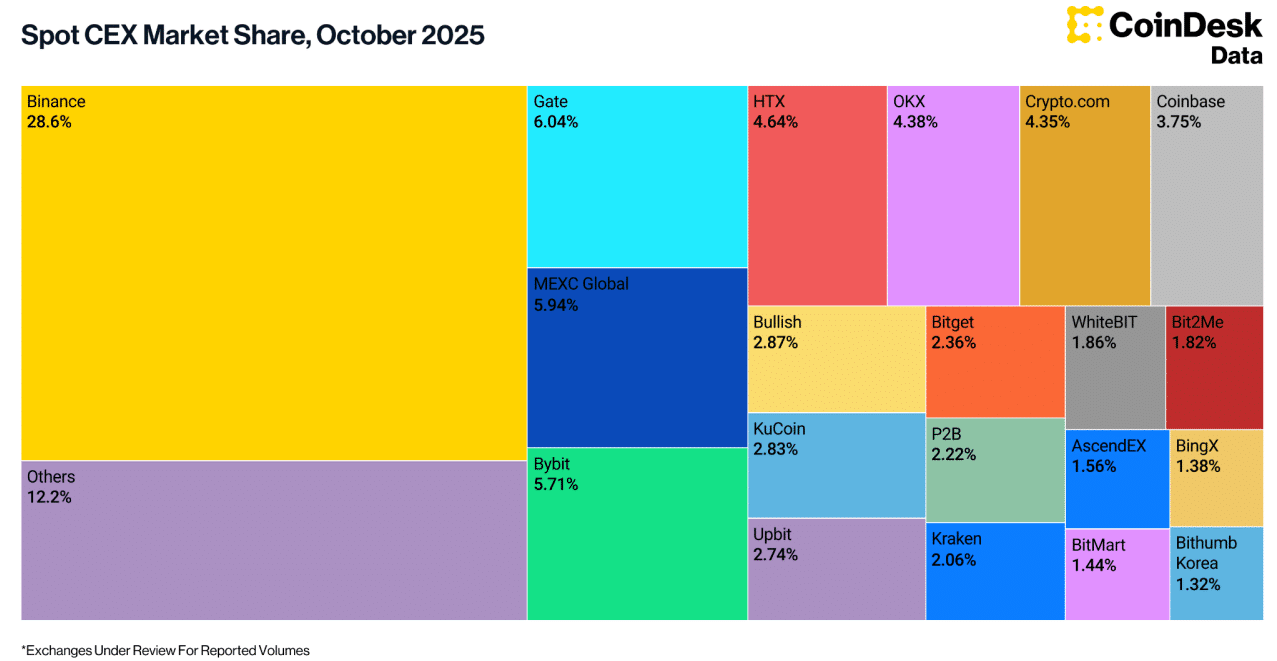

Gate posted impressive gains in October, with spot trading volume jumping 39.1% to $163 billion. The exchange now holds 6.04% of the spot market, making it the second-largest platform by volume and bumping MEXC to third place.

Year-to-date, Gate has added 3.43% to its market share—the biggest increase among all exchanges.

Other notable performers included Bullish, which doubled its volume with a 103% increase to $77.4 billion, and KuCoin, up 73.4% to $76.3 billion.

Binance maintains its dominant position with 28.6% of spot market share, though this represents a slight decline from previous months.

These volume shifts matter for traders because higher liquidity typically means tighter spreads and better execution prices. The growing competition among exchanges also tends to drive down fees and improve user experience across the board.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.