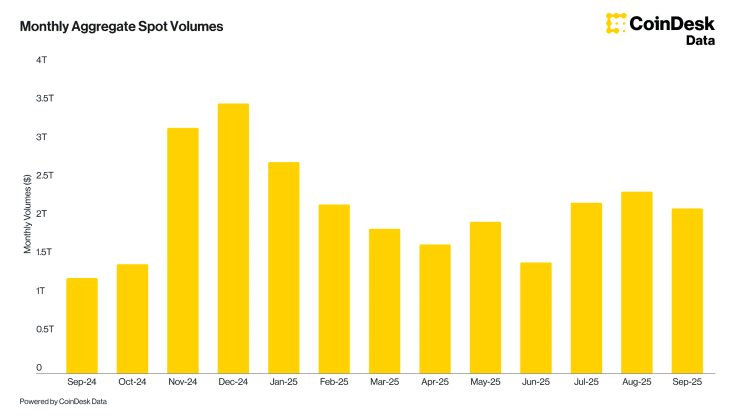

Trading activity across crypto exchanges dropped in September 2025, ending a three-month growth streak. Combined spot and derivatives volumes fell 17.5% to $8.12 trillion, marking the fourth straight year that September has seen declining volumes.

Spot trading took a smaller hit, declining 9.43% to $2.14 trillion.

The derivatives markets felt more pressure, dropping 20.1% to $5.98 trillion. This shift pushed derivatives’ share of total trading down from 76% to 73.7%—the lowest level since March, according to the latest CoinDesk report.

The seasonal pattern is clear. September consistently brings slower trading across centralized platforms. This year followed that trend perfectly.

Open Interest Hits All-Time High

What’s interesting is that while trading volumes declined, total open interest climbed 3.20% to $204 billion. The metric even touched $230 billion during the month—a new record for the market.

Binance led with 19.3% of total open interest. CME followed with 16.6%, then Bybit at 12.4% and Bitget at 11.1%.

This creates an unusual situation. Traders are holding more positions than ever, but they’re trading less frequently. The gap suggests people are waiting—possibly for clearer market direction or major news.

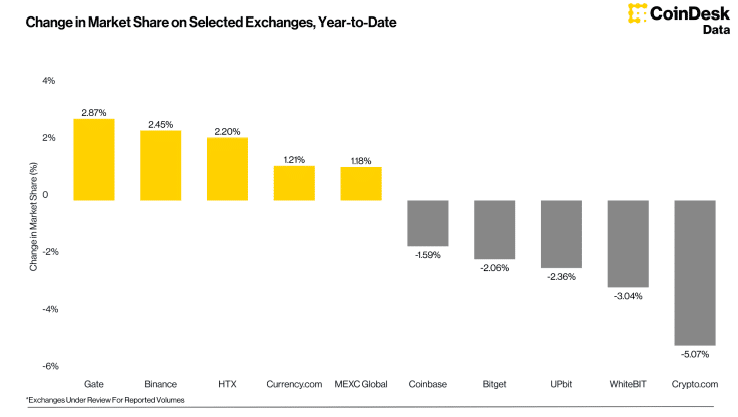

Market Share Shifts Among Crypto Exchanges

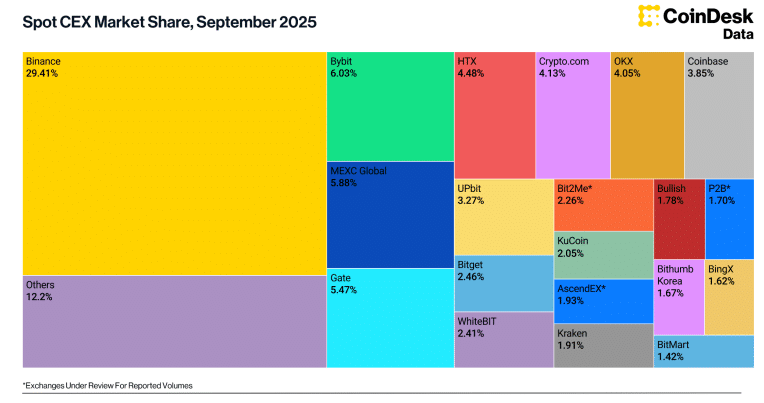

Gate made the biggest gains in spot market share during September. The exchange’s spot volumes rose 20.1% to $117 billion, pushing its market share to an all-time high of 5.47%. Year-to-date, Gate has added 2.87% to its market share—the largest increase among all exchanges.

Bybit and MEXC Global also grew. Bybit’s spot volumes increased 3.17% to $129 billion, while MEXC rose 1.89% to $126 billion. Their market shares climbed to 6.03% and 5.88%, respectively.

Binance still dominates with 29.4% of spot trading. But the exchange lost 1.64% of market share in September.

In derivatives, Gate and Coinbase International posted the biggest gains. Gate’s derivatives market share jumped 1.11% to 11.3%. Coinbase International surged 147% in trading volume, though from a smaller base.

CME’s institutional trading stayed relatively flat. Total derivatives volume dipped just 0.08% to $287 billion. Bitcoin futures fell 4.05%, while Ethereum futures dropped 17.9%. Solana futures bucked the trend, rising 57.1%.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.