The U.S. Securities and Exchange Commission (SEC) continues to tighten its grip on the cryptocurrency industry, with recent actions sparking debate and raising concerns among market participants. As the regulatory landscape evolves, crypto companies and advocates are pushing back against what they see as overreach by the federal agency.

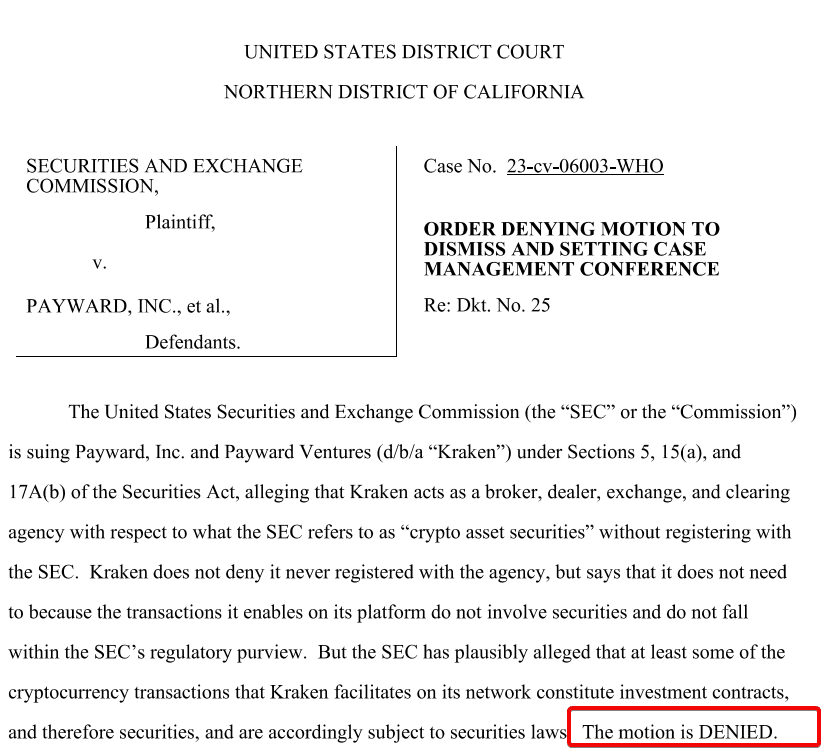

To start with, U.S. crypto exchange Kraken recently failed to dismiss a case brought against it by the SEC. The lawsuit, filed in November 2023, accuses Kraken of operating as an unregistered securities exchange, broker-dealer, and clearing agency.

U.S. District Judge William H. Orrick ruled that the SEC has made a plausible case that at least some of the cryptocurrency transactions Kraken facilitates may be considered securities under existing laws.

The Kraken case is part of a broader trend of SEC enforcement actions against major crypto firms. Under the leadership of Chair Gary Gensler, the agency has taken a hard stance on digital assets, arguing that most tokens should be treated as securities and fall under its jurisdiction.

This approach has led to lawsuits against other industry giants like Binance and Coinbase, both of which have also failed to fully dismiss their cases.

Crypto Community Pushes Back on Aggressive Stance By the SEC

The SEC’s aggressive stance has raised alarm bells within the crypto community. Industry groups like the Blockchain Association and the DeFi Education Fund have voiced concerns about the potential privacy implications of the SEC’s newly operational Consolidated Audit Trail (CAT) database.

These organizations warn that the CAT could turn blockchains into a “massive and fully deanonymized repository” for government surveillance, potentially exposing users’ financial transactions to unprecedented scrutiny.

Critics argue that the SEC’s interpretation of existing securities laws, particularly the Howey test, may be too broad when applied to digital assets. They contend that not all cryptocurrencies should be classified as securities and that the agency’s approach could stifle innovation in the rapidly evolving blockchain space.

Despite pushback, the SEC shows no signs of slowing down its enforcement efforts. The agency continues to assert that it has the authority to regulate a wide range of crypto activities, from token offerings to exchange operations.

This regulatory pressure is forcing many crypto firms to reevaluate their compliance strategies and consider the possibility of registering with the SEC.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.