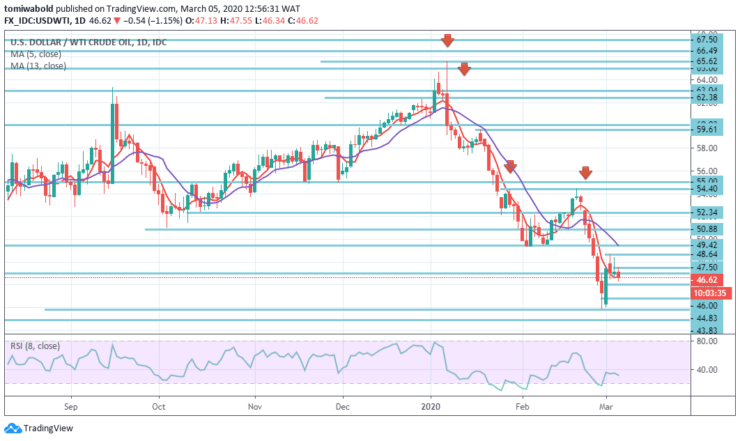

USDWTI Price Analysis – March 5

OPEC members rallied to discuss a reduction of 600,000 barrels per day (BPD) of oil production to raise crude oil prices, affected by global demand problems caused by a coronavirus. In general, the product is traded at the bottom of its range, and any drop below $47.00 may lead to a further selling mood.

Key Levels

Resistance Levels: $65.62 $54.40, $48.64

Support Levels: $46.00, $44.83, $43.83

USDWTI Long term Trend: Bearish

The WTI barrel is expanding its latest decline to $46.50 level, as a renewed wave of risk aversion combined nervousness in anticipation of OPEC’s decision to keep the bulls at bay.

Black gold is losing 0.70%, trading at the lowest levels in three days, as sellers now converge to the support zone at $46.

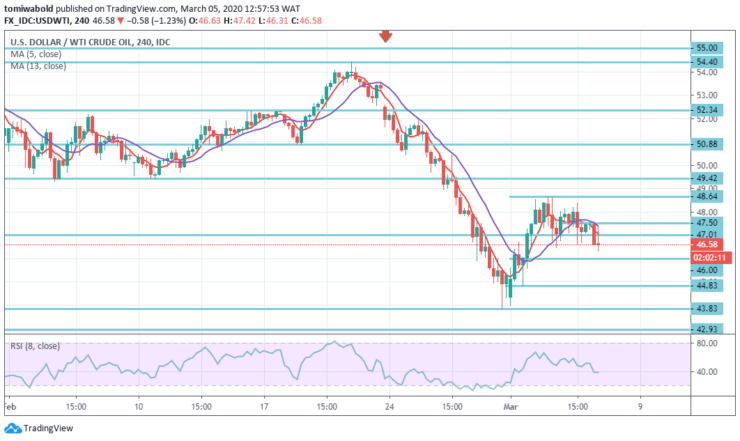

USDWTI Short term Trend: Ranging

Although WTI is at a two-day-old range handles, WTI is up 0.45% to $47.50 in the Asian session on Thursday.

While an area of $48.64–$46.00 levels restricts short-term black gold movements, the RSI range, as well as multiple support around $44.83–$43.83, are favorable for buyers.

Instrument: USDWTI

Order: Buy

Entry price: $46.50

Stop: $46.00

Target: $48.64

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.