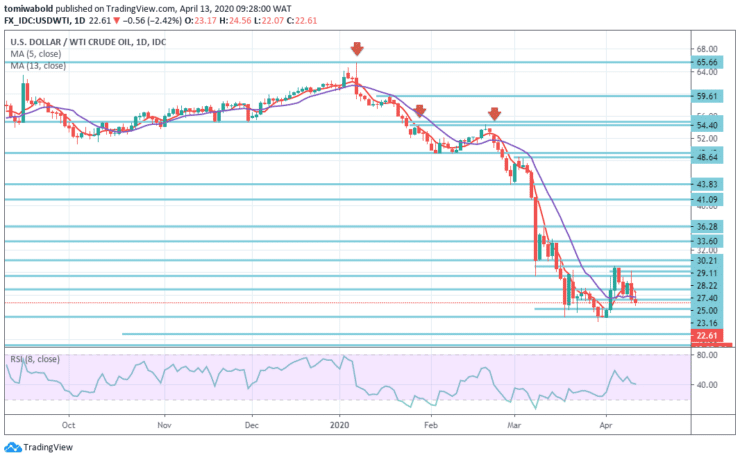

USDWTI Price Analysis – April 13

Despite the enormous losses, WTI reluctantly welcomes the OPEC+ deal, as the market matches it to initial forecasts of 20 million barrels a day of cuts as fresh recovery seems unable to sustain rates beyond $25.00 level. Although further recovery is anticipated, the lack of major economic calendar events may limit price volatility.

Key Levels

Resistance Levels: $28.22, $27.40, $25.00

Support Levels: $21.50, $20.08, $17.00

USDWTI Long term Trend: Bearish

From the daily chart, USDWTI has declined to test liquidity beneath the low level of the last session around $22.07, in the medium to long term, towards this perspective oil prices may probably stay at their current levels.

Nevertheless, USDWTI should rebound and push above today’s initial high of about $25.00 level and go on to break through the $27.40 mark, shifting the medium to long-term view of bearish.

USDWTI Short term Trend: Ranging

Oil rates moved down on the flipside, but overall market action on the day was down just 0.28 percent. A high selling momentum supports another attempt to breakout down below.

It has driven oil prices down. Additional declines may see a re-test of the $21.50 level. But the current setup may suggest a possible rebound, as long as the level of $21.50 remains intact.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.