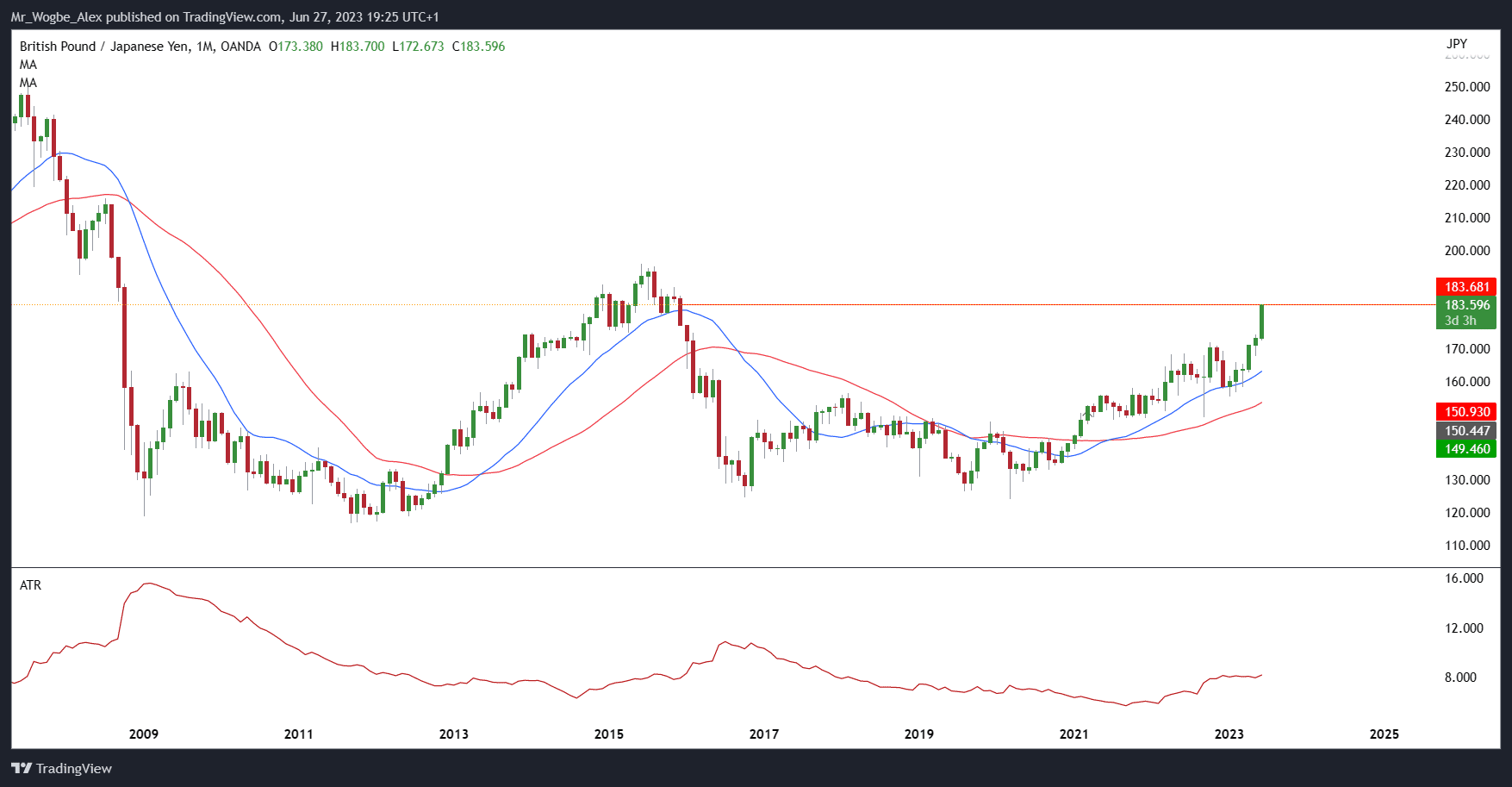

The GBP/JPY pair skyrocketed on Tuesday, reaching its highest level since December 2015, as the British pound (GBP) continued to appreciate against the Japanese yen (JPY).

Multiple factors contributed to the GBP’s impressive performance, including the anticipation surrounding key speeches by influential figures such as Governor Andrew Bailey of the Bank of England (BoE), Governor Kazuo Ueda of the Bank of Japan (BoJ), and Chairman Jerome Powell of the US Federal Reserve.

These speeches are expected to provide valuable insights into the future monetary policy decisions of their respective central banks, leading investors to closely analyze any indications of potential movements.

BoE’s Surprising Announcement Boosts Pound but Raises Concerns

The recent announcement by the Bank of England caught markets off guard when they unexpectedly announced a 50 basis point hike, signaling the possibility of further increases in 2023. This unexpected move generated significant interest in the GBP.

However, market participants remain concerned about the UK’s economic outlook, fearing a potential recession. Consequently, any forward guidance or hints regarding the BoE’s next steps could introduce volatility to the pound’s price action.

Meanwhile, the 2-year British Bond yield has surged to 5.23%, its highest level in 15 years. This rise in yields has propelled the Pound’s performance against major currencies, including the US dollar (USD), Swiss franc (CHF), and Japanese yen (JPY).

Conversely, investors are closely monitoring the upcoming speech by Bank of Japan Governor Kazuo Ueda, following the BoJ’s decision to maintain its ultra-dovish stance during the June meeting. The central bank’s focus on increasing wages rather than curbing inflation has resulted in a loss of interest in the yen, leading to its weakening against most major currencies.

Conclusion: Central Bank Sentiment-Induced Surge in GBP/JPY

The GBP/JPY pair has surged to its highest level in nearly eight years, driven by various factors such as upcoming speeches by influential figures and speculation about the future actions of central banks.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.