Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

$COIN (NASDAQ: COIN) Forecast: January 5

The Coinbase Global (NASDAQ: COIN) is facing a new correction to resume its upward rally. The stock price may increase further to break through the $392.16 supply level, provided buyers intensify their buying pressure and don’t give up. A bullish reversal would often follow testing the support level; however, if the share price could hold above the pattern supply trend line, it may trigger a move up to the overhead resistance mark at the $405.88 level, indicating an increase in investor interest.

Key Levels:

Resistance Levels: $387.00, $388.00, $389.00

Support Levels: $225.00, $224.00, $223.00

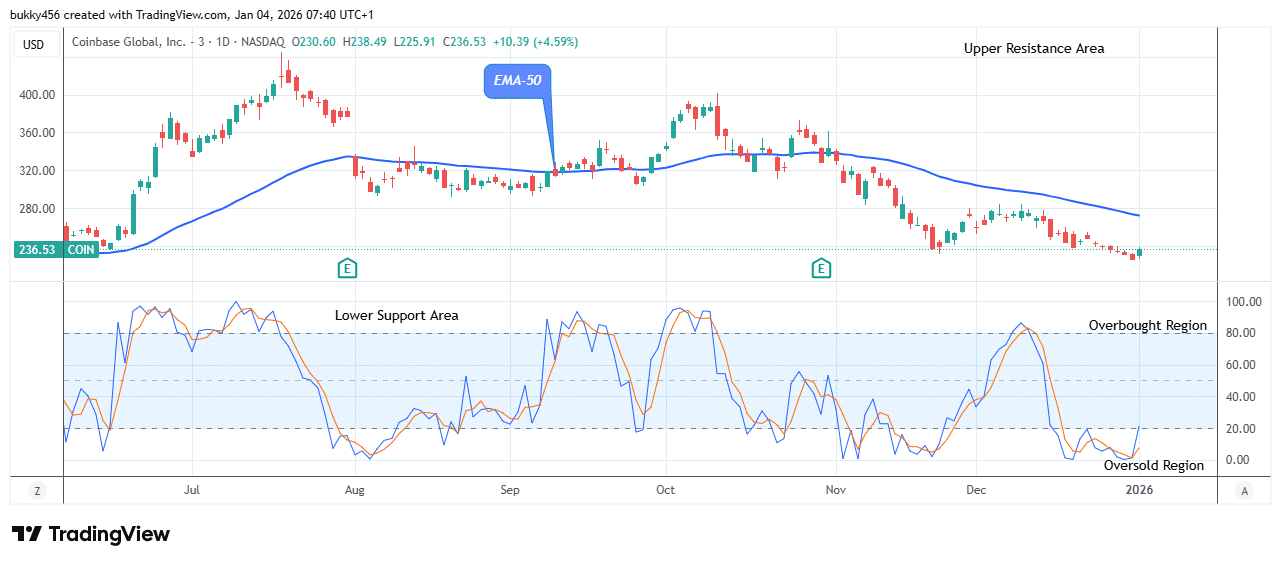

COIN Long-term Trend: Bearish (Daily Chart)

$COIN rebounded after its massive drop. The stock market is pushing back the selling pressure as a new correction begins at the support level.

The previous action of the bears at a $225.47 low value has added to its bearishness in its recent price level.

However, the bulls are ready to swing the price to a higher level as a new correction has taken place below the trend levels.

The current price of NASDAQ:COIN at the $238.49 high level, below the EMA-50 as the daily session opens today, indicates investors’ high optimism on the asset, and this may break the crucial resistance level.

Thus, if the stock price can sustain above the $392.16 high level, the potential rally could surge to hit a significant level at the upper channel, suggesting a high potential rally for stock buyers.

The daily stochastic also shows an upward trend. Therefore, if the current support level holds, there is a tendency for the price of NASDAQ stock to increase.

As a result, buyers may push the stock price to the upper resistance level of $405.88 in the next days.

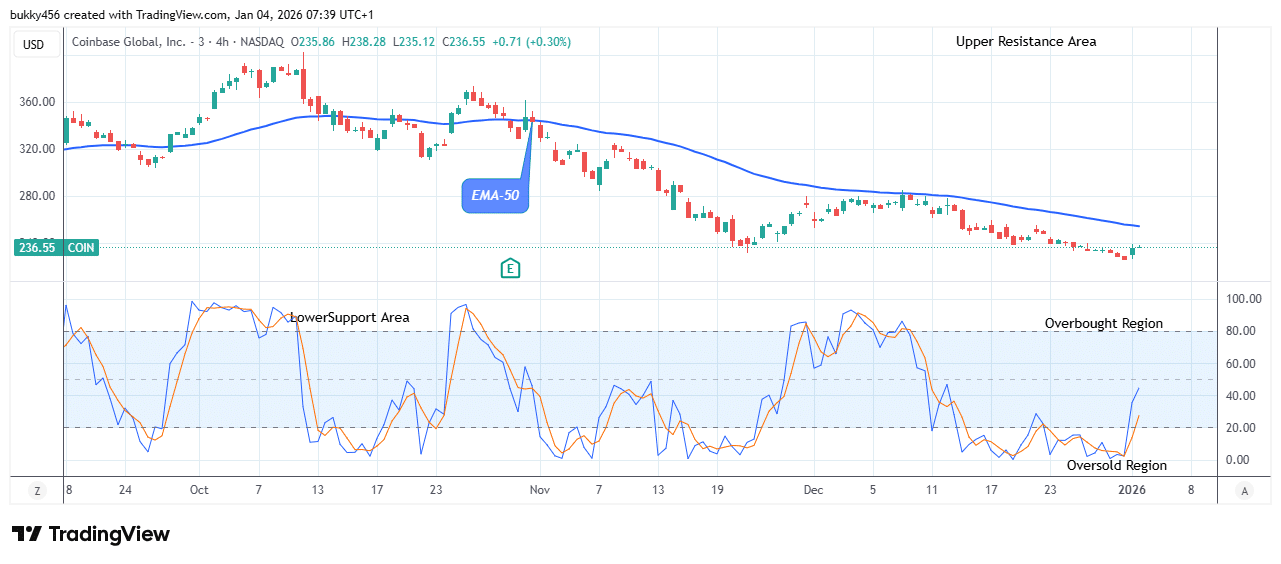

COIN Medium-term Trend: Bearish (4H Chart)

The $COIN buyers are making recovery attempts to bounce off the support and gain more strength in the medium term. The stock price is below the resistance level, indicating a bearish trend.

The NASDAQ: COIN market price at the $238.28 supply mark, close to the EMA-50 shortly after the 4-hourly chart opens today, is a pullback by the bulls, suggesting investors’ interest and confidence in the share.

Therefore, if buying pressure increases, the stock price may surge to retest the previous high of $388.27, gaining a stronger foundation for further growth.

Additionally, if shareholders can exert more buying pressure, the stock price could rise to the prior resistance and extend its leg to reach the $405.88 upper resistance level, fueling investors’ optimism in the asset in its medium-term time frame.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.