$COIN (NASDAQ: COIN) Forecast: November 3

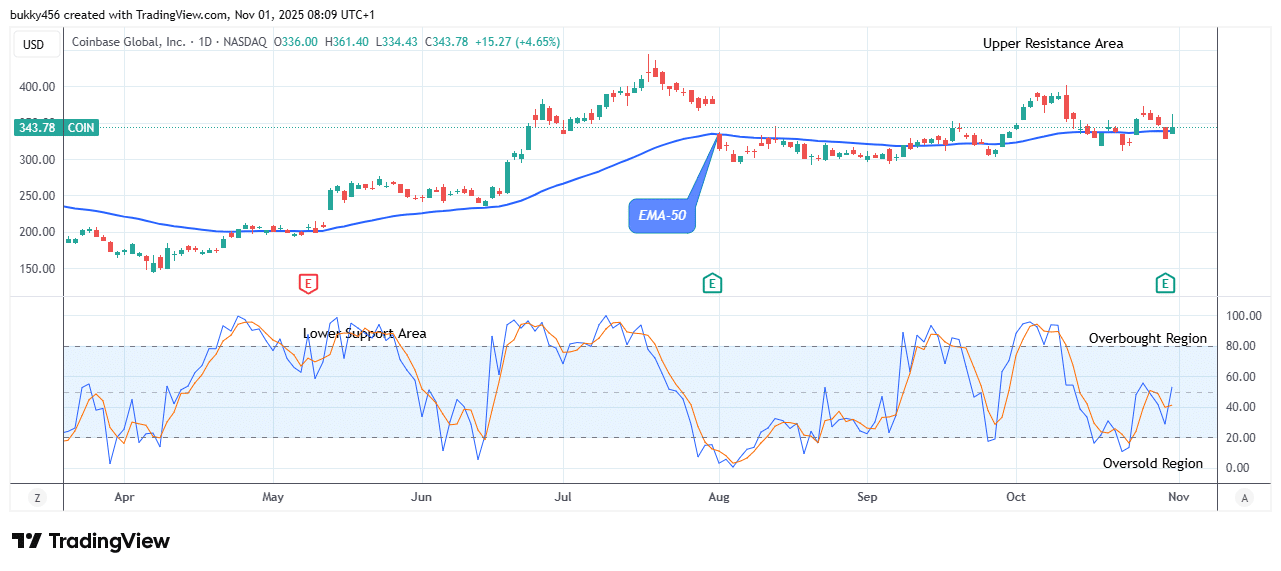

The Coinbase Global (NASDAQ: COIN) market is poised for new jumps, and an upside reversal at the medium-term level is imminent on a slight downturn, which is about to end. The share price is trending upward on the daily chart and may possibly break up at the $405.88 supply level, if the support level at $343.43 holds. Therefore, if buy investors could prove stronger and put a hold on the mentioned support, the bulls may drive the price action to hit the previous high and extend further to a $415.96 upper resistance level, registering a high potential for the stock buyers.

Key Levels:

Resistance Levels: $368.00, $369.00, $370.00

Support Levels: $198.00, $197.00, $196.00

COIN Long-term Trend: Bullish (Daily Chart)

Despite the push from the bulls, the $COIN market has experienced a slight pump and could still see an increase as it begins the bullish trend.

The sustained bullish pressure at a $356.88 level in the last session has enabled the share price to remain above the supply trend levels at its recent high.

Despite the activities of sell traders, the price of NASDAQ:COIN is rising as the daily chart opens today at the $361.40 supply value above the moving average.

Therefore, staying above the crucial level will enable the share market to increase in value, reaching the $405.88 previous peak, giving buyers an intraday gain.

Notably, the daily stochastic suggests that the NASDAQ stock market is currently rising, implying that the market value will keep soaring.

Given this, it is expected that bulls will push the stock price higher, and in the long run, it may reach the $415.96 upper resistance level in the next days.

COIN Medium-term Trend: Bearish (4H Chart)

The medium-term outlook appears bearish. The NASDAQ: COIN market price is trading slightly below the EMA line, suggesting that it’s in a bearish market at the moment.

The price of $COIN responded to the change in market structure at the time this article was written, and as the 4-hourly chart opens today, it is presently below the moving averages at the support value of $343.43.

In the meantime, traders who purchase the share when the market is down will profit later on.

Therefore, a positive breakout above the current level is required to validate the bull run if buyers eventually overcame sellers’ trend control and rebounded from the $323.43 support.

As the price is currently approaching the oversold area, the NASDAQ stock may shortly reverse.

We may now become more certain that a possible buy is approaching, which will allow the stock buyers to resume later and drive the price upward.

As the share market is currently approaching the oversold area, the price may shortly reverse.

As a result, the stock buyers may resume and drive the price upward. Hence, the $430.36 upper resistance level may be the target in the next days.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.