$COIN (NASDQ: COIN) Forecast: October 29

Today, the rising $COIN price breached the $362.82 neckline resistance, eyeing a break above the $405.88 previous barrier level. Due to the continued intense interest in the asset by experts and investors, the stock market saw a 17.58% increase in value. Over the last 24 hours, the share has recovered considerably, outpacing the overall decline. As a result, if purchasing pressure continues, the stock price may rise sharply and reach the resistance level of $405.88, extending to the upper high of $415.96, resulting in a high momentum rally and an investment opportunity for interested traders.

Key Levels:

Resistance Levels: $375.00, $376.00, $377.00

Support Levels: $200.00, $199.00, $198.00

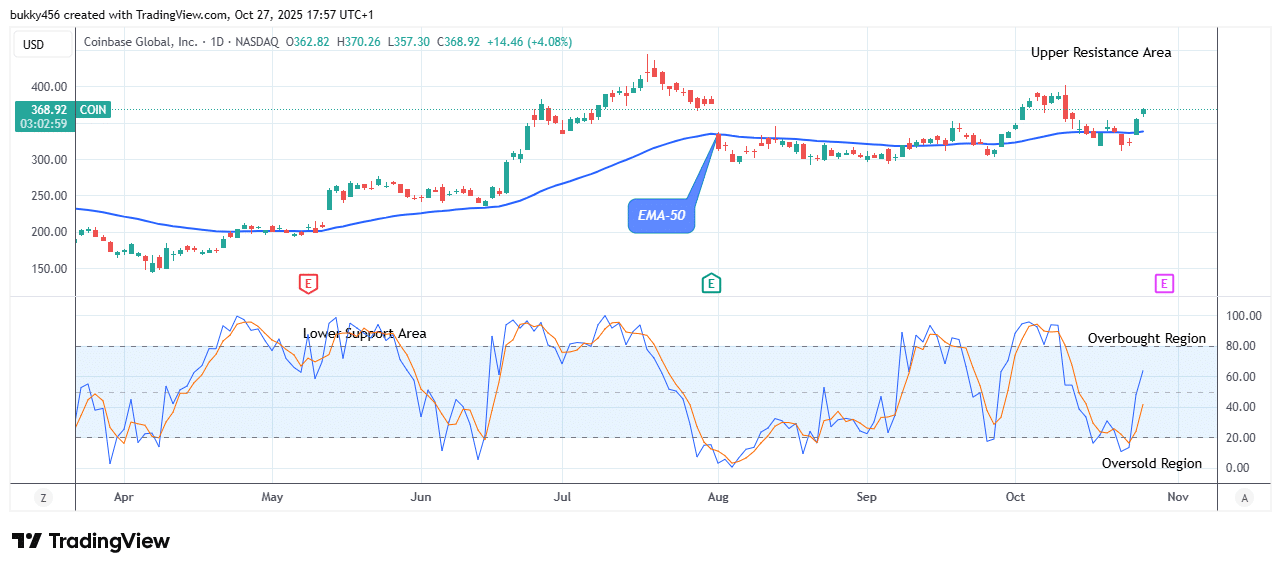

$COIN Long-term Trend: Bullish (Daily Chart)

The $COIN market records massive growth, establishing a solid base and showing promising signs of recovery over the crucial level on a higher timeframe. The price action is above the crucial level, suggesting a bullish momentum.

As of this writing, the price of NASDAQ: COIN is trading at the $370.26 resistance level above the EMA-50 as the daily session begins today.

This, however, suggests an uptrend given the market’s strength and could push the stock price towards $405.88 previous peak level, providing buyers with a solid entry point.

Furthermore, the daily stochastic shows an upward trend; therefore, if the $318.50 support level holds, there is a chance that the NASDAQ stock price will continue to rise.

In light of this, buyers may drive the stock price towards the $415.96 upper resistance level, bolstering further recovery in its long-term perspective.

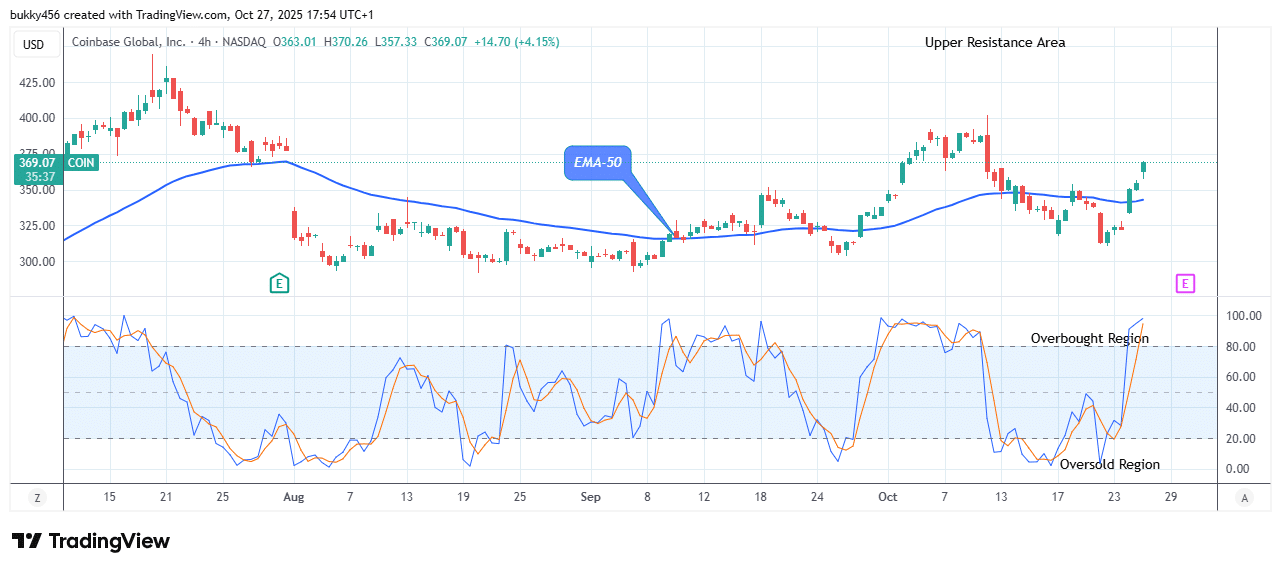

$COIN Medium-term Trend: Bullish (4H Chart)

In its medium-term forecast, the NASDAQ: COIN market is at the top of its correction trend.

The prior action by the bulls, which culminated in a high of $356.85, has enabled the share to maintain and sustain a steady upward trajectory in recent times.

When writing, the $COIN market indicates that the price will rise further as the price action moves upward to a $370.26 high mark above the EMA-50 as the 4-hourly chart resumes, suggesting that buyers are defending this level and attempting to push the price higher.

The stock price may therefore rise above the current resistance level, aiming for a significant market correction level at the $436.30 upper channel, provided the bulls increase the vigor of their market activity.

Notably, the NASDAQ stock price remains in an uptrend, suggesting the share may continue its bullish momentum and drive the stock price to surpass the previous barrier level, reaching the $405.88 upper resistance value in the days ahead.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.