$COIN (NASDAQ: COIN) Forecast: August 18

The Coinbase Global (NASDAQ: COIN) market price could see another trend reversal sooner. The stock price may retrace in a bullish direction and soon be ready for another probable upward surge. Hence, if buyers can demonstrate their strength and trade hands with sellers at the daily current support level of $314.56, the price may perhaps retrace to retest the previous high of $415.96, reflecting growing confidence among investors in a correcting market.

Key Levels:

Resistance Levels: $389.00, $390.00, $391.00

Support Levels: $178.00, $177.00, $176.00

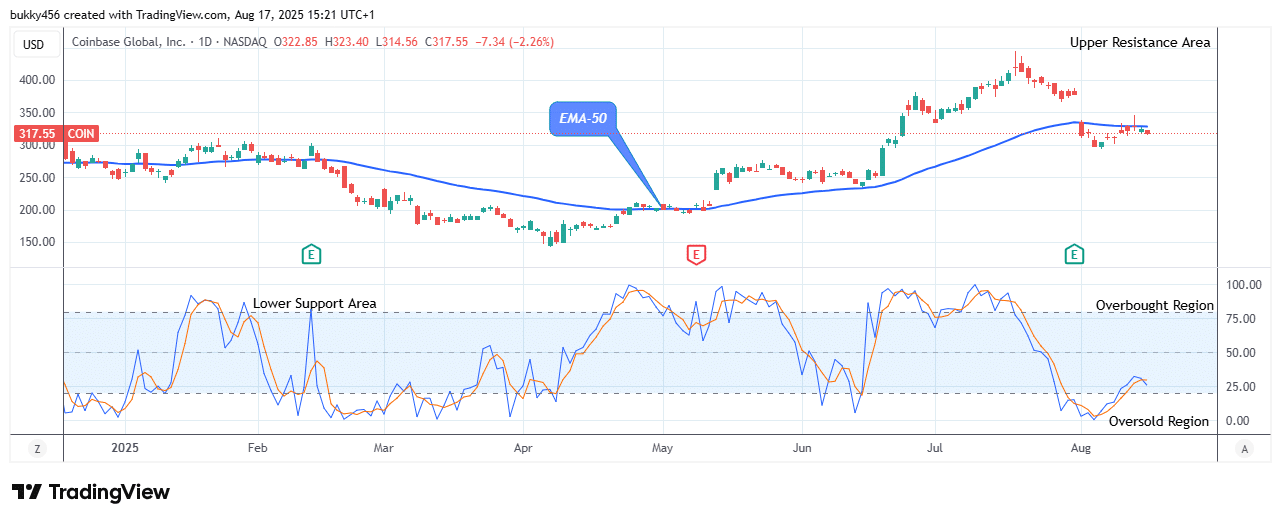

COIN Long-term Trend: Bearish (Daily Chart)

As the chart below illustrates, the long-term outlook for the $COIN market is bleak due to the inflow from selling traders. The price could see another retracement as the selling pressure prepares to wind up.

Today, action from short traders dropped the NASDAQ: COIN price to $314.56 below the moving averages. Given the current trend, buyers can purchase the item at a lower cost and drive the market price higher.

Therefore, if the bulls increase their level of market stress, the price inclination will rise above the critical levels.

Furthermore, as the market is currently close to the oversold area, the NASDAQ stock selling pressure may soon end, and the share price might turn around and go to the upside.

The buy traders will be forced to restart an upward trend as a result, and the $415.96 supply level may be broken in its higher time frame.

COIN Medium-term Trend: Bearish (4H Chart)

The $COIN price could see another retracement as the selling pressure is about to subside in its medium-term outlook.

Thus, the price could rise from the current trend sooner as it approaches the oversold region.

As the 4-hourly chart opens today, bearish activity caused the price of NASDAQ: COIN to decline to a support level of $317.33 below the EMA-50.

The share price may rise from the support level to retest the previous high point of $436.30 if the bulls prove stronger and intensify their buying push.

In the meantime, buyers could seize this opportunity to buy the stock at a discount in order to increase their profit later.

Furthermore, the NASDAQ stock market’s proximity to the oversold area raises the possibility that the stock price will soon break through the resistance level.

Therefore, in the medium-term forecast, the share values may swing above the previous barrier line, signaling an intraday gain for interested traders, if buyers increase their market tension and reverse from the $317.33 support level, providing stock buyers with great recovery potential.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.