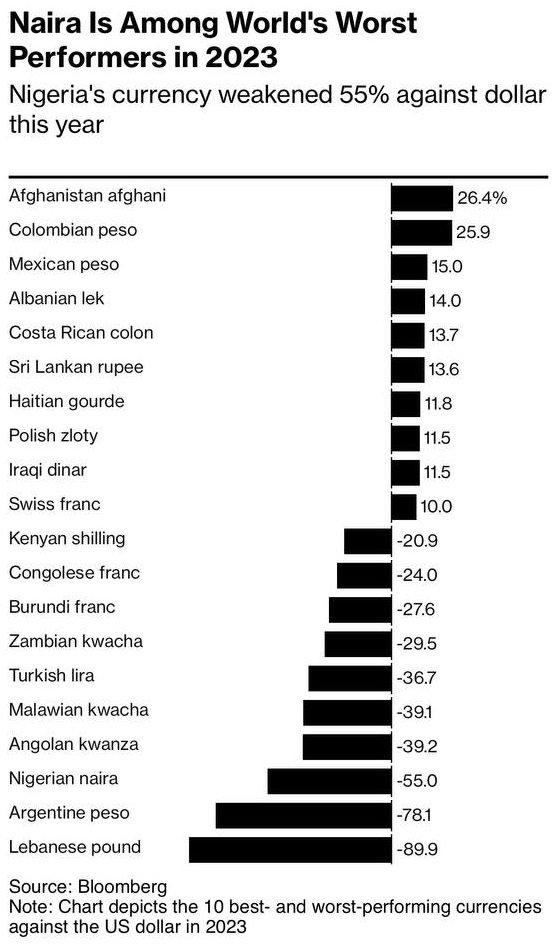

In a turbulent economic year, the naira, Nigeria’s currency, has experienced a sharp decline, shedding more than half of its value against the US dollar in official markets and even more in the parallel market. Bloomberg identifies it as the world’s worst-performing currency, trailing only behind the Lebanese pound and the Argentine peso.

The primary culprit behind the naira’s struggles is the dwindling foreign reserves, which are scarcely sufficient to meet the country’s short-term external obligations. Nigeria, heavily reliant on oil exports for foreign exchange earnings, grapples with the aftermath of a double blow: a global oil price slump and the COVID-19 pandemic, which slashed demand for its crude.

CBN Measures Falls Short of Saving the Naira

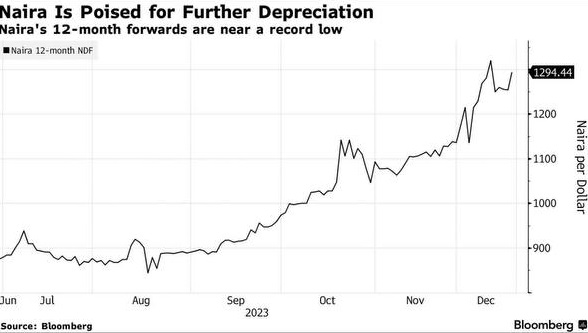

In an effort to stabilize the situation, the Central Bank of Nigeria (CBN) has devalued the naira three times since June and introduced a more flexible exchange rate regime. Despite these measures, confidence in the currency remains elusive, and foreign investors remain hesitant due to the combination of a high inflation rate and a negative real interest rate.

November witnessed inflation reaching a staggering 28.2%, driven by escalating costs of food and fuel, marking the highest in 13 years. To counteract inflation and prop up the naira, the CBN raised its benchmark interest rate to 18.75%. However, this move has inadvertently increased borrowing costs for businesses and consumers.

Analysts foresee a continued depreciation of the naira in 2024 unless President Bola Tinubu’s government can bolster oil production, diversify the economy, and implement structural reforms. In the non-deliverable forwards market, where investors speculate on the naira’s future value, the 12-month contract hovers near a record low at 1,294 to the dollar.

Nigeria’s e-Naira Volume Surge

A glimmer of hope for the beleaguered naira lies in the October launch of the e-Naira, Nigeria’s digital currency. The CBN envisions the e-Naira enhancing financial inclusion, reducing the cost of cash management, and facilitating cross-border payments.

The volume of e-Naira in circulation surged by 284.6% to N9.78 billion in August, while traditional notes and coins witnessed a 14% decline to N2.65 trillion, according to the CBN’s most recent “Monthly Economic Report.”

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.