In a robust show of resilience, the Canadian dollar, affectionately known as the loonie, surged against the US dollar on Friday, spurred by a trifecta of positive factors: better-than-expected employment figures, unshaken labor market stability, and a buoyant oil market.

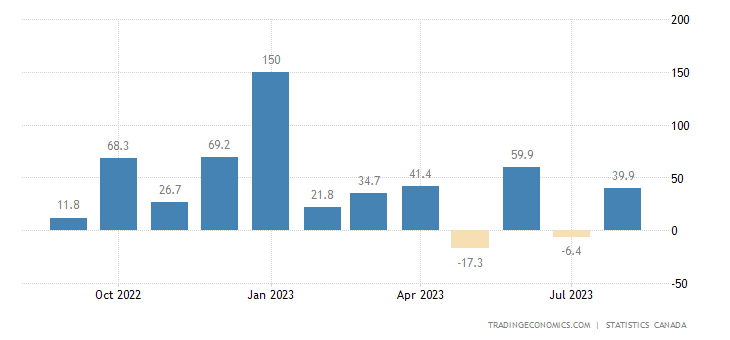

Statistics Canada revealed that the Canadian economy added a remarkable 39,900 jobs in August, handily eclipsing the market’s modest prediction of 15,000. Remarkably, the unemployment rate held its ground at 5.5%, proving the labor market’s unwavering strength in the face of recent interest rate hikes by the Bank of Canada (BoC).

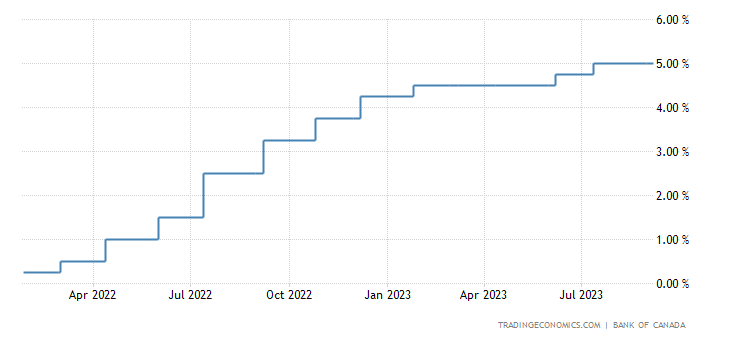

These stellar employment figures have injected fresh vigor into the possibility of another BoC rate hike by year’s end. Money markets, quick to react, now price in a 44% probability of a 25-basis-point increase, a notable jump from the previous 36%, according to Reuters.

It’s worth noting that the BoC has already elevated its benchmark rate twice this year, reaching a 22-year peak of 5%. However, the central bank opted for stability at its latest meeting, citing a temporary dip in growth.

Canadian Dollar Ascent Bolstered By Oil Price Spike

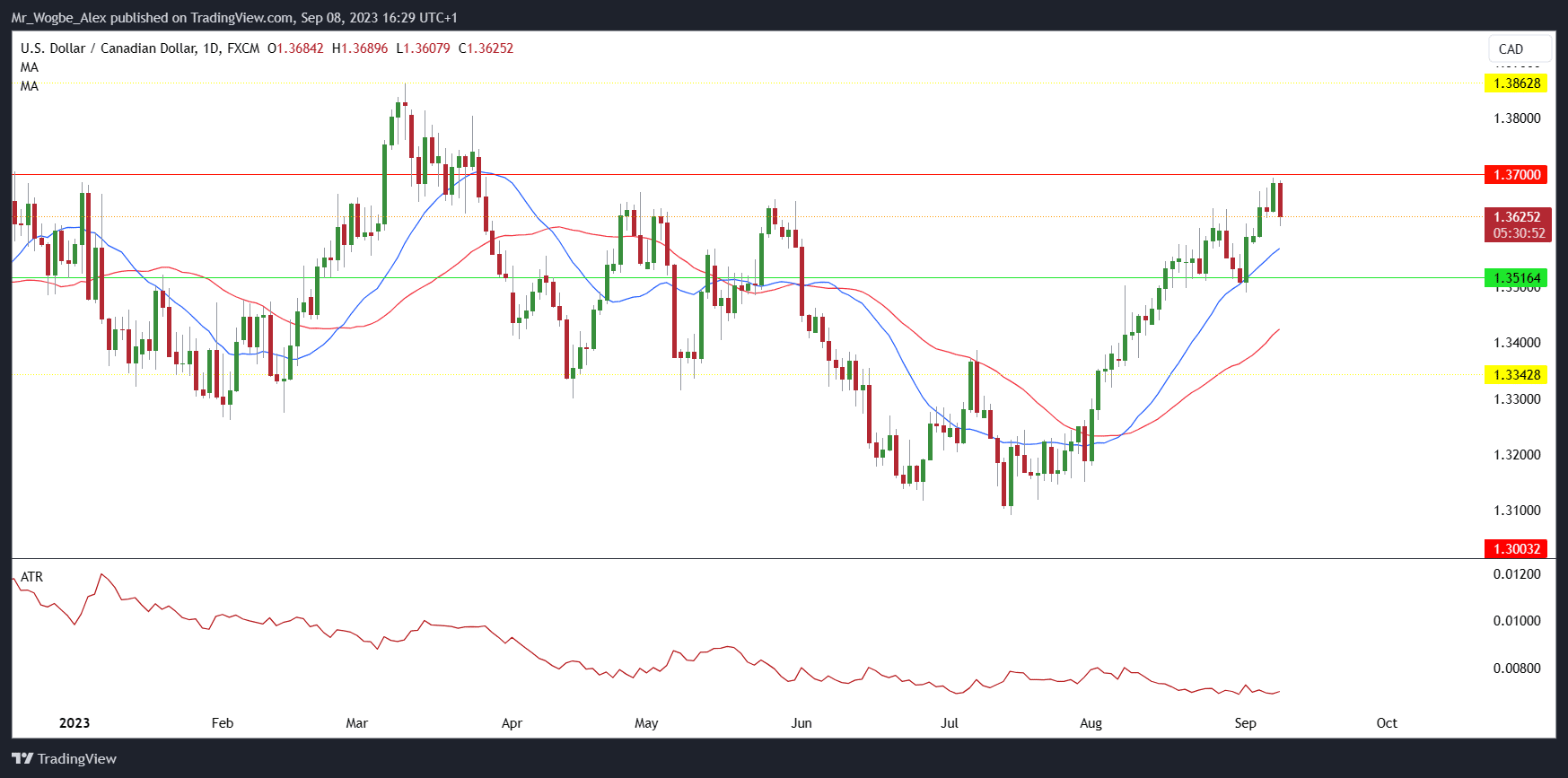

The loonie’s ascent was further turbocharged by the uptick in oil prices, a sweet melody to Canadian ears as the nation is a heavyweight crude oil exporter. US crude oil futures ascended by a robust 1% to hit $87.67 a barrel, with investors keenly monitoring global supply dynamics amid mounting uncertainties. Meanwhile, the US dollar index, gauging the greenback’s performance against six major currencies, receded by 0.11% to settle at 104.93.

Friday saw the loonie soar to 1.3607 against the greenback, marking a commendable 0.5% gain from Thursday’s close. This positive momentum comes after a recent low of 1.3694 on Thursday, with the loonie finishing the week down by a modest 0.2%.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.