Buyers are getting ready to take over Uniswap market

Uniswap Price Analysis – 21 September

If there is enough purchasing pressure to go through the $4.5 resistance level, the $4.7 and $4.9 resistance levels might be broken. If sellers are successful in driving the price below the $4.0 support level, the price levels of $3.5 and $3.1 will be put to the test.

UNI/USD Market

Key Levels:

Resistance levels: $4.5, $4.7, $4.9

Support levels: $4.0, $3.5, $3.1

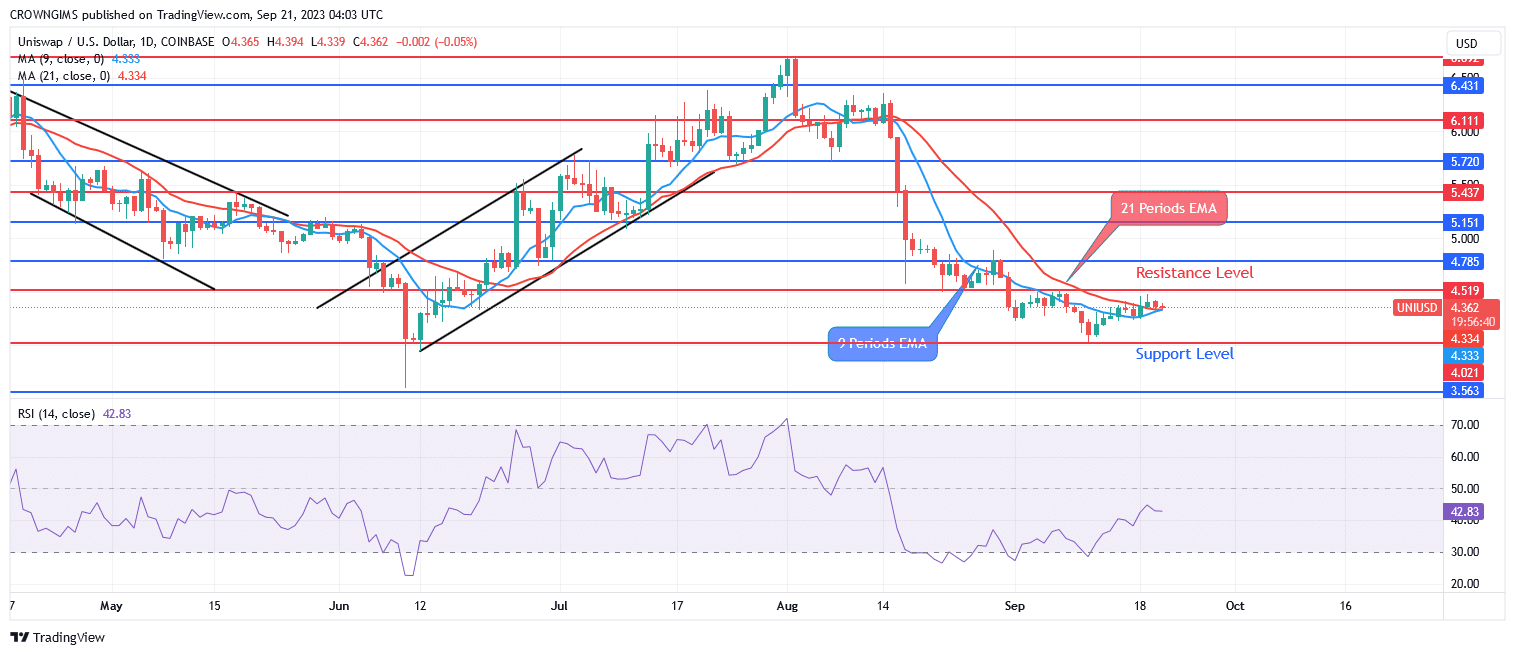

UNI/USD Long-term Trend: Bearish

On the daily Chart, Uniswap has a bearish bias. Near the $4.0 level, buyers are seeking to halt further drop. Positive pressure was applied to the cryptocurrency in the previous month. Uniswap has to move higher to get past the $6.4 barrier level. When the $6.6 high was contested, the bullish fervor diminished. A significant bearish daily candle appeared on August 2 and the price started to fall. Prior support levels of $4.9, $4.7, and $4.5 were breached by the plunge. The support level of $4.5 has already been crossed, and the price is now rejecting $4.0 level.

Trading above the two EMAs on Uniswap indicates a bullish trend. If there is enough purchasing pressure to go through the $4.5 resistance level, the $4.7 and $4.9 resistance levels might be broken. If sellers are successful in driving the price below the $4.0 support level, the price levels of $3.5 and $3.1 will be put to the test. The period 14 relative strength indicator bends upward at level 42, indicating a buy.

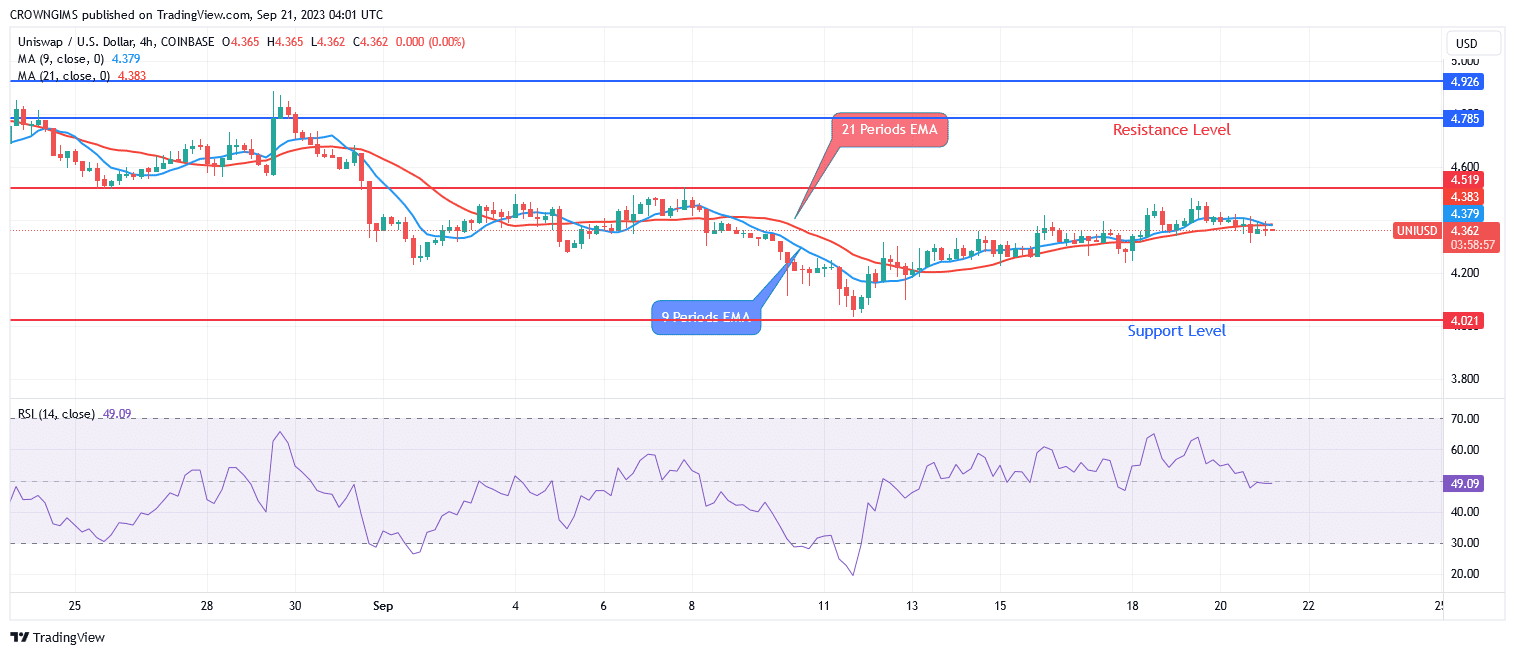

UNI/USD Medium-term Trend: Bullish

The 4-hour Uniswap chart shows a bullish tendency. The cryptocurrency surmounted many challenges, including those at $6.1 and $6.4, before finding resistance at a price of $6.6. When the sellers maintained the $6.6 barrier level, the price started to decline. Due to greater vendor pressure, the price has decreased to $4.0. Bulls and bears are currently fighting, which causes range movement.

Buyers are currently applying price pressure. The exponential 9- and 21-period moving averages for the Uniswap price are presently above them, suggesting a buy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.