Inchcape (INCH) is riding the wave of the uplift in second-hand car prices that has hit the markets as a result of supply shortages in new cars.

In the UK second-hand car prices rose 28% year on year in December – that was the 84th straight week of price appreciation.

The average price of a used car in the UK has leapt £5,000 to around £20,000.

Inchcape is a global automative distributor with operations in around 36 countries, spanning all regions, with its strongest markets the UK/Europe and AsiaPacific. In common parlance, it is car dealer.

Inchcape sells new as well as used cars. But it is more than just a dealer. It has a parts and service business in addition to providing finance and insurance.

The non-retail sales side of the business falls under into its distribution segment which also includes all the marketing and logistics services. the segment also includes aftersales and body shop repairs and parts.

The retail segment groups the same products and services as in distribution, with the exclusion of logistics, but catering to retail customers.

But whereas distribution segment covers Asia Pacific, United Kingdom and Europe, Americas and Africa, retail is more concentrated in Asia Pacific, United Kingdom and Europe.

In total Inchape has approximately 1,000 distribution and retail locations worldwide, including 100 dealerships in the UK.

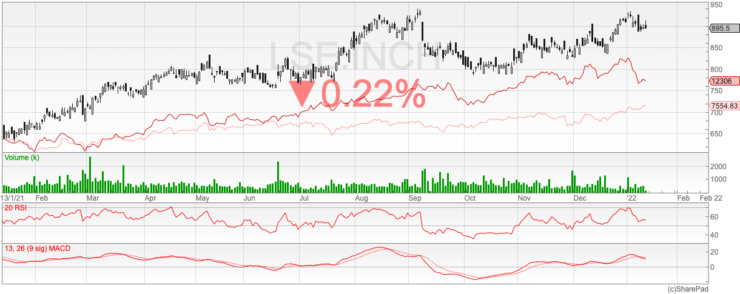

Priced at 655p 12 months ago, the company’s stock has risen to 895p, but we think there is still more upside to come with a consensus price target of 1044p.

Inchcape is buying back its shares at the moment in a programme valued at £100 million that began on 2 August last year and is due to end on 28 February.

In December US broker Jefferies made Inchcape a top pick for 2022 – pointing to “balance sheet optionality” as its main reason. free cash flow per share has nearly doubled, from 52.6p in 2020 to a trailing twelve moth figure of 100p.

Analysts suggest that Inchcape has around $1.25 billion available for acquisitions.

Improving earnings outlook in 2022

The company provided a third-quarter 2021 trading update on 28 October in which it raised its annual earnings outlook.

Inchcape based its upbeat outlook on what it described as a strong rebound in demand following the ending of Covid lockdowns.

Like its peers, Inchcape has been affected by the supply chain disruptions that have been such a feature of the pandemic economy, but the unleashing of pent up demand has more than made up for revenue shortfalls due to supply constraints.

“Whilst the widely reported supply issues are not expected

to improve until well into 2022, we are confident that margins

will remain robust through this period, mitigating the likely

impact on our topline,” CEO Duncan Tait said

in a statement that accompanied the update.

The global semiconductor shortage has hit the auto sector particularly hard because of the number of chips that modern cars rely on. That, combined with the increased demand for digital hardware such as laptops and tablets that created by the work from home changes which in some respects have accelerated already existing digitisation trends, has added to the supply problems.

Add to that the impact of Brexit, and UK-based car dealers such as Inchcape have faced headwinds on several fronts.

But Inchcape has a strong foothold at the premium end of the new car market, selling premium German marques such as Mercedes-Benz, BMW, Audi. It also has a notable profile in Volkswagen and Land Rover cars.

Although those auto companies/brands mentioned have all had to idle some production facilities, they have generally fared better than producers of lower-priced vehicles.

In the third-quarter Inchcape pulled in revenue of £1.9 billion ($2.61 billion), which was up 10% on a year earlier. However, it should be noted that was still 2% lower than for 2019.

For more information on stock trading check out our comprehensive Learn2Trade guide.

Inchcape annual profits to beat market consensus

The company expects annual profits of £290 million on strong margins.

That comes after a statement in June in which it reported that its annual earnings were expected to beat market consensus of £216 million. Net profit pre-pandemic (2019) was £323 million.

“While the ongoing supply shortages have had some impact on

our topline performance, the Group has, to date, benefited from

higher vehicle gross margins,” the company stated.

Although inflation was not mentioned as a concern, there may be some impact on demand going forward as consumers start to think twice about purchases of big ticket items.

However, that is yet to show up and the gap between producers prices is widening, which means for now manufacturers are absorbing some of the price increases and not passing them on fully to consumers.

Inchcape is the sort of cash generative cyclical company that will benefit from the continued economic recovery – and also from the flip side of supply disruption, in which demand remains robust and elevated prices provide room for continued margin improvement.

We rate Inchcape a low-risk medium-term buy.

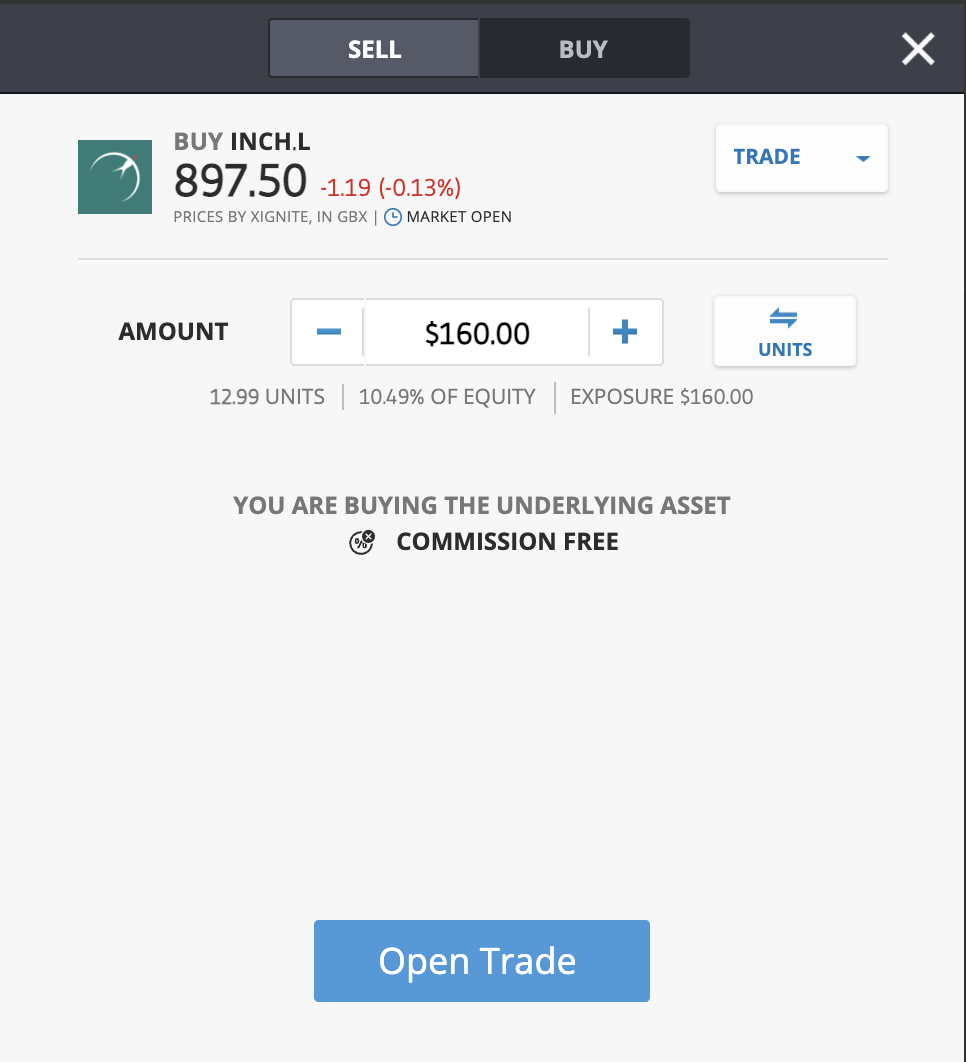

You can buy Inchcape shares for 0% commission on global investment platform eToro.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.