EURUSD Price Analysis – May 17

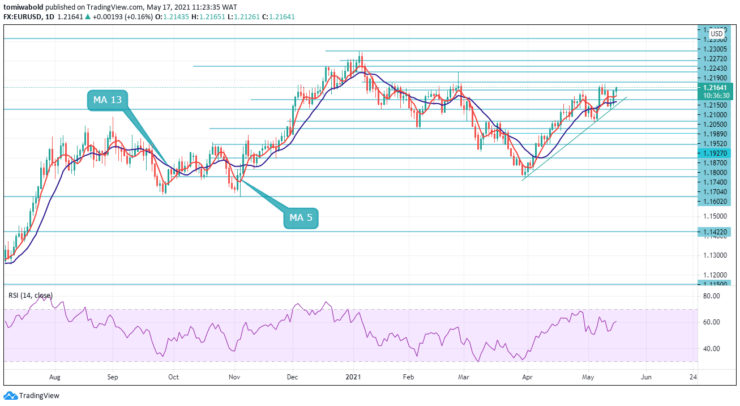

Buyers of the EURUSD are set to return the pair towards the 1.2200 area after Friday’s advance. As it attempts to range the price continues to rally to break higher the 1.2150. The dollar is being weighed down by falling US Treasury yields.

Key Levels

Resistance Levels: 1.2272, 1.2243, 1.2190

Support Levels: 1.2100, 1.2050, 1.2000

The pair is currently up 0.05 percent at 1.2152, with a breakout of 1.2150 (psychological zone) targeting 1.2200 on the way to a 1.2243 high of Feb. 23. The next support on the other hand, appears at the moving average (MA 50) at 1.2115, followed by the 1.2100 low level, and finally 1.2050.

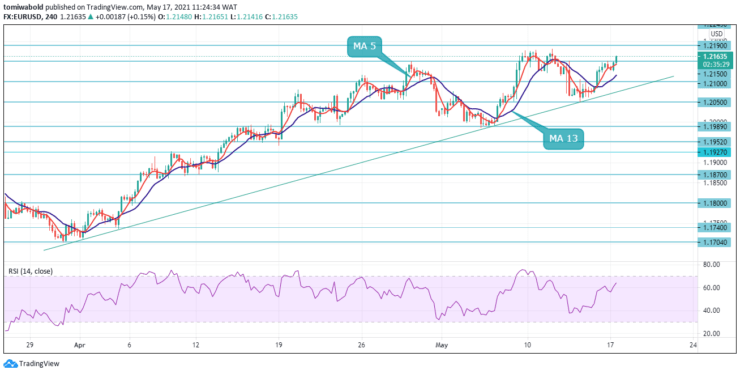

The EURUSD’s recent rally from 1.2126 intraday low is continuing on a positive path. A drop below the ascending trendline and horizontal support zone at the 1.2100-1.2115 boundary, on the other hand, could exacerbate negative tendencies.

Further growth in the EURUSD is anticipated as long as the breach of 1.2150 is sustained. The new rally from 1.2050 should strive for a 61.8 percent gain from 1.2050 to 1.2150 followed by 1.2150 to 1.2200. A break of 1.2150 resistance, however, could confirm a short-term peak, provided the bounce condition in the 4 hour RSI.

For a steeper pullback, the intraday slope can be shifted back downward. The pair may correct below the support levels of 1.2150 and 1.2100 on the 4-hour chart. A fall below the ascending trendline with support at 1.2050 will alter the narrative. The sustained breakout of 1.2150, on the other hand, would suggest that the euro would stabilize and trade upward for some time.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.