A bundle of financial information discharged on Friday demonstrated that the US economy is having the longest development ever, appears to have kept up moderate development rates toward the year’s end, upheld by a solid labor market.

The gross domestic product expanded 2.1% year on year, the Department of Commerce said in its third-quarter GDP evaluation. This was unaltered from the November evaluation.

The US economy appears to have quit easing back. There is no sign that this will be a hit to the downturn. Not long ago, speculators were startled by the dread of a downturn in the United States, when the yield curve in the United States flipped around, which verifiably was one of the most dependable indications of a downturn in the United States.

Independent information displaying consumer spending, which is answerable for more than 66% of US monetary action, expanded 0.4% a month ago as household increased car purchases and spent more on health services. This stands out from the sudden weakening in consumer sentiment in Germany.

The greenback fell 4.4% on the second exchanging day of this current year, as a lack of yen because of an end of the week in the Japanese market increased the fall in the dollar/yen, brought about by an uncommon notice about income from Apple.

Currency traders marginally decreased their net short positions in the yen in the week that finished last Tuesday, after consistent increments in money rates for a while, information from the US monetary observer displays on Friday.

Even though the dollar is upheld by optimism about the worldwide economy after Washington and Beijing went into an interval exchange agreement before this month a few recall concerns about increased tensions between North Korea and the United States.

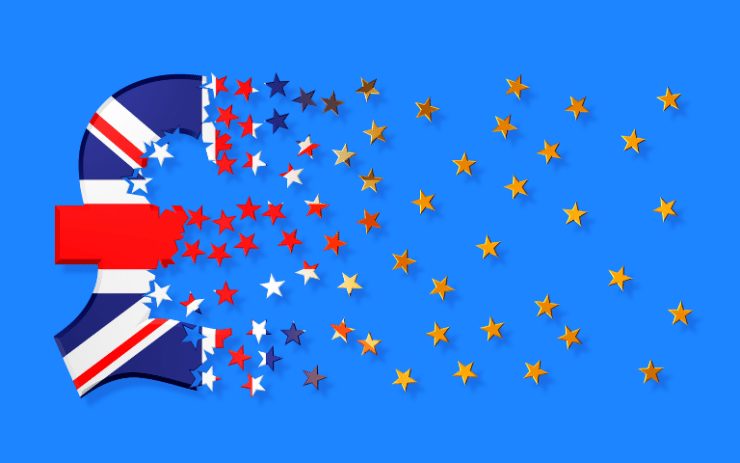

Sterling was exchanging at $ 1,2924, receding marginally in the wake of discovering some support after arriving at a low of $ 1.2900 in very nearly more than about fourteen days. A week ago, it fell 2.6%, the biggest week by week fall since October 2016, after British Prime Minister Boris Johnson set December 2020 as a tight cutoff time for arriving at a trade truce.

On Friday, Johnson got an endorsement for his negotiations on Brexit in parliament, which was the initial move towards satisfying his campaign promise to leave Britain from the European Union by January 31.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.