Bitcoin (BTC) Price Analysis – October 1

Bitcoin is still bearish. What we are experiencing now is just a proper retracement to $9000 zone that was lost on September 24. Once Bitcoin reaches the mentioned zone, we can expect a massive dump to the $7000 price zone. The correction is normal for BTC to gather momentum for the next bearish move. As of now, the market is up by +3.59% with a more short-term bullish outlook.

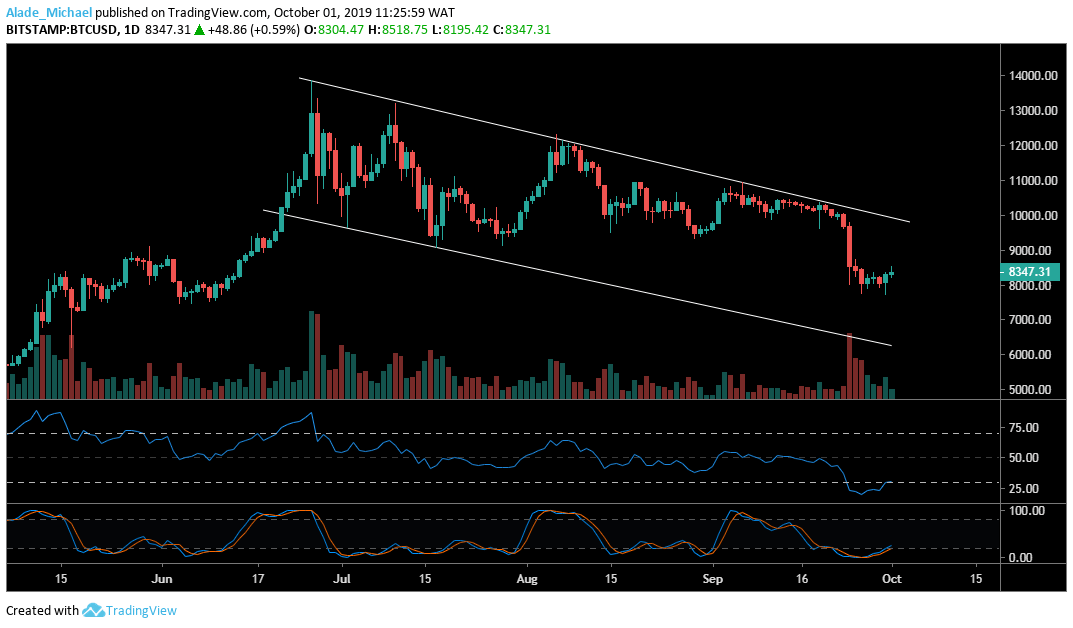

Bitcoin (BTC) Price Analysis: Daily Chart – Bearish

Key resistance levels: $8600, $8800, $9000

Key support levels: $8200, $8000, $7750

The price of Bitcoin has struggled to hit $8500 earlier today after bouncing off at the $7750, which now holds as support. Currently, the market has slightly dropped to the current trading price at $8347. A bullish continuation could allow the market to further test the $8600, $8800 and $9000 resistance before resuming the bear rally.

As we can see, Bitcoin is now trending in a new descending channel pattern following the wedge break-down on September 24. However, the crypto trading signals a potential buy on the technical indicators. If BTC rolls back, we might see a bearish extension towards the $8200. $8000 and $7750 support, the mid-year low.

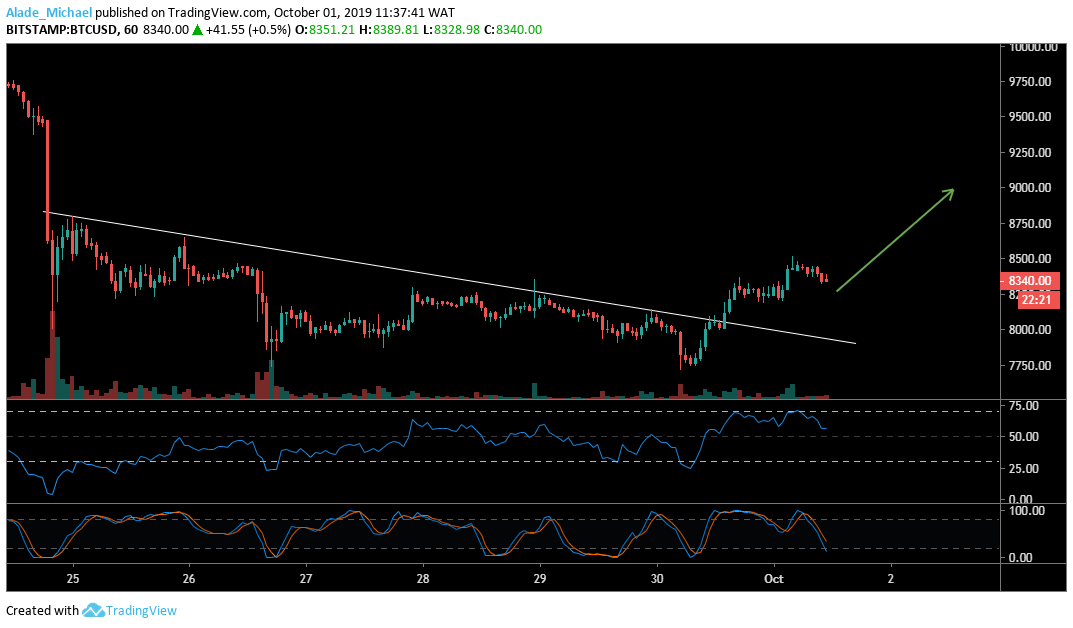

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

Bitcoin is now bouncing higher following the break above the descending trend line (white) along with the important $8000 resistance-turned-support. The buyers are now targeting $9000 resistance. Before then, Bitcoin needs to climb to $8512, $8700 and $8850 resistance. But now, the market is currently pulling back.

If the price further pulls lower, the BTC price may floor at $8250, $8142 and $8015 support to test the while line. The crypto trading signals a selling pressure on the Stochastic RSI. We can expect a buy-back as soon as the oscillator turns bullish. The RSI is now pointing downward to show a slight drop in price. If the RSI 50 can remain strong, a price will continue to rise.

BITCOIN BUY SIGNAL

Buy Entry: $8268

TP: $8888

SL: $8153

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.