The British pound weakened on Tuesday, losing 0.76% against the U.S. dollar, with the exchange rate hitting $1.2635.

This reversal follows a recent surge that saw the pound reach a nearly five-month high of $1.2828 on December 28, attributing its climb to a weakened dollar amidst global economic and geopolitical uncertainties.

Simultaneously, the U.S. dollar index (DXY), measuring the greenback against six major currencies, rose by 0.74%, underscoring the pound’s decline in comparison.

The sterling’s robust performance in 2023, witnessing an almost 6% increase, was fueled by positive economic indicators and expectations that the Bank of England (BoE) would maintain higher interest rates.

However, concerns about a weakening economy and uncertainties surrounding upcoming elections cast doubt on the pound’s ability to replicate last year’s success.

British Pound Falls Against the Euro Amid BoE Rate Cut Speculations

The pound also experienced a minor dip against the euro, rising 0.13% to 86.77 pence, reflecting a broader trend as inflation data fuels speculations about potential BoE rate cuts.

Recent data released on Tuesday indicated a slowdown in inflation, with prices charged by British store chains experiencing the slowest increase in a year and a half in December, according to the British Retail Consortium. Food price inflation also cooled to 6.7%.

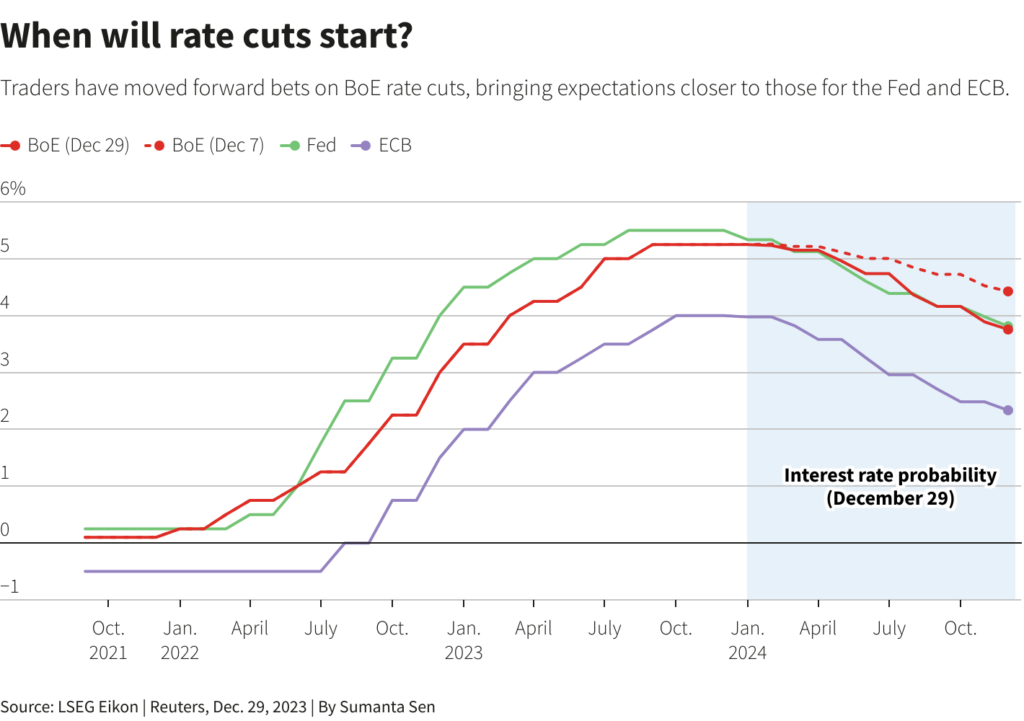

Despite these figures, analysts at Monex Europe argue that the market might be overestimating the possibility of rate cuts in the U.K., according to Reuters.

They interpret the data as only mildly disinflationary, cautioning that current market expectations anticipate a 25 basis point BoE rate cut in May and nearly 140 basis point cuts throughout the year.

As the pound navigates these economic waters, the impact of global economic dynamics, coupled with domestic factors, will likely continue to shape its trajectory in the coming weeks.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.