BNBUSD may retest $204.9 level

BNBUSD Price Analysis 01 September

If selling continues at their current rate, BNB might drop to its most recent lows of $204.9 and $187.3 before closing beneath the crucial $167.9 mark. The $219.2 resistance level can be broken higher, providing a challenge to the $237.0 and $254.2 resistance levels, if buyers can hold the $204.9 support level.

BNB/USD Market

Key levels:

Supply levels: $219.2, $237.0, $254.2

Demand levels: $204.9, $187.3, $167.9

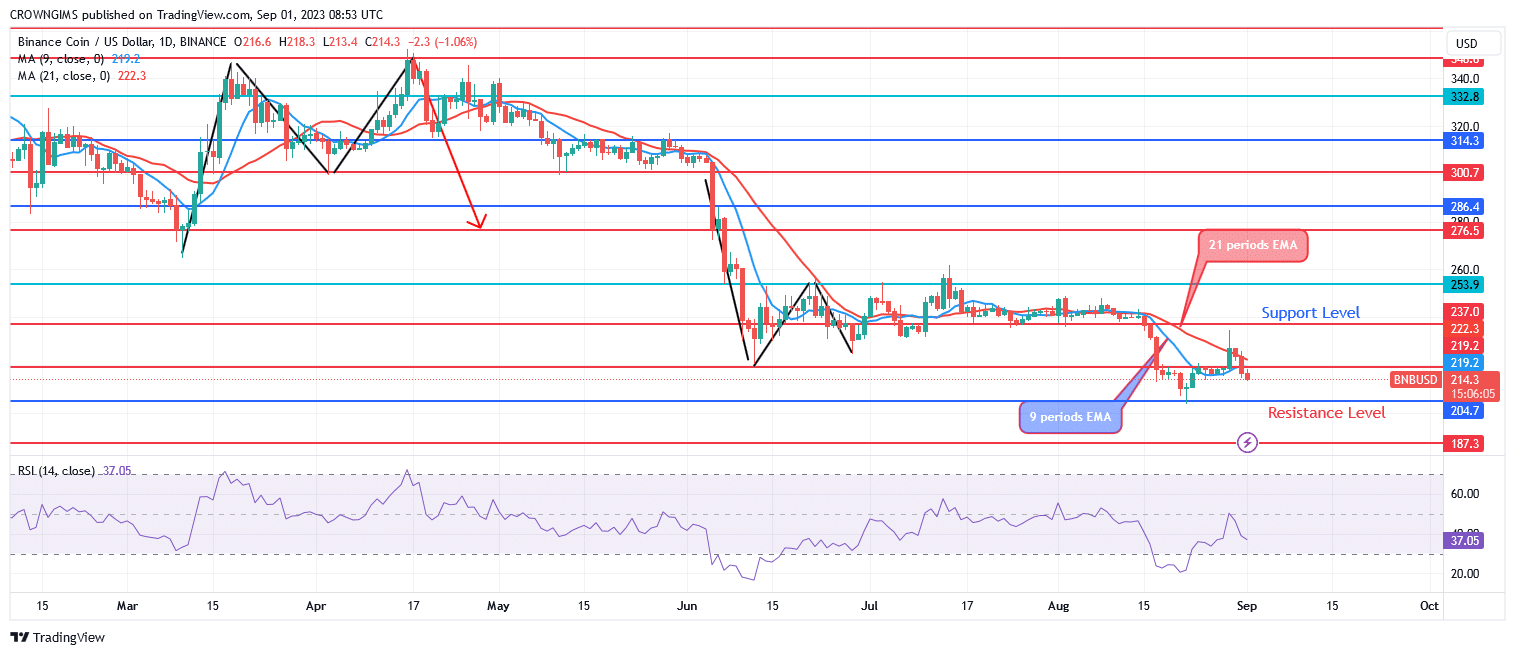

BNBUSD Long-term Trend: Bearish

BNBUSD exhibits a bearish movement. Sellers are gaining the upper hand in the BNB market after a pullback experienced last week. Three weeks ago there was a low volatility, price changes were limited to the $254.2 to $236.9 range. On August 29, buyers won the day over sellers. The previous high of $237.0 was tested after the resistance level of $219.2 was breached. The sellers defend the just-mentioned level and it prevents further price increases. Yesterday, $219.2 level was breached and the price faced a previous low of $204.9 level.

The currency pair is below both the 9-period and 21-period exponential moving averages, indicating a bearish trend. If selling continues at their current rate, BNB might drop to its most recent lows of $204.9 and $187.3 before closing beneath the crucial $167.9 mark. The $219.2 resistance level can be broken higher, providing a challenge to the $237.0 and $254.2 resistance levels, if buyers can hold the $204.9 support level.

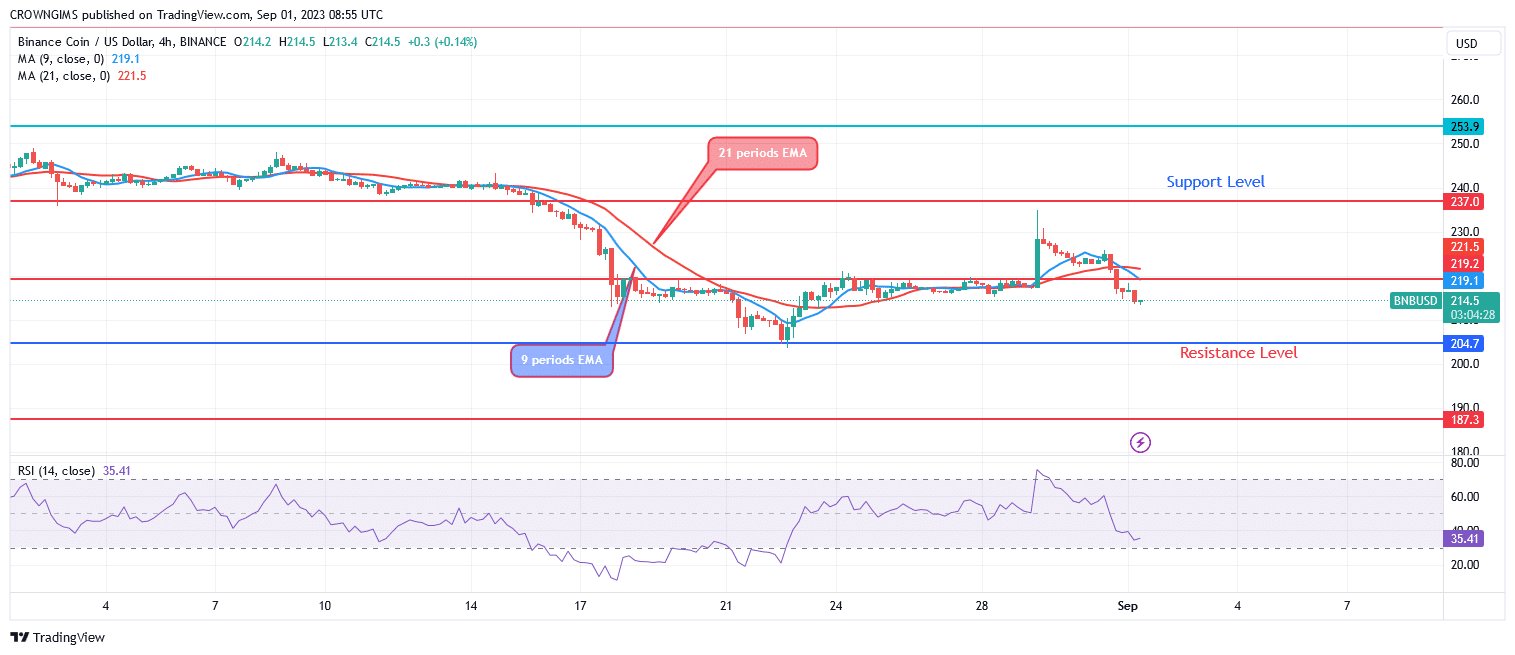

BNBUSD medium-term Trend: Bearish

Bearish movement may continue in the 4-hour time frame. The significance of the double bottom chart pattern that had emerged at the $219.2 support level was lost as the bears’ momentum increased. Initial signals suggested that purchasers would probably seize market control. The buyers’ enthusiasm decreased after the forced price test at the $237.0 barrier level. The price is currently attempting to challenge $204.9 level.

BNB is currently trading below both the 9- and 21-period exponential moving averages. A sell is implied when the relative strength index period 14 signal line is pointing downward at level 36.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.