Bitcoin exchange-traded funds (ETFs) are swiftly becoming the preferred choice for investors seeking exposure to cryptocurrency without the complexities of direct ownership.

In a remarkable surge, nine new spot bitcoin ETFs have debuted in the US over the past month, collectively amassing over 200,000 bitcoins, equivalent to a staggering $9.6 billion at current exchange rates.

There we have it! The new nine have amassed more than 200k BTC.

Second-strongest daily U.S. spot flow since launch yesterday.

Since launch, the total net inflow to U.S. spot ETFs sits at a massive 51,134 BTC. pic.twitter.com/6RFugg7jZO

— Vetle Lunde (@VetleLunde) February 9, 2024

Distinguished by their methodology of holding actual bitcoins in custody, these ETFs mark a departure from previous offerings reliant on derivatives or trusts.

These ETFs track the price of bitcoin by holding the actual coins in custody, unlike previous products that used derivatives or trusts. The nine ETFs are:

- BlackRock (IBIT)

- Fidelity (FBTC)

- Bitwise (BITB)

- Ark 21Shares (ARKB)

- Invesco (BTCO)

- VanEck (HODL)

- Valkyrie (BRRR)

- Franklin Templeton (EZBC)

- WisdomTree (BTCW)

Surpassing notable bitcoin holders like MicroStrategy and Tether, these ETFs collectively secure 0.95% of the finite 21 million bitcoin supply, signaling a seismic shift in investor sentiment toward cryptocurrency exposure.

Leading the pack, BlackRock’s IBIT and Fidelity’s FBTC command significant holdings, with respective bitcoin reserves exceeding 80,000 and 68,000 (equivalent to $3.8 billion and $3.3 billion). Notably, these ETFs rank among the top 25 ETFs overall in terms of assets under management, as indicated by Bloomberg ETF analyst Eric Balchunas.

Here's a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

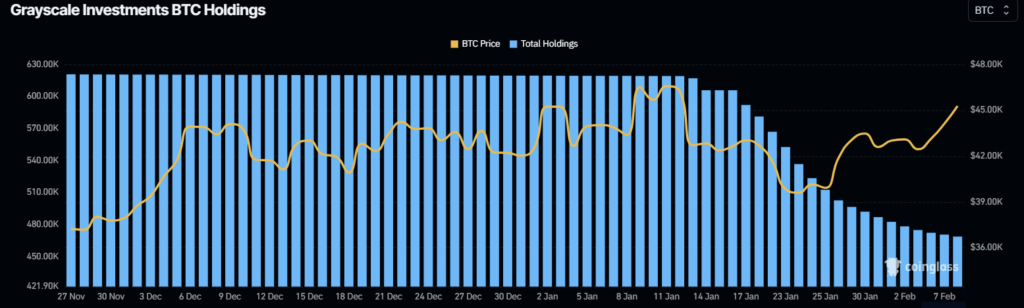

In contrast, Grayscale’s GBTC, the pioneer and largest bitcoin fund to date, has experienced a substantial decline of nearly 25% in assets since the advent of these new ETFs. This shift underscores investors’ pivot towards more liquid and cost-effective alternatives.

BlackRock and Fidelity’s Bitcoin ETFs Top Global ETF Chart

In terms of trading volume and inflows, the new ETFs have demonstrated remarkable prowess, outpacing GBTC on multiple fronts. Notably, on Thursday alone, IBIT and FBTC boasted trading volumes of $481.6 million and $246.6 million, respectively, eclipsing GBTC’s $373.9 million.

Furthermore, IBIT and FBTC recorded net inflows of $204.1 million and $128.3 million, while GBTC saw net outflows of $101.6 million, according to insights from BitMEX Research and The Block’s data dashboard.

For those interested in exploring investment opportunities in bitcoin and other crypto products, a free newsletter offers access to invaluable market insights and crypto signals.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.