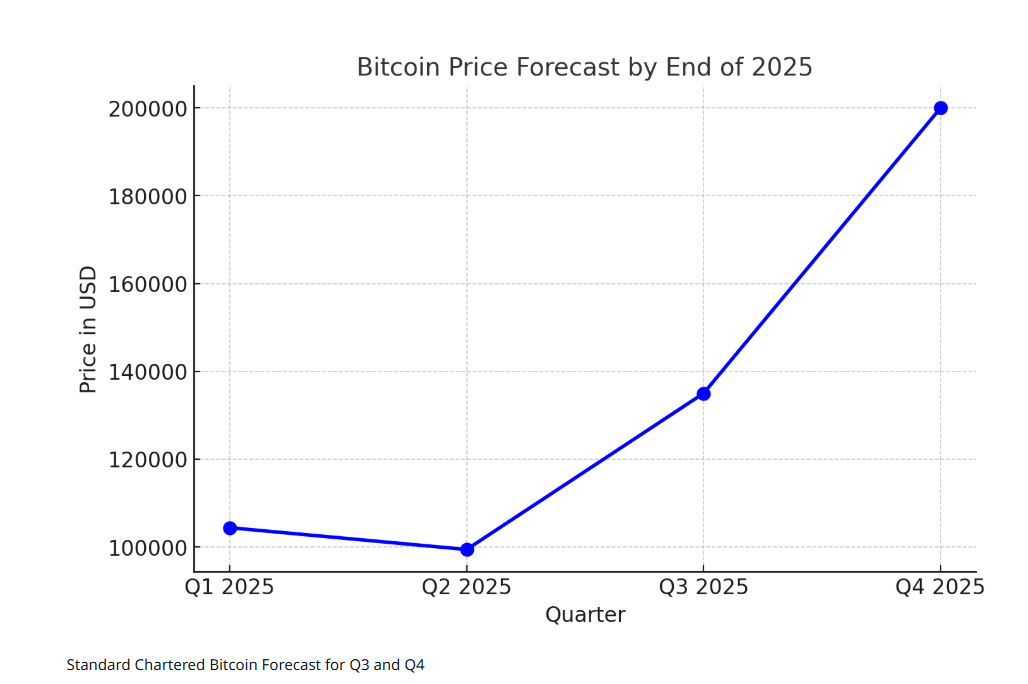

Bitcoin has broken through its previous record high and closed above this critical level, marking a significant shift in market dynamics. Standard Chartered Bank projects the cryptocurrency will reach $200,000 by the end of 2025, with an even bolder prediction of $500,000 by 2028.

This forecast stems from growing institutional adoption and government interest in cryptocurrency exposure.

The bank’s Global Head of Digital Assets Research, Geoff Kendrick, maintains specific price targets: $120,000 by the end of Q2, $200,000 by late 2025, and $500,000 by 2028.

These projections are backed by concrete data showing institutional money flowing into the space at unprecedented levels.

BITCOIN EXPECTED TO REACH NEW ALL-TIME HIGHS IN 2H

Standard Chartered expects Bitcoin to reach new all-time highs in the second half of 2025, driven by rising ETF flows, corporate buying, potential Fed rate cuts, and a U.S. stablecoin bill. The bank forecasts Bitcoin to hit…

— *Walter Bloomberg (@DeItaone) July 2, 2025

Government Entities Drive Institutional Adoption in Bitcoin

Recent SEC filings reveal a notable trend in government-related investments. During the first quarter, 12 government institutions, including US state retirement funds and foreign central banks, increased their holdings in MicroStrategy shares. This indirect approach gives them exposure to approximately 31,000 Bitcoin worth of value.

Many government entities face regulatory constraints that prevent direct Bitcoin purchases. Instead, they invest in companies holding substantial Bitcoin reserves, creating a backdoor entry into the cryptocurrency market. This strategy allows institutional players to gain exposure while staying within regulatory boundaries.

The shift in investment patterns is particularly striking when comparing Bitcoin ETFs to traditional safe-haven assets. Over five weeks, US spot Bitcoin ETFs attracted $7.2 billion in net inflows, while gold ETFs experienced $3.6 billion in outflows during the same period. This represents a clear preference shift toward Bitcoin as a store of value.

Market Sentiment Remains Controlled Despite Breakout

Crypto analyst Nic Puckrin from The Coin Bureau notes that current market conditions differ significantly from previous rallies. Unlike the January surge driven by unrealistic expectations about political changes, this movement appears more sustainable and fundamentally driven.

The market has entered price discovery territory, potentially enabling swift moves toward $120,000, though resistance may emerge around $115,000 as traders take profits. Puckrin’s longer-term base case targets $150,000 for this cycle, supported by several key indicators.

Current ETF flows, Bitcoin options implied volatility, and Google search trends remain subdued compared to the last time Bitcoin approached $100,000. This suggests retail euphoria hasn’t peaked yet, leaving room for further growth as mainstream adoption continues expanding.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.