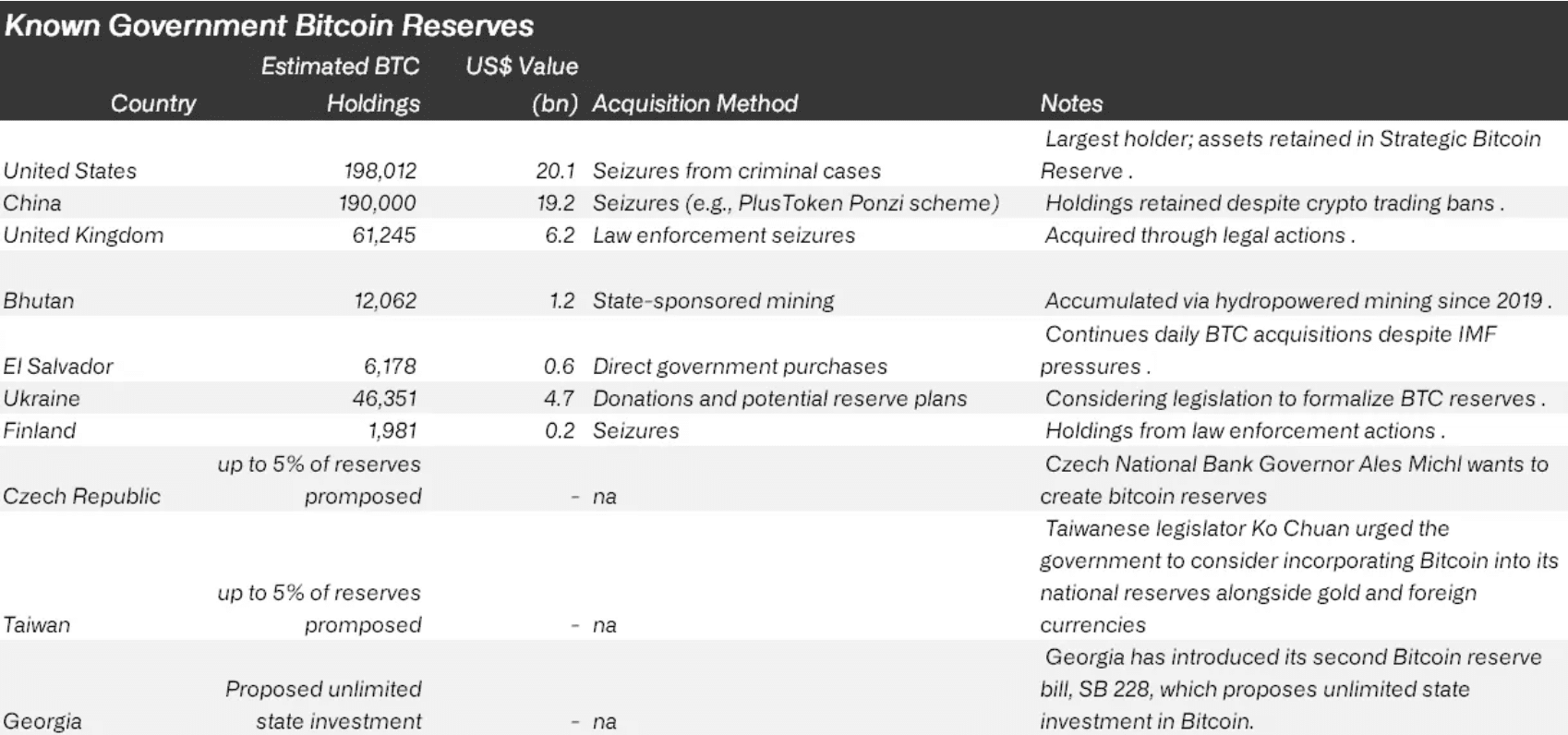

Bitcoin adoption has reached a new milestone as governments worldwide begin adding the cryptocurrency to their strategic reserves.

The United States established its Strategic Bitcoin Reserve in March 2025, marking a significant shift in how nations view digital assets alongside traditional holdings like gold and foreign currencies.

This move comes at a time when global economic pressures are mounting. National debts continue climbing, inflation remains persistent, and geopolitical tensions create uncertainty in traditional financial systems.

Bitcoin’s unique characteristics are drawing attention from policymakers who need alternatives to conventional reserve assets.

Why Governments Are Choosing BTC

Several factors make Bitcoin attractive for national reserves. The cryptocurrency has a fixed supply cap of 21 million coins, which cannot be changed through political decisions or monetary policy adjustments. This scarcity provides predictability that fiat currencies lack.

The numbers support Bitcoin’s appeal as an inflation hedge. Between 2020 and 2024, US inflation rose approximately 20 percent, while Bitcoin’s value increased over 1,000 percent during the same period.

Since 2009, Bitcoin has delivered average annual returns of 165 percent, significantly outperforming gold’s 7.6 percent annual returns.

Bitcoin also offers portfolio diversification benefits due to its low correlation with traditional assets. Research shows that even a modest 4 percent allocation to BTC can improve the overall risk-adjusted returns of reserve portfolios. Central banks are already modeling these benefits in their strategic planning.

The cryptocurrency provides protection against financial sanctions and restrictions. Unlike traditional assets that can be frozen or seized, Bitcoin operates on a decentralized network that no single entity controls.

This characteristic proved valuable during recent geopolitical conflicts when traditional payment systems faced restrictions.

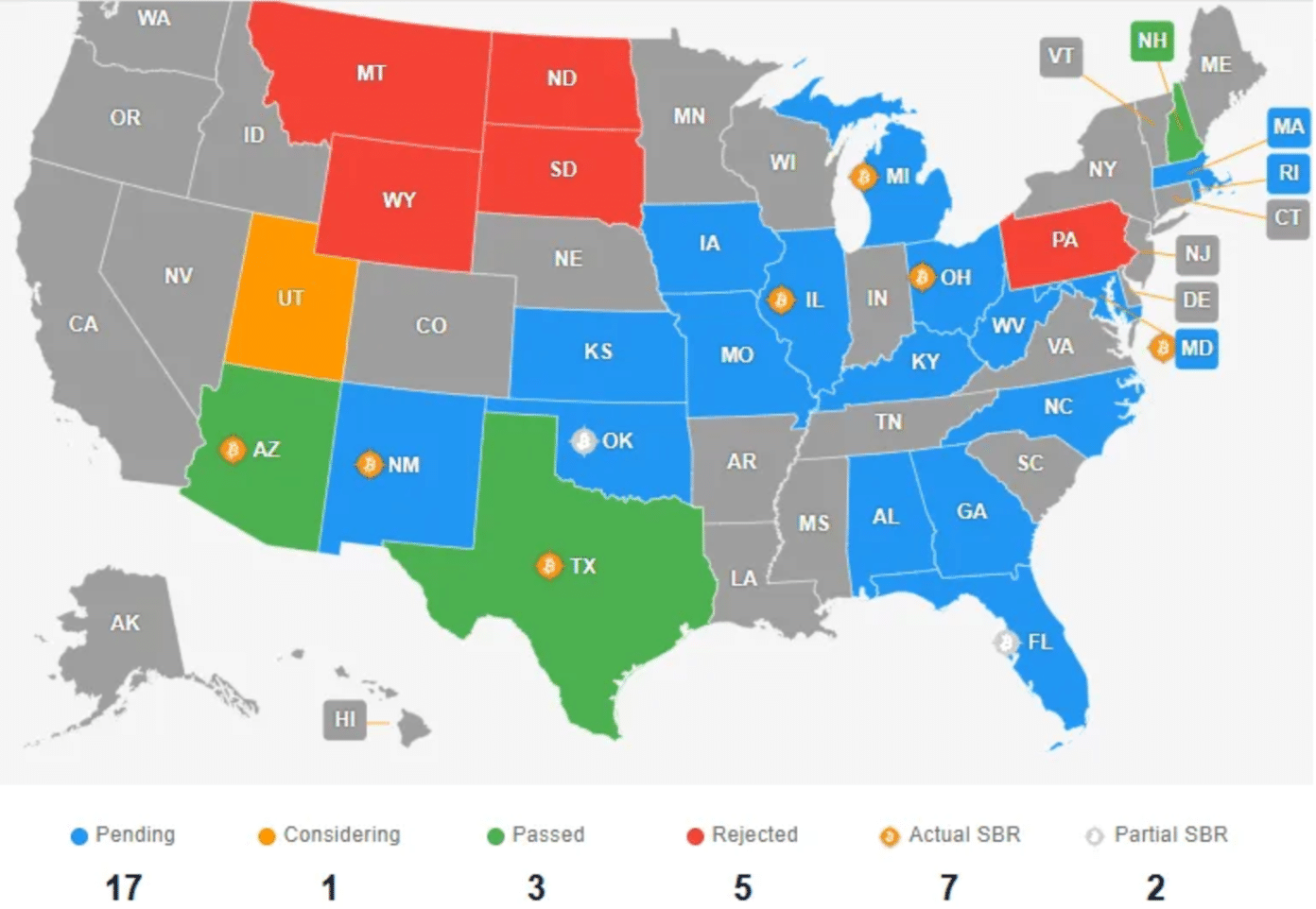

Bitcoin Reserve Implementation Spreads Across States

Beyond federal adoption, individual US states are creating their own Bitcoin reserves. New Hampshire enacted legislation establishing the nation’s first state-level Bitcoin and Digital Assets Reserve.

Arizona recently approved similar legislation, while Texas signed Senate Bill 21 to create a strategic bitcoin fund outside the state treasury. These developments reflect growing confidence in Bitcoin’s role as a strategic asset.

The cryptocurrency’s network has maintained 99.98 percent uptime since 2009, with its security strengthening as computational power protecting the network reached approximately 900 exahashes per second in 2025.

However, BTC adoption faces challenges including price volatility, regulatory uncertainty, and limited use for trade settlement.

Despite these concerns, the trend toward Bitcoin reserves appears to be accelerating as nations seek alternatives to traditional monetary systems facing unprecedented strain.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.