The cryptocurrency market has shed about $13 billion from yesterday’s peak of $387 billion over the past 24 hours.

Although it’s still largely unknown what triggered the sharp reversal, many traders believe that it was as a result of BTC venturing into overbought territory. This technical factor likely activated massive sell-offs in some trading bots, which as a result caused the decline.

Key Levels to Watch

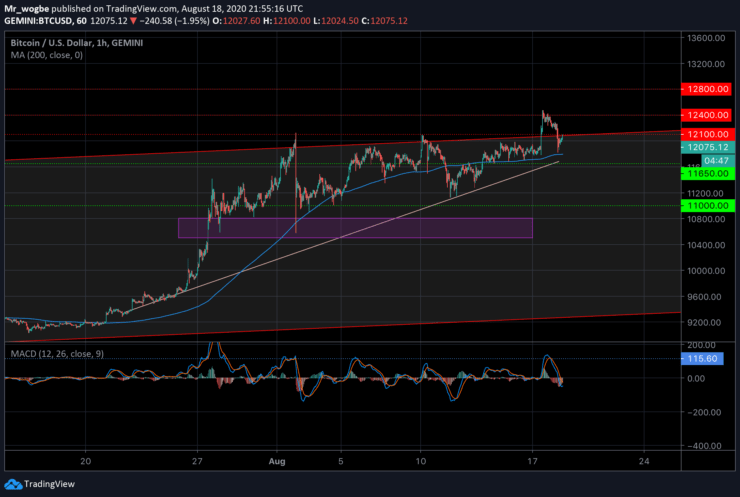

According to our hourly chart, we can see that the price has dropped back into our previous channel. We are now back in the range of the strong $12K psychological line.

Meanwhile, BTC is now approaching a cross-section between the $12,100 resistance and the top of our ascending channel around the same level. Bitcoin will have to break this cross-section resistance to regain its bullish momentum. A break and close above this level could send the price back to the $12,400 level.

After that, Bitcoin will be faced with the $12,800 and $13K resistance level.

On the flip side, immediate support can be found at the 200 moving average ($11,801) which has been a strong ‘floor’ for BTC since last week. A break beneath that line could extend this correction to the $11,650 support and beyond.

In retrospect, it can be observed that Bitcoin always regains its footing shortly after a major sell-off. This is because whales are always lurking around to buy back into selling pressure after ‘weak hands’ panic and sell their positions. That said, we are likely to see this play out once again in the near-term.

Total market capital: $378 billion

Bitcoin market capital: $222.9 billion

Bitcoin dominance: 58.7%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.