According to a Bitcoin price monitoring website, more than $200 million worth of long positions were liquidated just a few minutes after the drop. This is said to be the largest liquidation frenzy since the crypto crash of March which sent Bitcoin from a high of $7,700 to $3,700 within just a few hours.

This liquidation is indicative of how “overleveraged” Bitcoin longs were, presumably because many expected the price of BTC to continue upwards after it broke the 5-digit barrier. However, analysts are confident that the drop bottoms out at $8,000 as a reshape technical pattern has been formed.

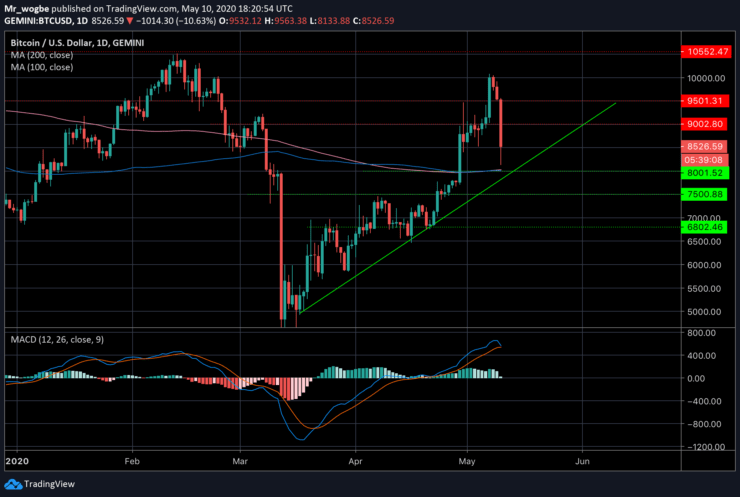

Bitcoin (BTC) Value Forecast — May 10

BTC/USD Major Bias: Bearish

Supply Levels: $9,000, $9,500, and $10,550

Demand Levels: $8,000, $7,500, and $6,800

Although Bitcoin fell about 18% the 100 and 200-day moving averages served as powerful supports against a further decline in price. BTC is also supported by an ascending trendline which has helped for some days now. However, should Bitcoin drop below this line, we could see price dropping lower to the mid-$7,000 levels.

On the flip side, should price take the $9,500 resistance again, we could see further gains into the $11,200 – $12,000 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.