In a dramatic turn of events, Bitcoin (BTC) has bounced back from its recent slump, climbing past the $60,000 mark after a tumultuous week that saw prices dip below $50,000. This swift recovery has reignited optimism in the cryptocurrency market, with some experts predicting further gains on the horizon.

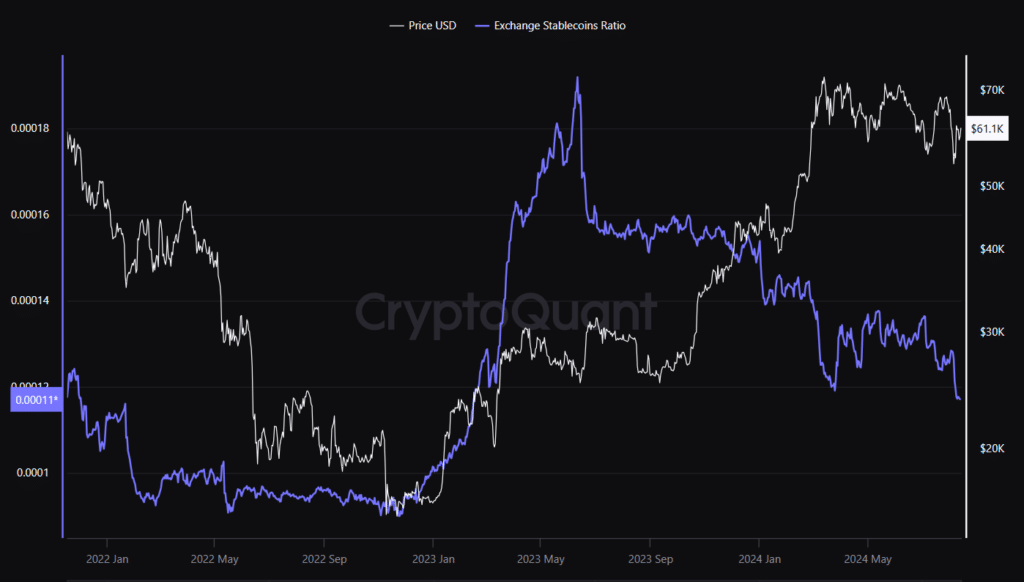

The world’s leading cryptocurrency has shown resilience in the face of recent market turbulence. Data from blockchain analytics firm CryptoQuant reveals an interesting trend: the “exchange stablecoins ratio“ has hit its lowest point since February 2023.

This metric, which measures the number of bitcoins held in wallets linked to centralized exchanges compared to stablecoins, suggests a potential decrease in selling pressure on BTC.

CryptoQuant explained to CoinDesk, “This could indicate reduced selling pressure on bitcoin as fewer traders are converting their BTC into stablecoins.” They added that this trend might point to bullish market sentiment, with traders holding onto their bitcoin in hopes of future price increases.

Adding to the positive outlook, the combined supply of the two largest stablecoins by market value, Tether (USDT) and USD Coin (USDC), has grown by about $2 billion since the market crash on August 5. This increase in stablecoin supply could signal continued fiat inflow into the crypto market, possibly from investors looking to buy bitcoin at lower prices.

Bearish Bitcoin Forecast – Guide, Tips & Insights | Learn 2 Trades

However, not all analysts share this optimistic view. Alex Kuptsikevich, a senior market analyst at FxPro, warns of potential short-term losses. According to a CoinDesk report, Kuptsikevich believes Bitcoin is more likely to fall by $5,000 than rise by the same amount in the near future.

Kuptsikevich points to Bitcoin’s struggle to maintain prices above $60,000 following a bearish technical indicator known as the “death cross”—when the 50-day moving average crosses below the 200-day moving average.

“Bitcoin does not break above $60K and faces selling after it tried to break above the 50- and 200-day MAs late last week, showing seller dominance,” Kuptsikevich noted.

In the meantime, the cryptocurrency market remains sensitive to external factors. The upcoming release of the U.S. July consumer price index data could significantly impact Bitcoin’s price. If the data shows higher-than-expected inflation, it might dash hopes for Federal Reserve rate cuts in the coming months, potentially putting downward pressure on Bitcoin’s price.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.