Bitcoin continues to maintain its upward momentum, trading at $95,200 after experiencing a 9% drop from its recent peak of $99,800. The leading cryptocurrency’s resilience in the face of this correction signals robust market confidence and sustained buyer interest at current price levels.

Key Support Levels Shape Market Dynamics

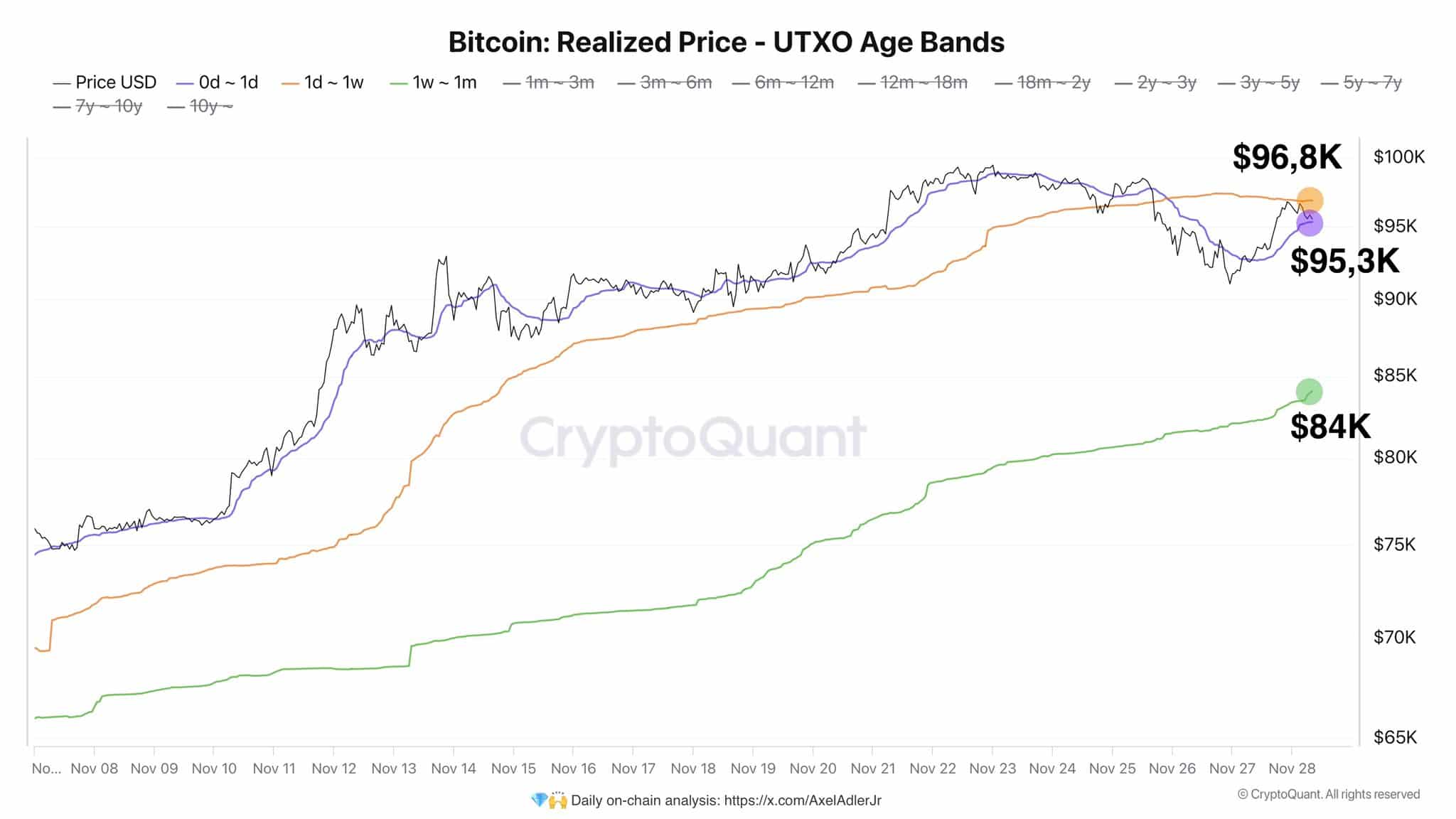

On-chain data from CryptoQuant analyst Axel Adler reveals critical price support zones that highlight Bitcoin’s strong market position. Two key investor groups are actively accumulating at current levels: short-term holders with an average entry point of $96,800 and medium-term investors who entered around $95,300.

These price points create significant support, suggesting buyers view recent dips as opportunities to increase their positions.

More notably, data shows a solid support floor at $84,000, representing the average entry price for investors who bought between one week and one month ago. This multiple-layer support structure indicates Bitcoin could maintain stability even if prices experience temporary declines.

MicroStrategy’s recent acquisition of 55,500 Bitcoin for $5.4 billion adds weight to institutional confidence in the cryptocurrency at these price levels.

MicroStrategy has acquired 55,500 BTC for ~$5.4 billion at ~$97,862 per #bitcoin and has achieved BTC Yield of 35.2% QTD and 59.3% YTD. As of 11/24/2024, we hodl 386,700 $BTC acquired for ~$21.9 billion at ~$56,761 per bitcoin. $MSTR https://t.co/79ExzXk4UM

— Michael Saylor⚡️ (@saylor) November 25, 2024

This purchase, along with broader market metrics, suggests that both retail and institutional demand remains strong despite Bitcoin trading near all-time highs.

Bitcoin at $100,000

Looking ahead, market participants are closely watching the $98,800 resistance level. A breakthrough above this mark could trigger significant momentum toward the psychologically important $100,000 milestone. However, traders should note that a failure to maintain support above $90,000 might lead to a test of lower support levels, particularly around $85,500.

The current market structure shows Bitcoin’s maturation as an asset class, with clearer support and resistance levels emerging from both retail and institutional trading patterns. While short-term volatility remains a factor, the underlying demand continues to provide strong price support, suggesting Bitcoin’s upward trajectory might persist in the coming weeks.

For investors considering entry points, the current price levels between $90,000 and $95,000 represent a critical zone where substantial buying interest exists. However, as with any investment in cryptocurrency markets, proper risk management and careful position sizing remain essential, given the asset’s historical volatility patterns.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.