• Bitcoin flashes drop to $9700 after losing 6% from a 3-month high.

A few hours ago, we saw Bitcoin losing about 6% after opening short around $10190 today. This sharp drop in price has led most correlating altcoins to see a sizeable loss over the past few hours. The $500 cut has made Bitcoin to now trade under $10000, although the bullish trajectory is still much intact for now.

Key resistance levels: $10200, $10400

Key support levels: $9800, $9200

Bitcoin (BTC) Price Analysis: Daily Chart – Bullish

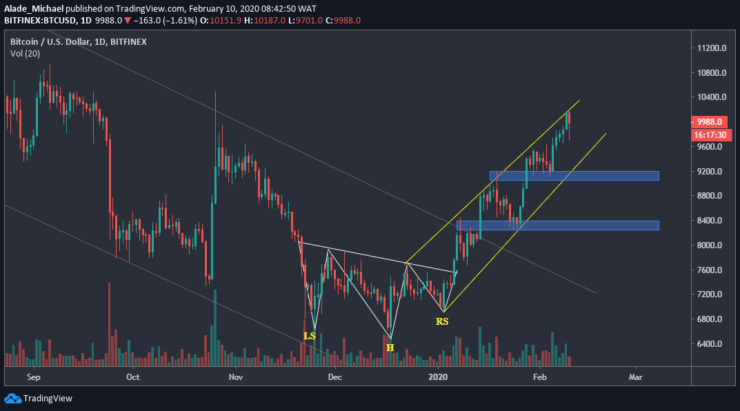

After breaking $10000 yesterday, Bitcoin has further marked a 3-month high near $10200. Today, Bitcoin saw a sharp fall to $9700 after meeting rejection around the wedge’s upper boundary, but the price has bounced back near $10000. Meanwhile, this rising wedge has held price actions since the beginning of the year 2020.

If BTC continues to correct downward, the price could fall to the wedge’s support at $9800. A break below this support could trigger a huge sell to $9200 as $8400 could play out if Bitcoin continues to drop. In case the buyers manage to regain $10200, the closest resistance to watch out for is $10400 and beyond. Nonetheless, Bitcoin remains bullish on the intraday trading.

Bitcoin (BTC) Price Analysis: 4H Chart – Bullish

The recent drop in price has made Bitcoin to almost touch the wedge’s support of $9700 on the 4-hours chart. But as we can see now, Bitcoin has slightly bounced back, forming a morning star candle pattern. If Bitcoin closes with this candle pattern, a huge price movement could lead to a wedge breakup to $10400. Though, $10200 is a close resistance to watch out for.

A continuous price drop is likely to send more selling pressure in the market. In this case, Bitcoin may revisit the wedge’s support of $9700. A slight wedge breakdown could further drop the price into the blue support area of $9500, followed by $9100. As of now, the bulls are still showing commitment in the market.

BITCOIN SELL ORDER

Sell: $9968

TP: $9700

SL: $10050

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.