Key Support Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Bullish

Yesterday, Bitcoin traded and climbed above the $10,000 price level. The upward move to the new high was short-lived as the bulls were resisted. The bulls were resisted at a high of $10,165 and the coin fell to the low of $9,812 at the time of writing. It appears the current low is holding as the bulls make an upward movement. The original target of the bulls is the $10,360 price level.

On the upside, if the coin picks up momentum, the bulls will be able to push the price above $10,200 resistance. If successful the momentum can be sustained. Then Bitcoin will be able to attain a high of $10,360. Conversely, if the downward move continues or the bears may break below $9,812 support, BTC may drop to the low of $9,400 or $9,200.

Daily Chart Indicators Reading:

Bitcoin has been on a downward move because the coin is trading above 80% range of daily stochastic. The stochastic bands are making a U-turn downward. This indicates that BTC is in the overbought region of the market. This is the region where sellers are generated to push the price downward. Bitcoin is falling as a result of the absence of buyers. The upward move may continue as soon the coin finds support.

BTC/USD Medium-term Trend: Bullish

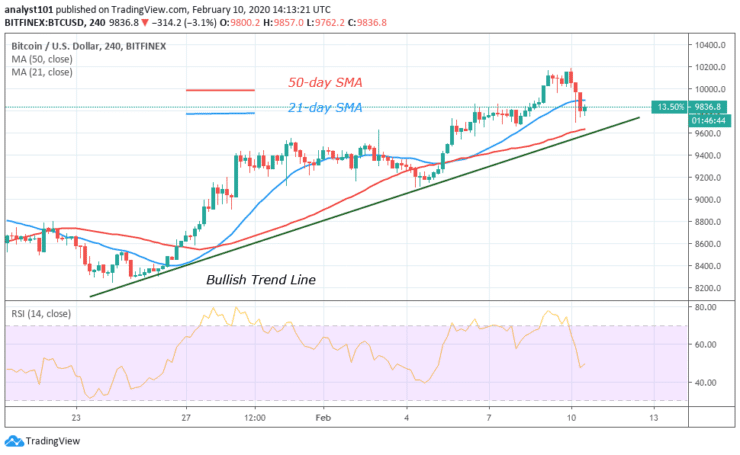

On the 4 hour chart, Bitcoin reaches a high of $10,200. The bulls were resisted after testing the resistance on two occasions. The coin fell to a low of $9,802 support. Incidentally, this was the previous resistance where the bulls had broken in time past. If the bears break this current level the selling pressure will resume.

4-hour Chart Indicators Reading

Bitcoin has fallen to level 47 of the Relative Strength Index period 14. This indicates that the coin is below the center line 50. Bitcoin is now a downtrend zone. On the downside, if the selling pressure continues and breaks the bullish trend line, the uptrend is said to be terminated.

General Outlook for Bitcoin (BTC)

On the daily chart, the price is still above the 50-day and 21-day SMAs which indicates that the uptrend is ongoing. Bitcoin will find support and resume the upward move. The $9,800 support is likely to hold. If it holds, the uptrend will resume. Conversely, if the support cracks, Bitcoin will depreciate further.

BTC Trade Signal

Instrument: BTC/USD

Order: Buy

Entry price: $9,817

Stop: $9,700

Target: $10,300

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.