• The latest weakness in the price could foot a short-term bearish setup for Bitcoin.

• Bitcoin turns weak after smashing 7-month high around $9600.

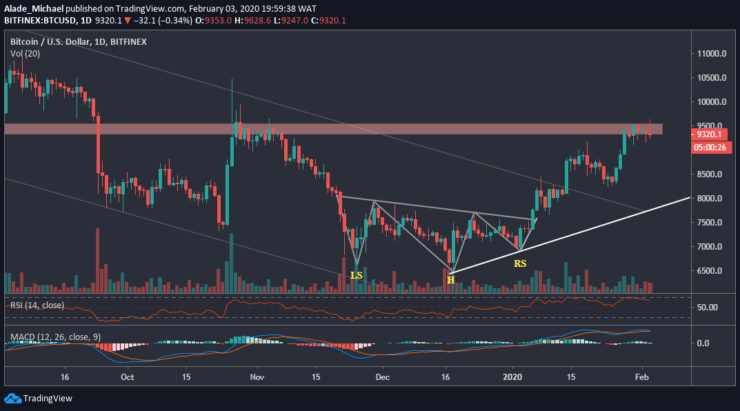

Over the past five days now, Bitcoin’s volatility has been subdued with choppy price actions and at the same time keeps the world largest cryptocurrency in a consolidation mode. Today, Bitcoin has slightly dropped from a 7-month high of $9625 to where it’s currently trading at. If the price manages to close below $9200, BTC would be doomed for a strong bearish correction.

Key resistance levels: $9625, $10000

Key support levels: $9000, $8600

Bitcoin (BTC) Price Analysis: Daily Chart – Bearish

Bitcoin has been struggling with the red resistance zone for a while now. Apart from suppressing bullish actions for days, this $9200-$9600 range has become a controversial area amongst traders since late January. This scenario has subjected Bitcoin to a squeeze. Most times, such squeeze often lead to a big move in the market, be it continuation or reversal.

However, a continuation would occur if Bitcoin breaks well above the red zone of $9625 resistance before looking next for $10000. In case of a reversal, Bitcoin could breach $9200 to $9000 and $8600 support. A steep drop could further roll BTC into $8400 on the rising trend line with a potential bounce. The technical indicators suggest that Bitcoin is getting weak on the daily chart. A fall could be underway.

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Bitcoin is slowly heading downward on the 4-hours chart. As we can see, the price was recently rejected from the channel’s resistance for the past few days now. The bearish play would become significant if Bitcoin slump to the channel’s support that is forming since January 11. However, the closest support is $9000 and $8800. If Bitcoin dips beneath this channel, it could result in a massive loss in price.

At the moment, the volume is dropping on the 4-hours chart. So we can expect a decline. Should Bitcoin keep supported by the $9200, the market could remain on a sideways or break up to the next resistance level of $9600 and $9800. After dropping, Bitcoin has now reached the mid-level on the technical RSI and MACD indicators. A cross below this level could trigger more sell for Bitcoin. As of now, Bitcoin is footing a bearish pattern.

BITCOIN SELL ORDER

Sell: $9300

TP: $9134

SL: $9704

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.