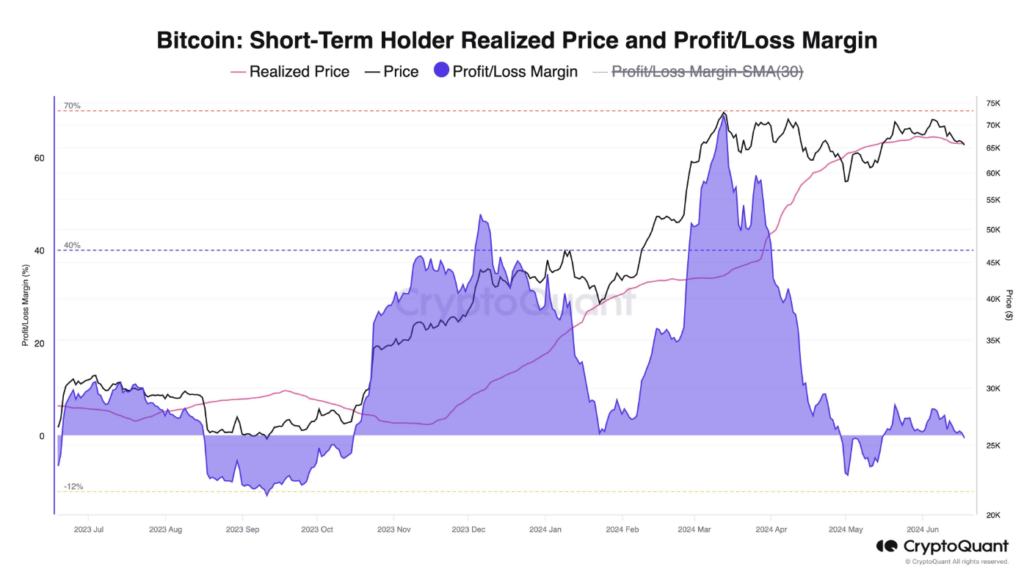

Bitcoin, the world’s largest cryptocurrency by market cap, has hit a rough patch as it dipped below a crucial price support level on Tuesday. This drop could signal the start of an 8% to 12% correction, according to analysts at CryptoQuant.

The concerning development comes as Bitcoin fell below the key support of $65,800, which is the average price that traders have paid for the digital asset. When Bitcoin crosses this level to the downside, it often means more trouble ahead.

CryptoQuant’s market report suggests that although downside pressure may be limited, the overall market is lacking in bullish momentum right now. Large Bitcoin holders, known as “whales,” are not increasing their positions, and the growth of stablecoin liquidity has slowed to its lowest pace since November 2023.

Bitcoin Basis Trading Unwinding Exerting Additional Pressure

Another factor putting pressure on Bitcoin’s price is the unwinding of “basis trades.” These involve traders trying to profit from differences between spot prices and futures contracts. As these trades get closed out, it can lead to significant selling in the spot market, pushing prices lower.

Jag Kooner, head of derivatives at crypto exchange Bitfinex, pointed to a $1.2 billion drop in outstanding Bitcoin futures contracts on the Chicago Mercantile Exchange over the past 10 days as evidence of the basis trade unwind in an interview with The Block.

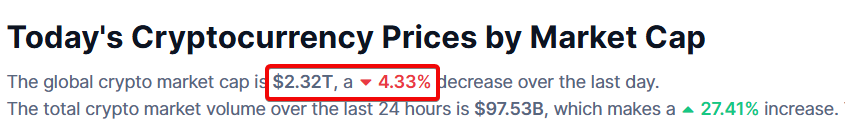

The wider cryptocurrency market has also felt the sting, with the total market cap shedding 4.3% in the past 24 hours to stand at $2.32 trillion.

Major altcoins like Solana, Dogecoin, and Polygon have seen even steeper losses than Bitcoin.

While some see this pullback as a buying opportunity, others are bracing for the possibility of Bitcoin revisiting the $60,000 level if the current weakness persists. The next few days will be critical in determining whether this is a minor stumble or the start of a more serious slide for the top cryptocurrency.

For now, market participants are keeping a close eye on key support and resistance levels, watching for signs of increased selling pressure or a potential rebound.

As always in the volatile world of crypto, investors are advised to manage risk, size positions accordingly, and stay tuned to the latest developments in this fast-moving space.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.