BTCUSD bears continue their dominance

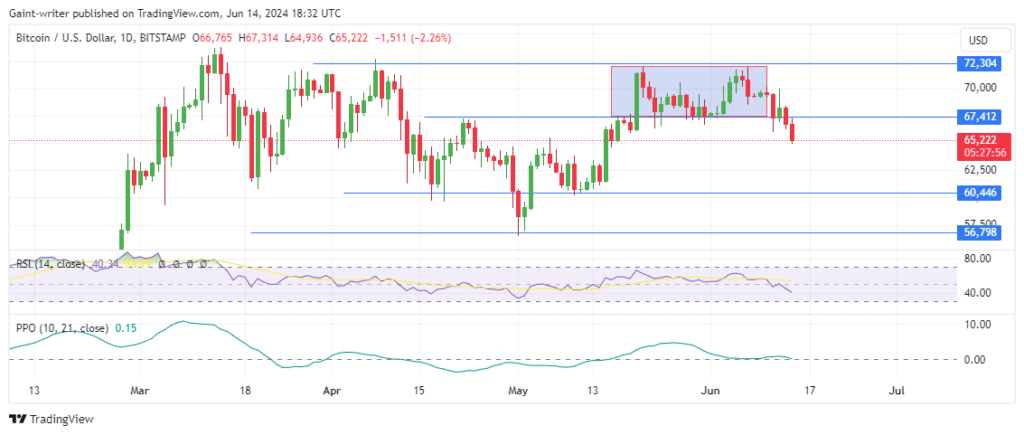

Bitcoin (BTCUSD) bears dominate after breaking the $67,400 key level. Bitcoin sellers have taken charge, pushing the cryptocurrency below this significant level. This move marks a notable shift in market sentiment, with bears likely to continue driving prices downward. After leaving buyers behind at the $67,000 mark, sellers have established their presence around $65,000, hinting at further bearish activity on the horizon.

BTCUSD Key Levels

Resistance Levels: $72,300, $67,400

Support Levels: $60,400, $56,700

The Price Oscillator shows that buyers are losing momentum while sellers are increasingly taking control. This shift suggests a sustained downward movement. The RSI (Relative Strength Index) indicates that sellers have a firm grip on the market. With the RSI trending lower, it reflects the growing dominance of bearish sentiment. Analysis of the signal line confirms that sellers are driving the market. The momentum has not waned, indicating that the downward trend may continue.

The 4-hour chart provides further evidence of the bearish momentum. A recent retest of the $67,400 zone confirmed the sellers’ dominance. The failed attempt by buyers to reclaim this level indicates that the bearish trend is likely to persist. An initial pullback was observed, followed by a retest, which solidified the sellers’ control. Crypto signals suggests that the retest at the $67,400 market zone makes the sellers well-positioned to push prices lower. The continued pressure from sellers is evident, with no signs of reversal at this stage.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.