Bitcoin mining has overcome halving-related worries with impressive growth in late 2024, according to CoinShares’ latest quarterly report.

The network’s hashrate jumped to a record 900 Eh/s during Q4 2024, driven by favorable political developments and strong Bitcoin price performance. Analysts now expect the network to hit the significant 1 Zettahash per second (Zh/s) milestone by July 2025.

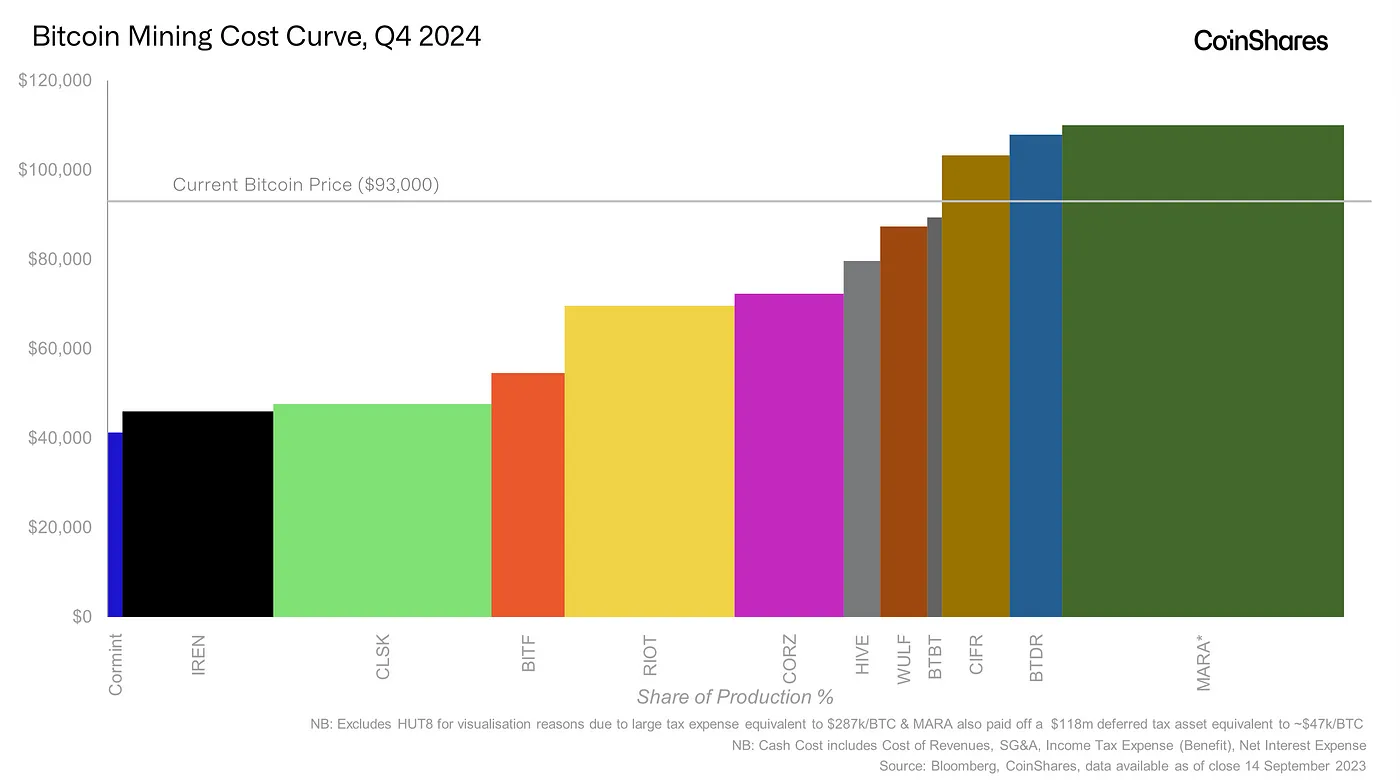

The cost to produce one bitcoin increased substantially in Q4. Public miners now spend around $82,162 in cash costs per bitcoin, up 47% from Q3’s $55,950. When including non-cash expenses like depreciation and stock compensation, the total cost rises to $137,018 per bitcoin.

Despite these higher costs, most mining operations remained profitable with Bitcoin trading around $82,000.

The Future of Bitcoin Mining Economics

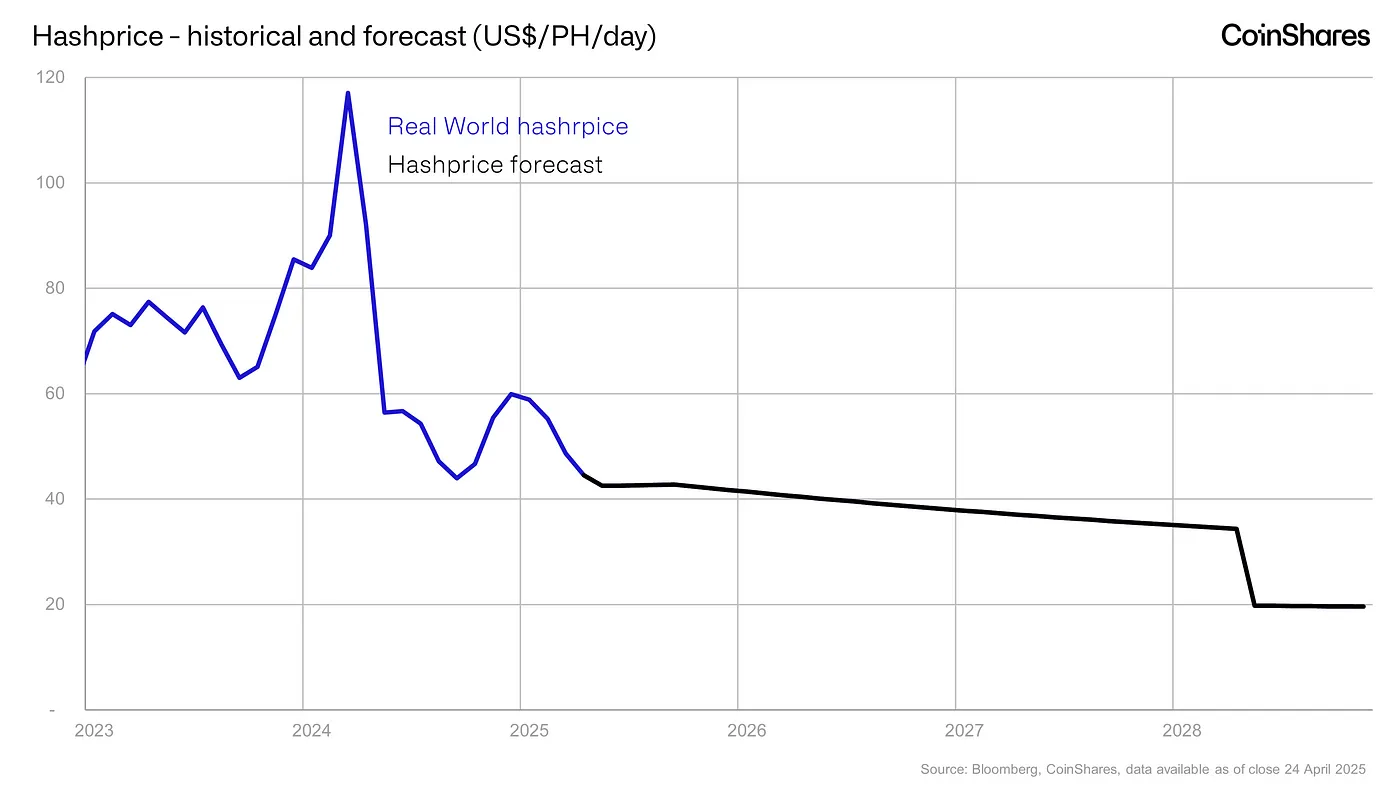

Bitcoin miners face a changing industry as hash price—a key measure of mining profitability—shows a modest rebound but remains on a long-term downward trend. CoinShares forecasts hash prices will stay between $35 and $50 per PH/day through the 2028 halving cycle, with average prices dropping below $40 by early 2026.

In response to compressed profit margins, several mining companies are shifting their business focus. Many are now diversifying into data center infrastructure and high-performance computing (HPC) hosting to create more stable revenue streams beyond Bitcoin production.

Core Scientific and Cipher Mining lead this transition, with Core Scientific already committing 43% of its capacity to AI infrastructure and Cipher Mining planning to allocate 35% of future capacity to AI computing, backed by a $50 million SoftBank investment.

The industry also faces new challenges with tariffs on imported mining equipment ranging from 24% (Malaysia) to 54% (China), potentially squeezing margins for operators using older or less efficient equipment.

Energy efficiency continues to improve, with the latest mining hardware averaging just 20W/Th—a fivefold improvement since 2018. This efficiency has helped stabilize energy consumption despite the massive hashrate growth.

At the state level, Bitcoin is gaining institutional traction. Arizona, Oklahoma, and Texas are considering allocating portions of their reserves to Bitcoin, which could create up to $10.3 billion in buying pressure at current prices.

Despite market volatility, CoinShares believes most macroeconomic scenarios remain supportive of Bitcoin. The asset has shown resilience compared to equity markets, highlighting its growing recognition as a credible long-term store of value that operates independently of government control.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.