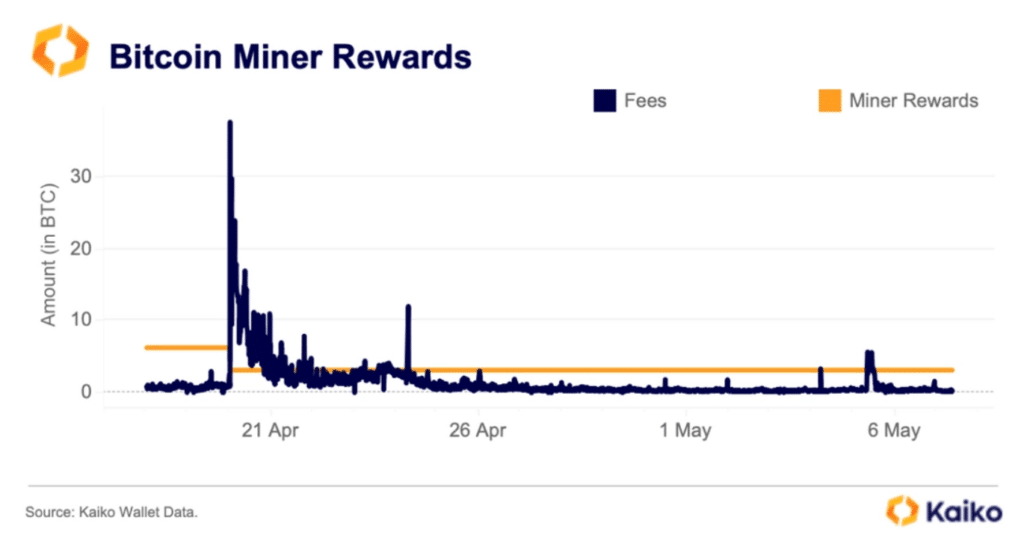

Bitcoin miners are currently encountering a new challenge as network fees fluctuate post-halving, according to a recent report by Kaiko.

The April halving event, which reduced the reward for mining new blocks, initially led to a surge in daily average network fees. This increase helped miners offset the impact of reduced block rewards. However, with the waning enthusiasm around the Runes protocol, these fees are now declining, once again pressuring miners financially.

Historically, halving events have prompted miners to sell Bitcoin to cover the high costs associated with creating new blocks. For instance, in April, transaction fees made up 16% of the total Bitcoin earned by Marathon Digital, a sharp increase from 4.5% in March. The recent fee downturn is expected to heighten selling pressure among miners, potentially affecting the market negatively.

Bitcoin Miners Selling BTC Reserves Could Hurt Market Sentiment

Bitcoin holdings are typically listed as current assets on miners’ balance sheets, indicating their willingness to sell if needed to fund operations. Marathon Digital holds over $1.1 billion in assets, including 17,631 BTC, while Riot Platforms owns 8,872 BTC, valued at over $500 million.

A forced sale of even a portion of these assets could have significant repercussions on the market.

Mt.Gox to Flood Market with 142,000 BTC

In other news, Mt. Gox, the Tokyo-based Bitcoin exchange, is preparing to inject a substantial amount of Bitcoin into the market as part of its planned compensation for creditors affected by the exchange’s 2011 hack.

The Kraken Bitcoin and Bitcoin Cash API interfaces indicate that Mt. Gox is set to disburse 142,000 BTC, 143,000 BCH, and 69 billion yen. The disbursement date is scheduled for October 31, 2024.

Speculation post: Kraken BTC payouts *might* start moving soon. Another user in one of the legal groups posted an API response with new properties

byu/BirdObjective2459 inmtgoxinsolvency

This impending release follows years of legal proceedings and negotiations after the exchange lost 850,000 BTC in the hack, now valued at over $51 billion. Mt. Gox’s bankruptcy filing stemmed from this security breach, and the exchange has been working towards reimbursing its creditors.

As the market prepares for these developments, the delicate balance between miner fees and market stability hangs in the balance. The decisions made by miners and the forthcoming Mt. Gox payout will undoubtedly shape Bitcoin’s trajectory in the coming months.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.