Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

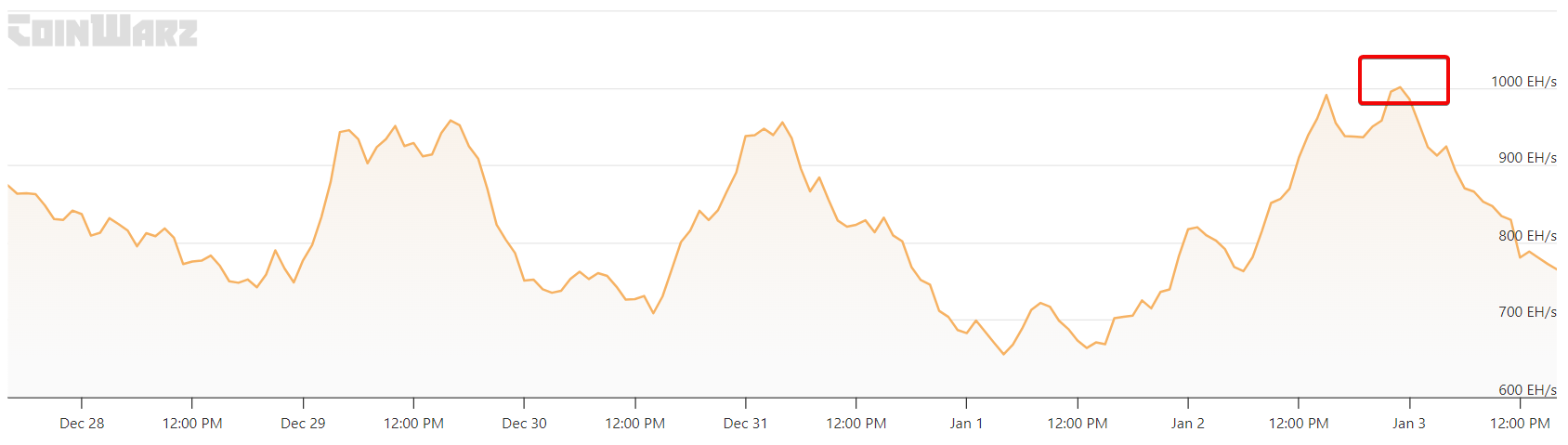

The Bitcoin network reached a significant technical achievement on January 3, 2025, as its hashrate—the total computing power securing the network—briefly touched 1,000 exahashes per second (EH/s). This marks a dramatic increase from just one year ago, when the network operated at around 510 EH/s.

The increased hashrate shows Bitcoin miners are adding more computing resources to secure the network, despite facing reduced mining rewards. In April, the Bitcoin halving cut these rewards from 6.25 BTC to 3.125 BTC per block.

Bitcoin Market Dynamics and Institutional Interest

While the network grows stronger, BlackRock’s Bitcoin ETF (IBIT) experienced its largest daily outflow since launch, with investors withdrawing $332.6 million on Thursday. This surpassed the previous record of $188.7 million in outflows seen on Christmas Eve.

Neal Wen, Head of Global BD at Kronos Research, explains this movement to The Block, saying:

“Institutional investors often rebalance their portfolios to align with asset allocation targets. The large outflows from BlackRock’s IBIT may reflect such activity, particularly in response to Bitcoin’s price movements.”

Despite these outflows, IBIT maintains its position as the largest spot Bitcoin ETF, with total net inflows of $36.9 billion and net assets approaching $53.5 billion. Other ETF providers saw positive flows, with Bitwise’s BITB receiving $48.3 million and Fidelity’s FBTC gaining $36.2 million in net inflows.

The broader Bitcoin ETF market remains active, with U.S. spot Bitcoin ETFs trading $3.24 billion in volume on Thursday. Bitcoin’s price showed resilience, rising 1.8% to $98,300.

Looking ahead, asset manager Sygnum predicts increased institutional involvement in 2025. Martin Burgherr, Sygnum’s chief clients officer, suggests that sovereign wealth funds, endowments, and pension funds may add Bitcoin to their portfolios, particularly as U.S. regulatory clarity improves.

The combination of record network strength and institutional interest through ETFs signals Bitcoin’s growing maturity as an asset class. Mining companies continue expanding operations despite reduced rewards, while trading volumes and institutional participation suggest sustained market interest beyond price movements.

This evolving landscape presents both opportunities and challenges for investors, as they navigate between direct Bitcoin ownership and ETF investment options, all while the network’s technical fundamentals continue strengthening.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.