Bitcoin, the leading cryptocurrency, is approaching its all-time high after breaching the $68,000 mark on October 16. This 16% surge over the past week comes amid a significant reduction in exchange reserves and increased institutional demand.

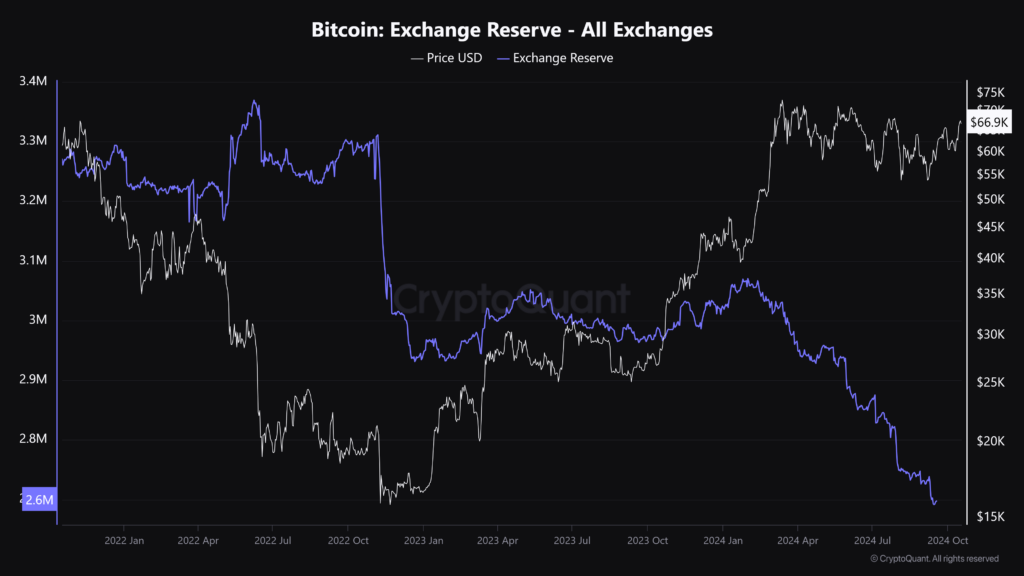

Bitcoin Exchange Reserves Plummet, Signaling Strong ‘HODL’ Sentiment

Data from CryptoQuant reveals that Bitcoin exchange reserves have fallen to their lowest levels since October 2021. Over 51,000 bitcoins have been withdrawn from major exchanges in the past month alone, reducing the liquid supply and suggesting a shift towards long-term holding strategies.

This trend is particularly noteworthy given the current market conditions. CryptoQuant’s analysis shows that 95% of the circulating Bitcoin supply is currently in profit. Historically, when this metric exceeds 94%, it often precedes market corrections due to profit-taking.

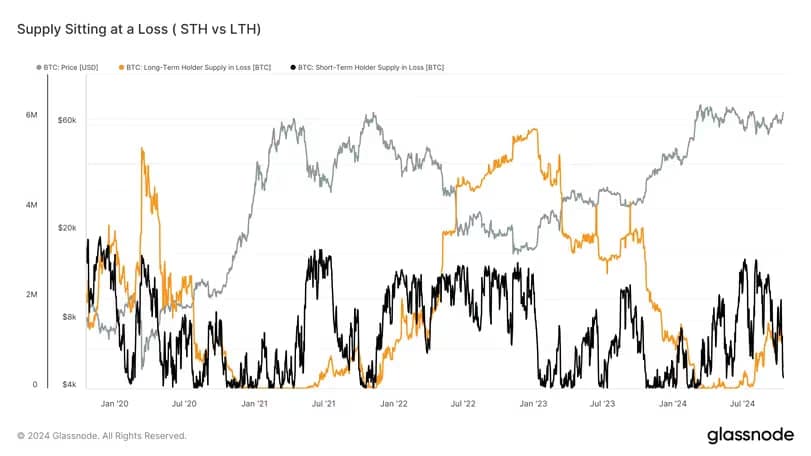

James Van Straten, senior analyst at CoinDesk, notes that long-term holders (LTHs), defined as those holding coins for at least 155 days, could be the primary profit-takers. “As of writing, LTHs hold only 500,000 BTC at a loss, which is a small fraction, considering they hold 14 million BTC as a cohort,” Van Straten reported.

New Institutional Players Fuel Buying Pressure

The market is witnessing unprecedented buying pressure from new institutional players. CryptoQuant data indicates that new “whale” wallets, holding over 1,000 BTC and excluding miners and exchanges, have significantly increased their holdings. These new whales now control approximately 1.97 million bitcoins.

CryptoQuant analyst J.A. Maartunn commented, “The buying pressure from this new accumulation is something we haven’t seen before. New whales are pushing bitcoin prices higher as they buy more.”

This institutional interest extends beyond the recently approved spot Bitcoin ETFs. Julio Moreno, Head of Research at CryptoQuant, pointed out that Coinbase’s declining Bitcoin reserves are primarily being moved to specific custody wallets, likely belonging to institutional players.

Market Dynamics and Future Outlook

Despite the bullish sentiment, potential challenges remain. The U.S. Dollar Index (DXY) has climbed above 103.8, a level last seen during the Yen carry trade unwind in early August, which previously triggered a significant Bitcoin price drop.

However, Bitcoin has shown resilience in the face of this dollar strength. Bitcoin dominance is approaching 60%, a level not seen since April 2021, indicating strong momentum in the crypto market.

At the time of reporting, BTC was trading at $66,935, down 1.32% in the last 24 hours.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.