Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

BTCUSD Buyers Lose Momentum as Sellers Take Control

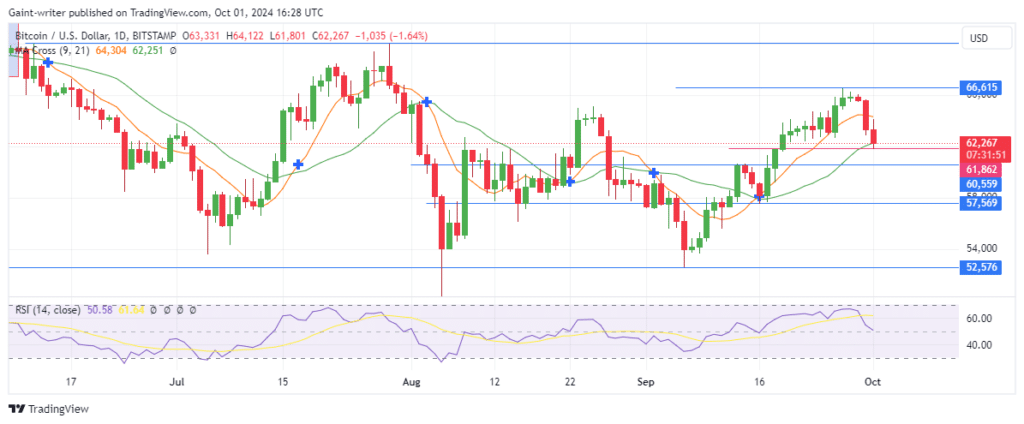

The Bitcoin crypto has dipped back to the $61,800 key level as sellers take charge, gaining momentum after a shift in market trend. Following several weeks of dominance by the buyers, the sellers are now asserting their presence and pushing prices lower. The bullish trend, which began in September with buyers recovering from a low of $52,500, saw Bitcoin reach a notable high of $66,600. However, the recent pullback suggests that the market could be experiencing either a temporary correction or the beginning of a potential trend reversal.

BTCUSD Key Levels

Resistance Levels: $66,600, $63,800

Support Levels: $61,800, $57,500

The RSI (Relative Strength Index) has crossed into bearish territory, indicating that sellers have overtaken the buyers. This shift in momentum suggests the market could see further downside in the near term. Additionally, the Moving Average crossover is nearing completion on the daily chart, and if confirmed, it could solidify the bearish shift.

As sellers continue to drive the market, the critical level to watch is the $61,800 support zone. If the price breaks below this level, the next target could be the $57,500 support area. The combination of the Moving Average crossover on the daily chart and bearish signals from the RSI implies that sellers are likely to maintain pressure on the market.

Market Expectation

In the short term, the Bitcoin crypto is expected to remain under selling pressure, with the potential for further declines toward $61,800 and below. Both the RSI and Moving Average indicators suggest that sellers currently hold the upper hand.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.