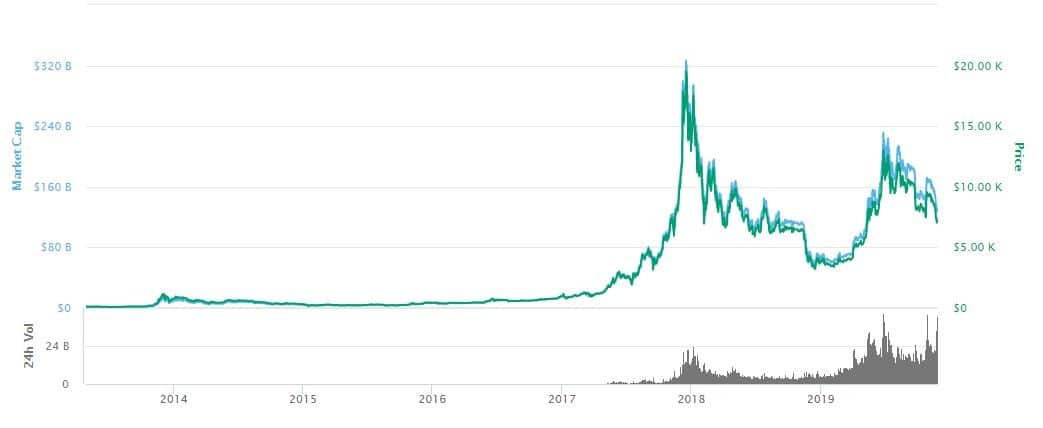

Bitcoin’s volume has been trading below $150 billion over the past few days due to liquidation which has stalled price movement below $7300 since Monday. Despite that, BTC dominance has continued to hold 66% of the market share for months. With the market cap statistics, there seems to be a sign of optimism from the bulls’ side as price pump may be around the corner for the primary cryptocurrency.

The Bitcoin perpetual future contract is another thing to thing that might trigger a bullish run for the market. Considering the current BTC futures volume which is technically low compared to last few months when BTC recorded its yearly high around $13700 before it started to roll over the last six month.

More so, looking at the year-to-date high of 19900 plus in 2017, Bitcoin has appeared to be seriously crashing. Many analysts have predicted that the next bearish phase might slip BTC price to $5000 while some believed that Bitcoin could even bottom at $1000 in the near future. However, Bitcoin futures volumes seem to have significantly increased on derivatives exchanges over the last 24-hours.

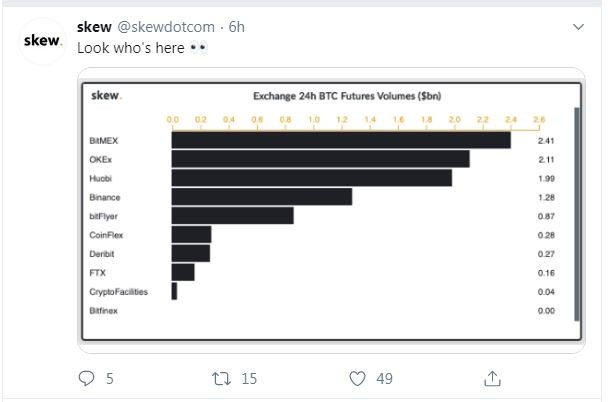

Following a tweet by a crypto derivatives analyst, SKEW earlier today, the last 24-hours Bitcoin futures volumes appeared to be on the rise on some prominent crypto exchanges:

Like Bitmex, which happens to be holding the highest volume of about $2.41 billion; followed by OKEx with $2.11 billion; Huobi records $1.99 billion; Binance trades $1.28 billion; bitFlyer saw $0.87 billion; CoinFlex holds $0.28 billion, Deribit $0.27 billion; FTX $0.16 billion, CryptoFacilities $0.04 billion and Bitfinex with an insignificant volumes.

The simple reaction to the recent volume surge could be traced to a potential forecast which is likely to trigger a sudden surge in price volatility. Additionally, another reason for this effect could be an act of the fear-of-missing-out (FOMO) in the market which could be around the corner.

However, since SKEW analytics, the market has seen a significant volume and volatility which made Bitcoin’s price to record a daily low of $6880 before surging to a high of $7300. BTC is currently trading at around $7300. If the volume and volatility continue to become significant, Bitcoin may print a fresh daily low or high.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.