Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin (BTCUSD) Buyers Still Continue to Dominate

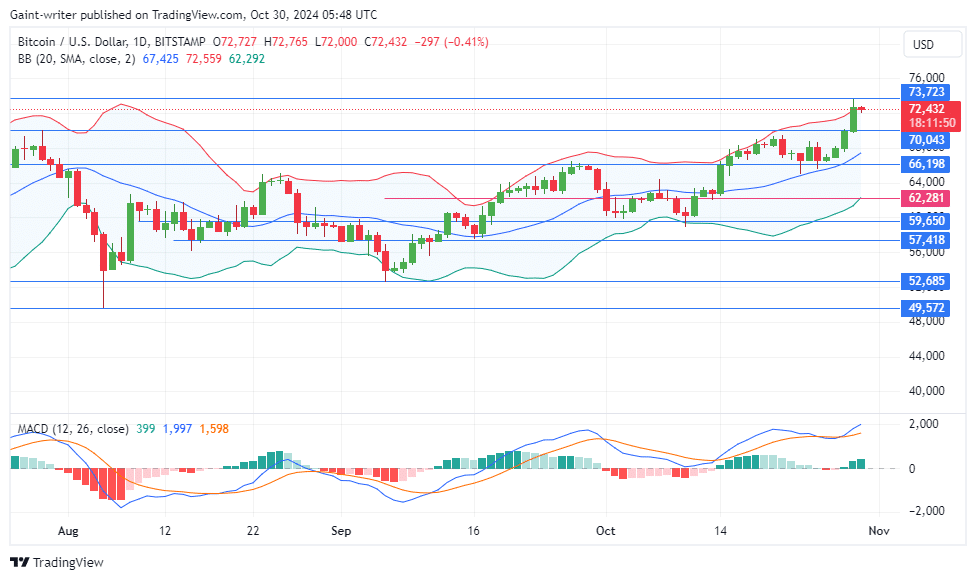

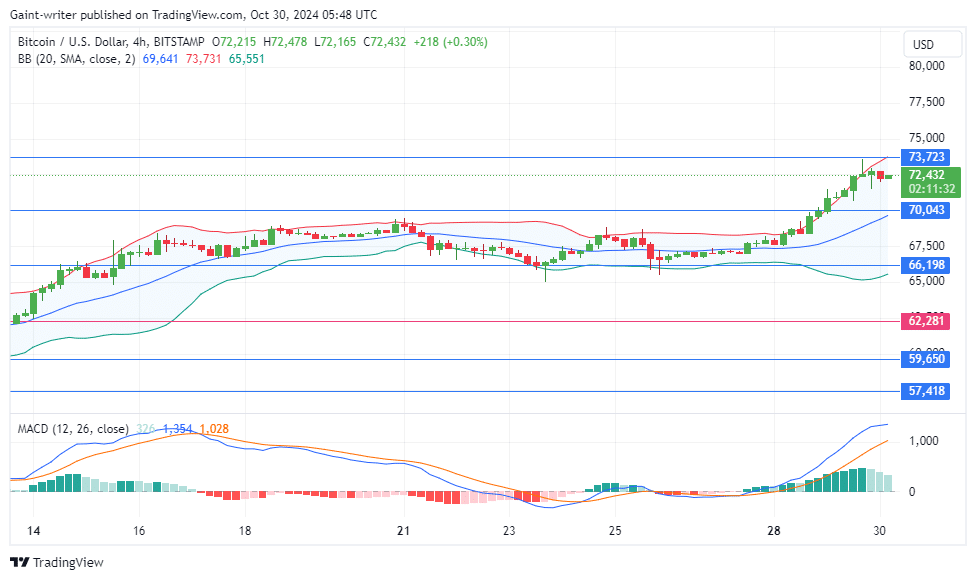

Bitcoin bulls approach key resistance at $73,720 amid strong uptrend. Bitcoin bulls are showing resilience as they cautiously approach the critical $73,720 resistance level. Currently trading near $72,000, BTCUSD has seen consistent price appreciation, with buyers maintaining their dominance over the past two months. After recovering from a consolidation around the $60,000 mark and a subsequent pullback near $66,000, Bitcoin’s bullish trend has remained intact as buyers refuse to cede control.

Bitcoin Key Levels

Resistance: $73,720, 70,000

Support: $66,000, $60,000

The MACD (Moving Average Convergence Divergence) Indicator also supports the bullish outlook, showing a widening spread between the MACD line and the signal line, signifying increased buyer control.

Should buyers sustain their momentum and break above the $73,720 resistance, Bitcoin price could experience a further rally toward the next psychological resistance level of $75,000 and beyond, supported by strong buying pressure on both the MACD and Bollinger Bands. However, if buyers encounter resistance at $73,720, a market pullback is likely, as profit-taking at this level could provide temporary relief for sellers. In such a scenario, Bitcoin may retrace to support zones around $70,000 or $66,000 before potentially resuming its uptrend.

Market Expectation

As Bitcoin approaches the $73,720 level, traders should remain vigilant for potential resistance. While the bulls have demonstrated remarkable strength, the likelihood of a short-term pullback should not be ignored.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.