Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

BTCUSD Bulls Push For Expansion Amidst Consolidation Phase

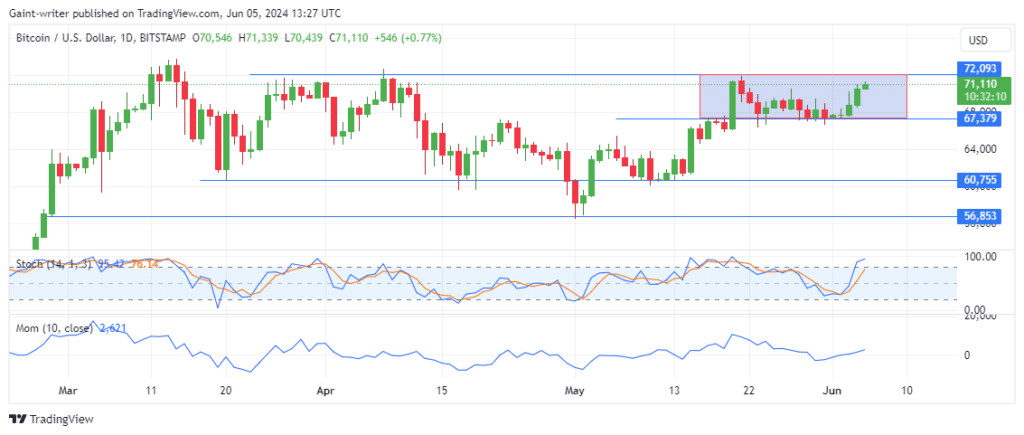

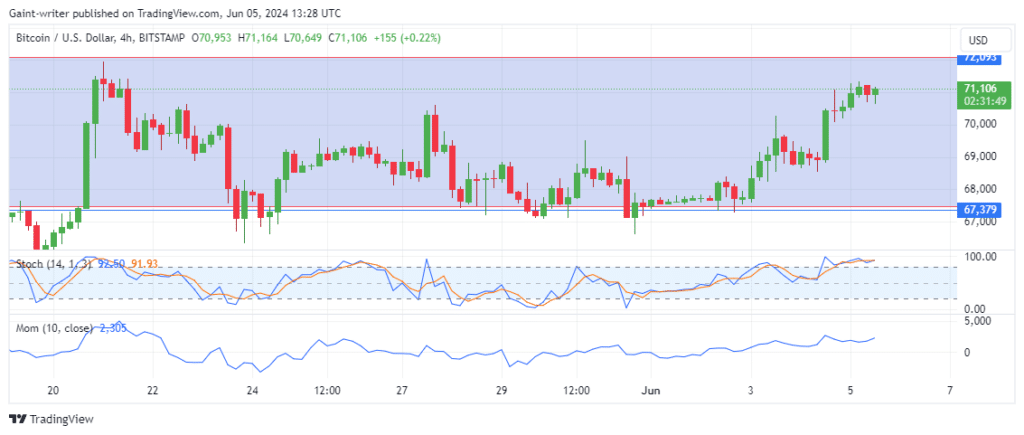

BTCUSD bulls aim to break through the $72,090 key level. The cryptocurrency market has been on edge, with buyers striving to attain a breakthrough at the $72,090 significant level. This level has been a strong resistance for buyers to penetrate. For the past few months, Bitcoin has been attempting to overcome this level, facing multiple rejections. However, the bulls have not given up and have been gaining strength, particularly since March and April.

BTCUSD Key Zones

Resistance Zones: $72,090, $67,370

Support Zones: $60,750, $56,850

Currently, the buyers are targeting another breakthrough at the $72,090 level. A successful attempt could ignite a bullish extension beyond this market zone. However, if the sellers gain strength, Bitcoin may pull back into consolidation.

The momentum indicator is rising, but the Stochastic is trading on the overbought side, indicating potential selling pressure. Traders and investors will need to closely monitor these signals to gauge the market’s direction. In the short term, the buyers are still aiming higher. The key level ahead can be a challenging area for buyers to penetrate. They will need to reinforce their buying strength as they approach this challenge. Crypto signals suggests that if Bitcoin faces rejection, it implies that the market is likely to remain in a ranging phase.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.