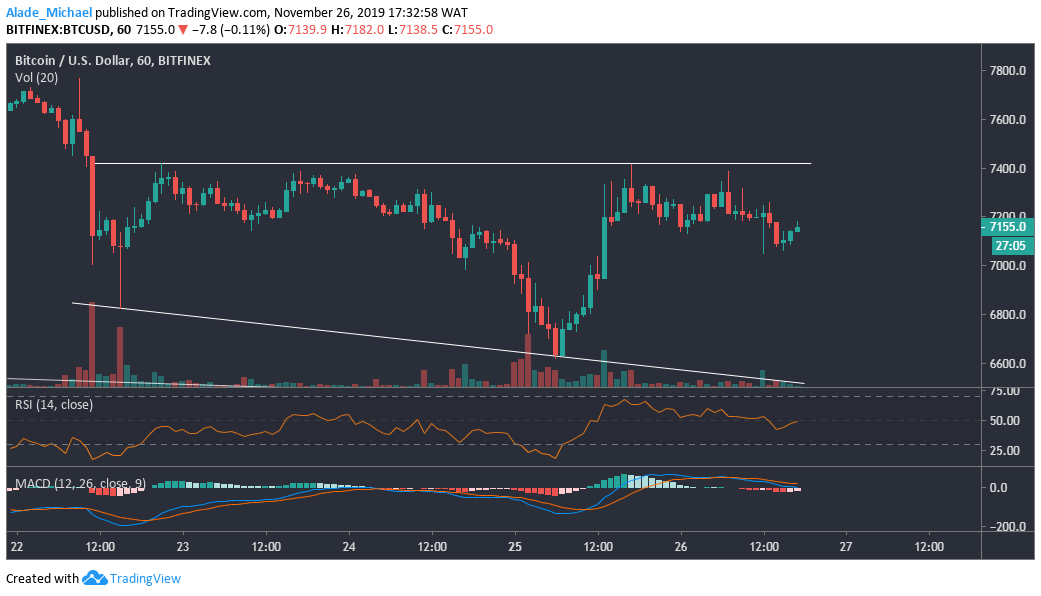

Bitcoin (BTC) Price Analysis: Hourly Chart – Neutral

Key resistance levels: $7300, $7400, $7700

Key support levels: $7000, $6800, $6600

From a short-term perspective, we can see that Bitcoin is finding it difficult to breach the $7400 resistance for a couple of days now. This resistance is an important level for BTC next bullish swing. But if the buying pressure continues to remain weak, the market may roll back to the bottom of the broadening wedge pattern that is now forming on the hourly chart.

Obviously, Bitcoin’s price is slowly dropping from the wedge’s upper boundary. A continuation of this slow price reduction could bring us back to $6600 after leaving $7000 and $6800 support. We can see that the RSI indicator has slightly dropped below 50 levels. Conversely, the MACD is testing the zero level. Inversely, a bullish surge could send BTC to $7300 -$7400 zones, followed by $7700.

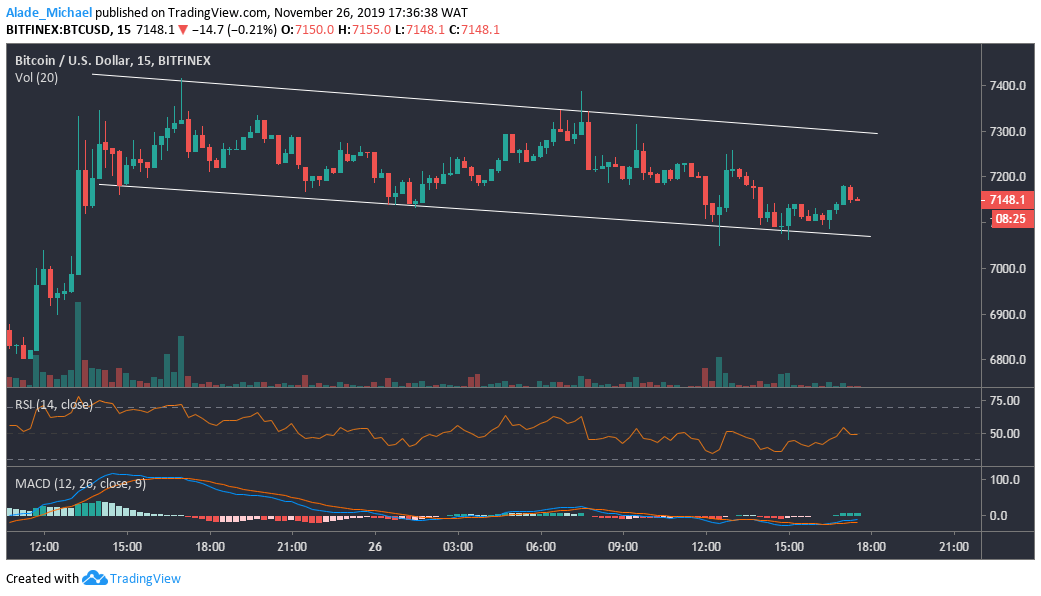

Bitcoin (BTC) Price Analysis: 15M Chart – Bearish

Bitcoin is slowly shaping in a descending channel for the past few hours now, suggesting a bearish formation on the 15-minute time frame. Though, the bear setup could gradually send BTC back below $7000 if the price continues to trade in the channel pattern for the next three days. In fact, the downward range is revealed on the technical RSI and the MACD indicators.

As we can see, the market has just bounced off the channel’s lower boundary. Therefore, we can expect a buying pressure to the channel’s upper boundary at $7300 before resuming bearish sentiment to $7000. However, a break at $7300 may extend buying pressure to $7400 and $7500 within a blink of an eye. Should $7000 support breaks, Bitcoin’s price could drop heavily to $6800 and beyond.

BITCOIN SELL SIGNAL

Sell Entry: $7288

TP: $7051

SL: 7412

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.