Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Key resistance levels: $7100, $7300, $7500

Key support levels: $6814, $6611, $6400

Looking at the formed bearish pattern on the 4-hour chart, Bitcoin may extend selling to the lower boundary of the channel soon. Following the latest break below $7000 support, BTC is now consolidating around $6916. More price drop is expected as soon as selling pressure resumes. The next key level of support here is $6814, $6611 and $66400.

For a bullish correction, there’s a close resistance at $7100, where the channel’s upper boundary lies. However, the buyers might take over the market if Bitcoin spikes to $7300 and $7500. As of now, the RSI is slightly trading in the oversold territory. It may reach the lowest condition if the selling pressure continues. Additionally, the MACD shows that the bears are slowly gaining control of the market.

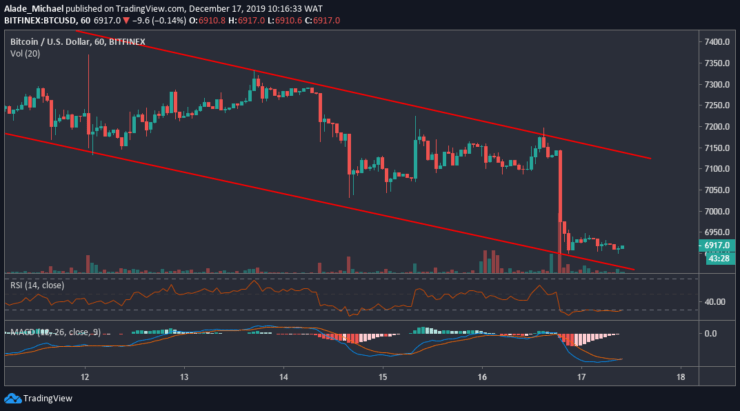

Bitcoin (BTC) Price Analysis: Hourly Chart – Bearish

The December 16 sudden drop has brought Bitcoin’s trading to the lower boundary of the channel, forming on the hourly chart. After falling to $6850 yesterday, BTC price has remained in a consolidation mode. Although, a possible retracement is likely to reach the channel’s resistance at $7000 and $7100 while selling pressure suspends.

But if the sellers regroup now, the scenario would get uglier as potential support lies at $6800, $6700 and $6600. As shown on the hourly MACD, Bitcoin is bearish but a possible correction is at hand. Conversely, the RSI is relying on the 30 levels, poised for recovery.

BITCOIN SELL SIGNAL

Sell Entry: $7045

TP: $6816

SL: $7188

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.