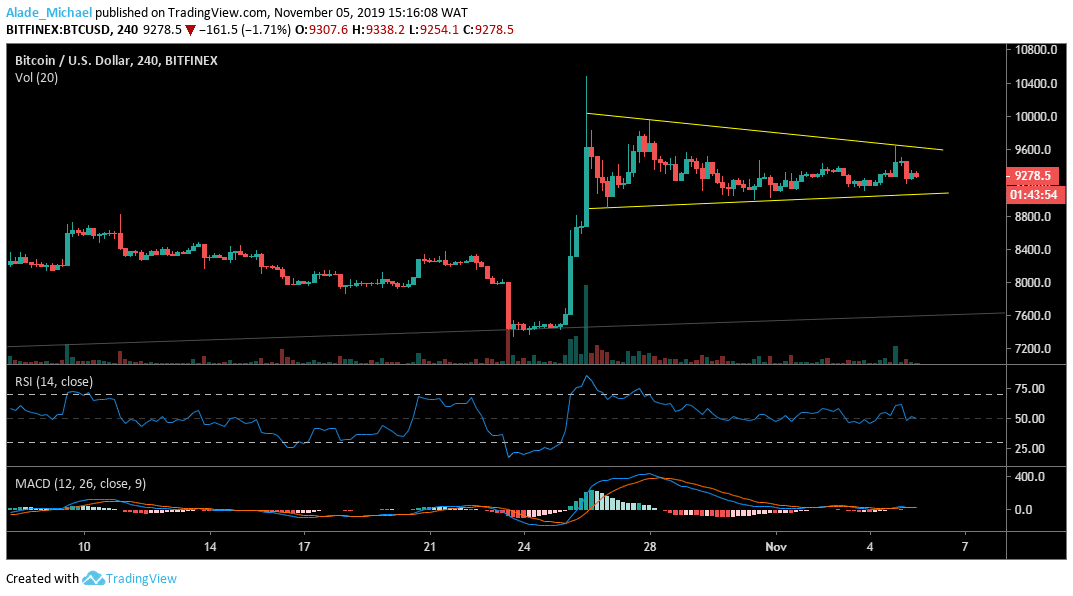

Bitcoin (BTC) Price Analysis: 4H Chart – Neutral

Key resistance levels: $9800, $10000, $10350

Key support levels: $9000, $8820, $8600

Bitcoin is trading inside a symmetrical triangle on the 4-hour chart as the price warms for a breakout which might allow BTC to see another substantial increase soon. However, we may need to consider close resistance at $9600 before spiking to $10000 and $10350 on the upside.

The RSI is currently at the 50 levels to show that the market is still in favour of the bulls. Conversely, the MACD is lying straight at the zero level – suggesting a neutral trend, although it appeared bullish at the moment. Immediate support for Bitcoin is at $9000. In case of a further price loss, support may resurface at $8820 and maybe $8600.

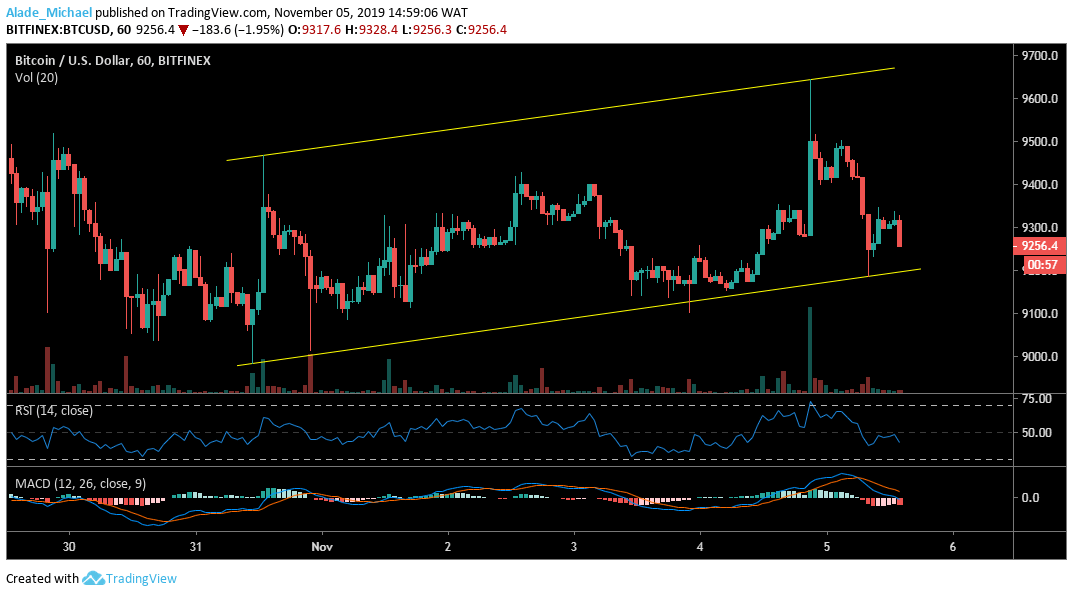

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

After Bitcoin was rejected yesterday at $9600, the price dropped to $9200 – where BTC tested the lower boundary of the ascending channel. Now, the price is attempting to retest the support area before rebounding to $9350, $9500 and $9700 in the next coming hours. Meanwhile, the $9100 and $9000 are still holding as support for the market.

More so, a sharp drop may floor Bitcoin at $8900 on a short-term. Currently, the RSI is in a downward position, reflecting the latest price drop. But the MACD has held support at the zero levels after seeing a little downward move. Above all, we can expect Bitcoin to climb higher if the channel’s lower boundary can continue to function as support for the BTC market.

BITCOIN BUY SIGNAL

Buy Entry: $9312

TP: $9551 / $9692

SL: $8870

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.